BNY Mellon's (BK) Q4 Earnings Beat Despite Lower Revenues

Bank of New York Mellon Corporation’s BK fourth-quarter 2022 adjusted earnings of $1.30 per share surpassed the Zacks Consensus Estimate of $1.22. The bottom line reflects a rise of 25% from the prior-year quarter. Our estimate for earnings was $1.09.

Results have been aided by a rise in net interest revenues. However, asset balances witnessed a decline, which was a negative. Higher expenses and lower fee revenues have hurt the results to some extent.

Net income applicable to common shareholders (GAAP basis) was $509 million or 62 cents per share, down from $822 million or $1.01 per share recorded in the year-ago quarter. Our estimate for net income was $852.2 million.

For 2022, adjusted earnings of $4.59 per share surpassed the Zacks Consensus Estimate of $4.41. The bottom line reflects a rise of 8.3% from the prior-year period. Our estimate for earnings was $4.31. Net income applicable to common shareholders (GAAP basis) was $2.36 billion or $2.90 per share, down from $3.55 billion or $4.14 per share recorded in the year-ago period. Our estimate for 2022 net income was $2.71 billion.

Revenues Decline, Expenses Rise

Quarterly total revenues declined 2.4% year over year to $3.92 billion. The top line missed the Zacks Consensus Estimate of $4.29 billion. Our estimate for revenues was $4.14 billion.

For 2022, revenues were $16.38 billion, up 2.8% year over year. The top line, however, missed the Zacks Consensus Estimate of $16.75 billion.

Quarterly net interest revenues, on a fully taxable-equivalent (FTE) basis, were $1.06 billion, up 55.4% year over year. The rise reflected higher interest rates on interest-earning assets, partially offset by higher funding expenses.

The net interest margin (FTE basis) expanded 48 basis points (bps) year over year to 1.19%.

Total fee and other revenues declined 14.3% to $2.86 billion. The decline was due to a fall in investment management and performance fees, foreign exchange revenues, financing-related fees, and investment and other revenues. Our estimate for the same was $3.19 billion.

Total non-interest expenses (GAAP basis) were $3.21 billion, up 8.3% year over year. The rise was due to an increase in almost all cost components, except for sub-custodian and clearing costs, bank assessment charges, costs related to the amortization of intangible assets, and other expenses. Our estimate for expenses was $3.02 billion.

Asset Balances Decline

As of Dec 31, 2022, assets under management were $1.84 trillion, down 25% year over year. The decline was due to lower market values, the unfavorable impact of a stronger U.S. dollar and the divestiture of Alcentra, partially offset by net inflows. Our estimate for AUM was $2.12 trillion.

Assets under custody and/or administration of $44.3 trillion declined 5%, primarily reflecting lower market values and the unfavorable impact of a stronger U.S. dollar, partially offset by client inflows and net new business.

Credit Quality: Mixed Bag

Allowance for loan losses, as a percentage of total loans, was 0.27%, down 2 bps from the prior-year quarter. As of Dec 31, 2022, non-performing assets were $109 million, down 9.2% year over year.

In the reported quarter, the company recorded provision for credit losses of $20 million against a provision benefit of $17 million in the year-ago quarter. We projected provisions of $4.5 million for the fourth quarter.

Capital Position Decent

As of Dec 31, 2022, the common equity Tier 1 ratio was 11.2%, unchanged from the Dec 31, 2021 level. Tier 1 leverage ratio was 5.8%, up from 5.5% as of Dec 31, 2021.

Our Take

Higher interest rates, BNY Mellon’s global footprint and a strong balance sheet position are likely to keep supporting its revenue growth in the near term. However, concentration risk, arising from significant dependence on fee-based revenues, is a major concern.

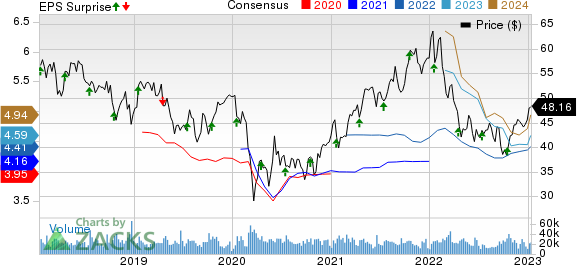

The Bank of New York Mellon Corporation Price, Consensus and EPS Surprise

The Bank of New York Mellon Corporation price-consensus-eps-surprise-chart | The Bank of New York Mellon Corporation Quote

Currently, BNY Mellon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Banks

We now look forward to the earnings release of Hancock Whitney HWC and Bank OZK OZK.

HWC is slated to release fourth-quarter numbers on Jan 17 and OZK will release quarterly results on Jan 19.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report