The Booking Holdings (NASDAQ:BKNG) Share Price Is Up 78% And Shareholders Are Holding On

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the Booking Holdings Inc. (NASDAQ:BKNG) share price is up 78% in the last 5 years, clearly besting the market return of around 45% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 1.5% in the last year.

Check out our latest analysis for Booking Holdings

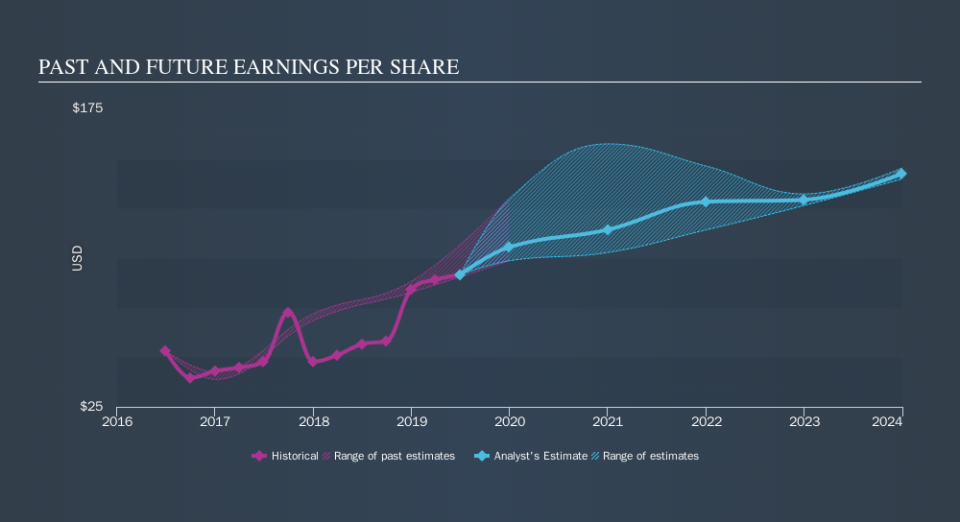

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Booking Holdings achieved compound earnings per share (EPS) growth of 18% per year. The EPS growth is more impressive than the yearly share price gain of 12% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Booking Holdings has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

Booking Holdings provided a TSR of 1.5% over the last twelve months. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 12% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. Before forming an opinion on Booking Holdings you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.