Boston Beer Surges 6.8% in a Month: What's Aiding the Stock?

The Boston Beer Company Inc. SAM witnessed significant momentum since reporting solid first-quarter 2017 earnings on Apr 25, 2018. The company’s upside story relates to continued progress on its strategic initiatives. We remain encouraged by Boston Beer’s three-point growth plan, focused on cost-saving initiatives, long-term innovation, and the revival of Samuel Adams and Angry Orchard brands.

Stock Surges

Shares of Boston Beer have increased 6.8% in the past month against the industry’s decline of 6.3%. However, the stock has witnessed growth of 9.4% after reporting solid results on Apr 25 while the industry declined 4%.

Boston Beer delivered earnings and sales beat in first-quarter 2018, marking its fifth earnings beat in the last six quarters and the third positive sales surprise in the trailing four quarters. Bottom line gained from solid revenue growth as well as higher gross margin, somewhat negated by rise in advertising, promotion and selling expenses. Results gained from gross-margin improvement, lower operating costs, owing to the company’s cost-saving initiatives, as well as lower tax rate. Meanwhile, sales benefited from improved shipment volumes and depletions.

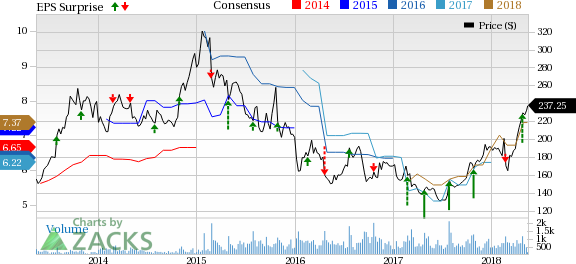

The Boston Beer Company, Inc. Price, Consensus and EPS Surprise

The Boston Beer Company, Inc. Price, Consensus and EPS Surprise | The Boston Beer Company, Inc. Quote

Let’s find out more about the growth drivers for this Zacks Rank #1 (Strong Buy) stock.

Strategic Initiatives Impress

The company remains committed to the three-point growth plan, focused on cost-saving initiatives, long-term innovation, and the revival of its Samuel Adams and Angry Orchard brands. Firstly, it plans to revive the Samuel Adams brand through packaging, innovation, promotion and brand-communication initiatives. Further, it remains keen on retaining Angry Orchard and Twisted Tea’s momentum while ensuring Truly Spiked & Sparkling's leadership position in the hard sparkling-water category. Efforts to improve trends at Samuel Adams comprise its integrated 'Fill Your Glass' marketing campaign alongside sales execution of its Samuel Adams initiative, Sam ’76. Additionally, the company is focused on making more investments in Angry Orchard media in the second quarter.

Secondly, the company accelerated its focus on cost savings and efficiency projects with these savings directed for further brand development. Based on current opportunities, the company continues to anticipate improving gross margin by one percentage point every year through 2019. The company’s third priority is long-term innovation and maximizing the shareholder value. Boston Beer remains optimistic about the future of craft beer and cider categories.

Improving Depletion Trends

Boston Beer’s top-line gains in the first quarter were driven by 15% improvement in shipment volumes and 8% depletions growth. In the reported quarter, depletion primarily gained from increases in Twisted Tea, Truly Spiked & Sparkling, and Angry Orchard brands, partially offset by the fall in the Samuel Adams brand. Depletions for the year-to-date period through the 15-weeks period, ended Apr 14, 2018, are estimated to have grown nearly 8% from the comparable year-ago period. For 2018, depletions and shipments are likely to range from flat to up 6%.

Cost Savings Aid Gross Margins

Boston Beer is making strides to address industry challenges through improved cost structure and re-investing these savings for brand development. This has been significantly contributing toward improving gross margin. In 2017, the company’s cost savings and efficiency projects delivered above the targeted ranges, providing increased flexibility to invest in brands. This positions the company well for 2018. Gross margin improved 330 basis points (bps) in the first quarter, driven by better pricing, product and package mix, and favorable fixed-cost absorption along with cost-savings gains from the company-owned breweries. For 2018, the company expects gross margins between 52% and 54%, driven by continued progress on cost-saving initiatives.

Do Consumer Staples Stocks Grab Your Attention? Check These

Investors interested in the space may also consider Pernod Ricard SA PDRDY, Church & Dwight Co., Inc. CHD and Brown-Forman Corporation BF.B, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Pernod Ricard surged 23.1% in the past year and has long-term growth rate of 7.5%.

Church & Dwight pulled off an average positive earnings surprise of 4.2% in the trailing four quarters. Additionally, it has long-term earnings growth rate of 10.1%.

Brown-Forman delivered an average positive earnings surprise of 9.3% in the trailing four quarters. Moreover, the stock has returned 38.6% in the past year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6% and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown-Forman Corporation (BF.B) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Pernod Ricard SA (PDRDY) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research