Block, Inc.'s (NYSE:SQ) Core Business is Growing Despite the Mixed Q2 Earnings

First published on Simply Wall St News on the 5th of August.

Summary:

SQ quarterly earnings and net revenue declined by $412 million and 5.9% respectively.

Growth from the Cash App is expected to continue on the 3-Yr CAGR trend of 83%. GPV expected to grow 23% in Q3.

Still in the high-growth phase for the core business, but earnings will need time to breakeven. Analysts are bearish on the short-term price targets.

Block, Inc. ( NYSE:SQ ) just released the second quarter results, indicating an overall stagnation in revenues and earnings. However, some investors remain bullish as the company is building up its core business as well as seeing high growth in the Cash App. Even though 2022 has been bad for young growth companies, there may be a good case for Block to keep growing and become a new major player in the fintech space.

The company that started as a payment processing service for point of sale terminals, now has multiple financial services that it offers to businesses and consumers, which give investors some needed reassurance that the business has fundamentals potential.

First, we will re-cap the important aspects of the latest Q2 earnings release .

Block's Q2 Earnings Analysis

Block, a.k.a. Square quarterly earnings summary:

Net revenue down 5.9%, at $4.404 billion, v.s. the estimated $4.3 billion.

Operating income is negative, with a loss slowdown to $-213.77 million.

Net Loss to common stockholders $-208 million, down $412 million YoY.

Number of shares grew by 40k, 11.25% to 581,350.

Diluted EPS came negative at $-0.36.

Adjusted EPS $0.18, slightly beating the expected $0.16.

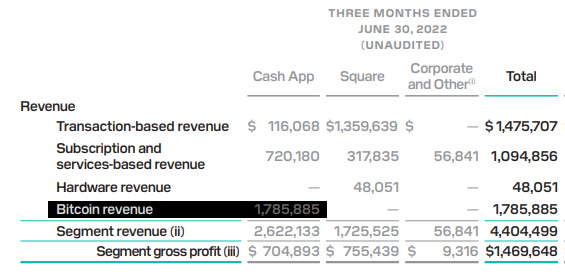

In the table below, we can see the distribution of revenues by segment - This gives us some perspective that the business is executing on its vision and is developing a broader ecosystem:

Block's income consists of three key FinTech segments : Square payment processing transactions, Cash App - including the "buy now pay later" (from Afterpay) and short term lending services, and Bitcoin revenue (within the Cash App).

Note that the Bitcoin revenue comes from allowing Cash App users to trade Bitcoin, but the gross profit from this segment is significantly lower at 2% or $41 million, close to the transaction fees for the cryptocurrency. This is why some investors like to focus on the revenue net of bitcoin, which was $2.62 billion, up 34% from last year.

The company is expecting revenue growth rates around 18% and 23% in July and the third quarter respectively for Square's GPV (Gross Payment Volume). For the Cash App, the company expects revenue growth to be in-line with the three year CAGR of 83%.

This shows that the company is successfully diversifying away some of the risks from competitive payment processors and short term lenders such as Apple Inc., ( NASDAQ:AAPL ). We will likely see a tight race for market cap between the two companies as their services develop.

Block's Price Targets are Under Pressure

Finally, we need to see what this means for investors. Looking at the price targets, it seems that the 39 Wall Street analysts covering Block, have decreased their price targets over time. This is a bad sign for short-term investors, but the growth expectations for the company may indicate a possible increase in future price targets.

See our latest analysis for Block

Currently, the average price target for block is $118.4 per share implying a 20+% upside, however there is low agreement between analysts for the targets, with the range spanning from $64 to $210. This indicates that analysts have significantly different theses on how fast the company will grow, as well as how profitable it will be for investors.

As analysts change their estimates for the company, it seems that Block will take longer to resurface and post positive earnings, you can track the estimated breakeven date from notifications on our Block report .

What This Means For Investors

Block's core business remains payment processing, however the company has built up a software ecosystem that mitigates competition risks and will allow them to concentre on the most viable growth avenue. Currently, it seems that the focus is on developing the Cash App, as a financial service platform that can reach many more users than the core business.

While the company is experiencing turbulence with its bitcoin investments and transaction fees, it has used this project to onboard many new users that have now become familiar with the Cash App and can continue using it for multiple financial services.

Even though the company has experienced a downturn in 2022, it now seems that the core business is healthy, growing, and Block has the opportunity to become a major player in the FinTech space.

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Block that you should be aware of.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here