BNY Mellon Releases 8 Investment Solution ETFs

On Thursday, BNY Mellon Investment Management launched funds that expand investment solutions to deliver BNY Mellon’s leading index capabilities in an ETF fund structure. The BNY Mellon US Large Cap Core Equity ETF (BKLC) and the BNY Mellon Core Bond ETF (BKAG) will be first zero-fee ETFs with no fee waivers or restrictions in two of the largest U.S. market categories.

BNY Mellon, one of the world’s largest asset managers with $1.9 trillion in assets under management, announced the expansion of its investment solutions line-up with the introduction of eight ETFs designed to cover the core exposures in a typical asset allocation strategy.

The first three Morningstar-benchmarked equity ETFs (BNY Mellon US Large Cap Core Equity ETF (BKLC); BNY Mellon US Mid Cap Core Equity ETF (BKMC); BNY Mellon US Small Cap Core Equity ETF) will commence trading today on the New York Stock Exchange (NYSE).

In the coming weeks, BNY Mellon expects to launch two additional Morningstar-benchmarked equity ETFs, the BNY Mellon International Equity ETF (BKIE) and BNY Mellon Emerging Markets Equity ETF (BKEM), followed by three fixed income ETFs benchmarked against the Bloomberg Barclays Fixed Income indices.

BNY Mellon’s ETF range will be among the lowest-cost ETFs in the industry. The BNY Mellon US Large Cap Core Equity ETF and BNY Mellon Core Bond ETF (BKAG) will be the first zero-fee ETFs in the largest equity and fixed income U.S. market categories offered to investors without fee waivers or other restrictions.

“Our aim is to strengthen and deepen our relationships with our clients by delivering relevant investment products and product structures that meet their evolving needs. That is why we are making our leading institutional-quality investment solutions available to a wider range of clients through a low-cost ETF fund structure,” said Stephanie Pierce, Chief Executive Officer of ETF and Index for BNY Mellon Investment Management. “Following the launch of this initial suite of eight ETFs, we expect to introduce additional ETFs in the future that feature the expertise and differentiated capabilities of our affiliated investment firms.”

The launch of low-cost ETFs draws upon BNY Mellon’s deep ETF experience, with $340 billion in index assets under management for institutional and retail clients, including over $44 billion in sub-advised ETF assets; and BNY Mellon’s suite of enterprise-wide ETF services covering asset servicing, securities lending, capital markets, brokerage and clearing services.

“By combining BNY Mellon Investment Management’s three decades of indexing experience as one of the pioneers in the field, with BNY Mellon’s existing end-to-end ETF capabilities, we are putting the entire firm to work for our clients to offer high-quality products at a very competitive fee level,” said Mitchell Harris, Chief Executive Officer, BNY Mellon Investment Management. “With the launch of our ETF range, BNY Mellon will now provide a complete ETF solution for our clients across the enterprise.”

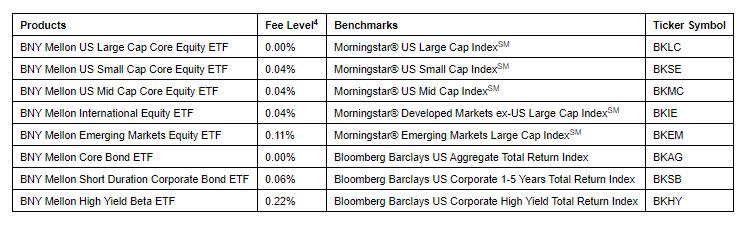

The complete range of BNY Mellon Investment Management’s eight ETFs to be listed on the NYSE are:

The investment adviser for the ETF range is BNY Mellon ETF Investment Adviser, LLC, with Mellon Investments Corporation (Mellon) serving as the sub-adviser. Mellon is a BNY Mellon multi-asset investment firm with over $545 billion of assets under management that provides institutional-quality portfolio construction and risk management.

The BNY Mellon High Yield Beta ETF (BKHY) offers broad high yield corporate market exposure utilizing Mellon’s proprietary credit model to enhance security selection and mitigate downside risk.

The ETF range will be available to individual investors and financial advisers through certain authorized broker-dealers and registered investment advisers. As an added benefit to clients, all BNY Mellon ETF assets held on the Pershing platform will be made available with no custody fees where applicable.

To learn more about BNY Mellon’s ETF range, including the prospectus documents, please visit https://im.bnymellon.com/etf.

This article originally appeared on ETFTrends.com.