Blackstone (BX) Beats on Q2 Earnings & Revenue Estimates

Have you been eager to see how The Blackstone Group L.P. BX performed in Q2 in comparison with the market expectations? Let’s quickly scan through the key facts from this New York-based premier global investment and advisory firm’s earnings release this morning:

An Earnings Beat

Blackstone came out with economic net income of 90 cents per share, which beat the Zacks Consensus Estimate of 71 cents.

Significant rise in revenues primarily aided earnings.

How Was the Estimate Revision Trend?

You should note that the earnings estimate revisions for Blackstone depicted optimistic stance prior to the earnings release. The Zacks Consensus Estimate has revised 1.4% upward over the last seven days.

Also, Blackstone has an impressive earnings surprise history. Before posting the earnings beat in Q2, the company delivered positive surprises in three of the four trailing quarters.

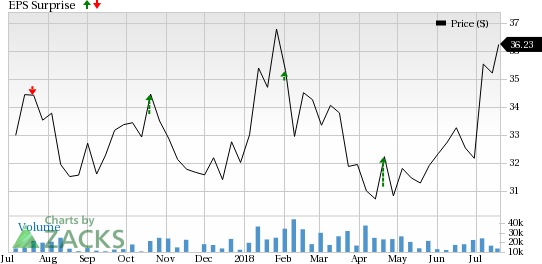

The Blackstone Group L.P. Price and EPS Surprise

The Blackstone Group L.P. Price and EPS Surprise | The Blackstone Group L.P. Quote

Revenue Came In Better Than Expected

Blackstone posted total revenues (on a GAAP basis) of $2.63 billion, which outpaced the Zacks Consensus Estimate of $1.65 billion. However, the figure jumped 71% from the prior-year quarter.

Key Stats to Note:

Total assets under management stood at $439.4 billion as of Jun 30, 2018.

Inflows were $20.1 billion in the quarter.

Total Dry Powder was $88.3 billion.

Returned nearly $200 million to unitholders through a special cash distribution of 10 cents per share and repurchase of 2.2 million units in the second quarter.

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #3 (Hold) for Blackstone. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look favorable, it all depends on what sense the just-released report makes to the analysts.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

How the Market Reacted So Far

Following the earnings release, Blackstone shares were up nearly 1% in the pre-trading session. This is in line with what the stock witnessed in the prior-day’s session. Clearly, the initial reaction shows that the investors have considered the results in their favor. However, the full-session’s price movement may indicate a different picture.

Check back later for our full write up on this Blackstone earnings report!

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Blackstone Group L.P. (BX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research