Boeing Shares Gain Despite Reporting 1st Annual Loss in Over 2 Decades

Shares of aircraft manufacturer Boeing Co. (NYSE:BA) rose 3% in premarket trading on Wednesday despite reporting disappointing results for fourth-quarter and full-year 2019.

The Chicago-based aerospace and defense company, which also designs and manufactures rotorcraft, rockets, satellites, telecommunication equipment and missiles, said it lost $636 million in 2019, marking its first annual loss since 1997, on the back of the ongoing issues with its 737 Max jet. The loss, however, was not as severe as Wall Street analysts were anticipating.

The best-selling planes were grounded last March after two crashes killed 346 people within a span of five months. Costs related to the grounding reached $14.6 billion in 2019, and Boeing warned that another $4 billion in charges is expected in 2020. The company has been updating the 737 Max's flight control system and software to fix issues believed to have played a role in both accidents. The U.S. Federal Aviation Administration has indicated the aircraft could be approved to fly again before the middle of the year.

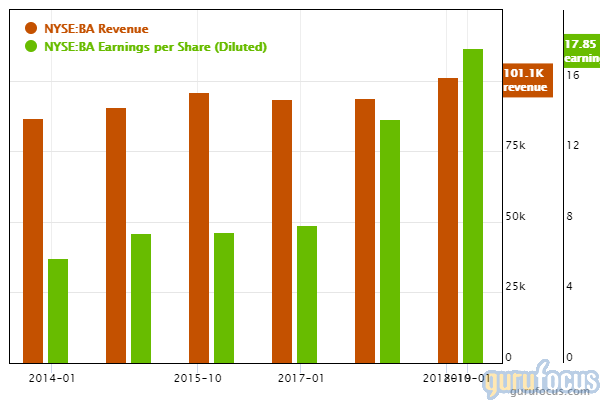

For the quarter, the company posted an earnings loss of $2.33 per share, down from earnings of $5.48 per share in the prior-year quarter. Revenue declined 37% from a year ago to $17.91 billion. Refinitiv analysts were expecting earnings of $1.47 per share.

For the full year, Boeing recorded a loss of $3.47 per share on $76.6 billion in revenue, which was down 24% from 2018 sales.

Adding to the pain, Boeing announced in October it planned to cut production of its 787 Dreamliner, which is currently its main revenue driver, from 14 to 12 per month in 2020 as a result of decreased demand from China amid the ongoing trade war. The company now expects to further low the aircraft's production to 10 per month in 2021.

In a statement, President and CEO David Calhoun, who just stepped into the role earlier this month, said he realizes Boeing has "a lot of work to do" to not only return to profitability, but repair its reputation.

"We are focused on returning the 737 MAX to service safely and restoring the long-standing trust that the Boeing brand represents with the flying public," he added. "We are committed to transparency and excellence in everything we do. Safety will underwrite every decision, every action and every step we take as we move forward."

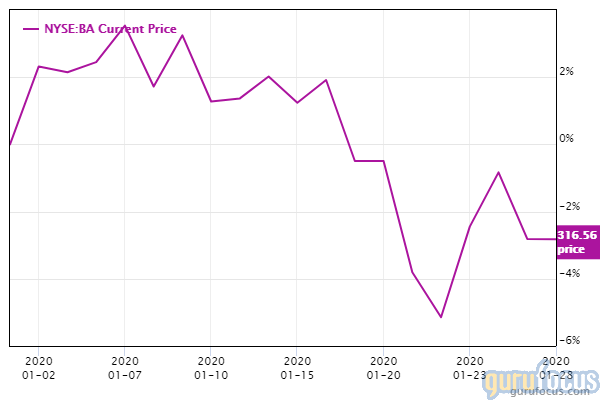

The stock, which has lost about a quarter of its value since March, was trading 2.62% higher on Wednesday morning at $324.85. GuruFocus estimates shares have fallen 3% year to date.

According to GuruFocus' Industry Overview page, Boeing is the largest aerospace and defense company in the U.S., followed by United Technologies Corp. (NYSE:UTX) and Lockheed Martin Corp. (NYSE:LMT).

Gurus with large positions in the stock include Andreas Halvorsen (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio) and the T Rowe Price Equity Income Fund (Trades, Portfolio).

Disclosure: No positions.

Read more here:

3M Shares Fall as 4th-Quarter Revenue and 2020 Outlook Discourage Investors

4 Transportation Companies to Consider as Coronavirus Outbreak Intensifies

Boyar Value Group's 'Forgotten 40' for 2020

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.