Boston Properties Will Remain Under Pressure

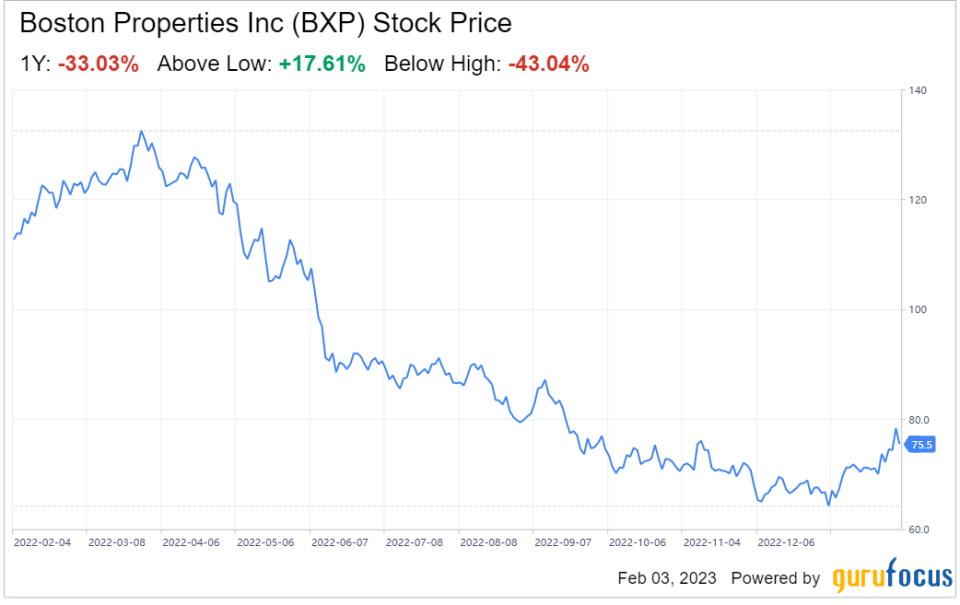

Shares of Boston Properties Inc. (NYSE:BXP) have taken quite a beating over the past year. The stock has tumbled nearly 35%, presenting investors with a potential value opportunity.

Moreover, the real estate investment trust offers a significant dividend yield of 5.3%, along with relatively strong financial metrics. However, the dwindling economic environment and secular headwinds from the work-from-home trend will likely weigh down the stock and its business in the interim.

Boston Properties has arguably been one of the best office REITs over the years, building a reputation for growing its business and rewarding shareholders. Its management's savvy business decisions enabled it to become the largest listed developer and owner of Class A office properties in the U.S. The company has also increased its exposure to tenants in industries such as life sciences and technology to strengthen its portfolio further.

Regardless, the REIT is currently trading at a substantial bargain. The stock trades at 3.81 times trailing 12-month sales, which is lower than the industry median of 7.40.

Work-from-home trend presents a major risk

The crippling effects of the pandemic cast a shadow on the future of office spaces. Businesses around the world increasingly moved toward remote and hybrid workplace models. This shift had a huge impact on vacancy rates in nearly every market. Moreover, the trend did not subside last year and vacancy rates are still climbing, a situation that may be felt for years to come.

Moreover, with federal tax breaks, low interest rates and inflated demand from unprofitable startups, the U.S. became one of the leaders in empty office spaces worldwide. Compounding the problem has been a migration from blue to red states following the pandemic. The higher taxes and living costs in blue states have led to a substantial loss in residents. As a result, REITs such as Boston Properties, which generate the bulk of their earnings from these states, are under immense pressure.

For instance, San Francisco, one of the major business areas for Boston Properties, saw record levels of office vacancies last year. Vacancies in the city climbed to their highest levels since 1993, according to real estate firm CBRE. Moreover, the city's office vacancy rate reached an eye-watering 25.5% after September, up from 20% during the same period last year. At the beginning of the pandemic, vacancy rates were at just 4%.

Pessimism reigns

Boston Properties has shown remarkable resilience in the past, so its current low share price suggests something may be off. Beyond the work-from-home trend, there are likely several other headwinds facing the company.

The pessimism is reflected in management's guidance from its fourth-quarter and full-year 2022 results, which were released earlier this week. The REIT reduced its funds from operations projections for 2023 to a range of $7.08 to $7.18 per share from the previous consensus guidance of $7.15 to $7.30 per share. Moreover, its outlook also falls short of analysts' estimates of $7.21.

The company's conservative guidance suggests occupancy levels may further deteriorate from where they ended the year, indicating it expects a slow comeback over the next several quarters. This forward guidance is undoubtedly disappointing and calls into question the long-term picture for this REIT.

On a more positive note, Boston Properties still has a rock-solid balance sheet, which should give it enough wiggle room to work through its issues. Its maturity schedule is under control, and it is unlikely to see a major impact from higher interest rates. The bulk of its debt is at a fixed rate, and the amount maturing is not that significant over the next few years. Moreover, during its fourth quarter, it could effectively execute 5.7 million square feet of leases.

Exposure to the tech industry is a negative

Looking beyond earnings, the next few quarters will likely be tricky for Boston Properties.

Whatever happens with the broader markets, CEO Owen Thomas believes the real estate sector is already in a recession. He said many clients are implementing cost-saving measures due to lackluster top-line revenue. This has prevented new expansions and resulted in the outright forfeiture of space.

The biggest issue for Boston Properties is that most of its customers are members of the tech space. These companies are aggressively cutting costs and laying off staff. Expansion is the last thing on their minds.

In addition, strong demand for premier workplaces has contributed significantly to the REIT's activity over the last several years. This is because they are a fixture of their portfolio and are responsible for 95% of the average volume over the past 10 years. However, roughly 20% of its portfolio is represented by premier workplaces and buildings. It can create a supply chain crisis, as there continues to be strong demand for office space, but the square footage is just not there.

Overall, the office and commercial real estate markets remain in trouble. Office transactions for the fourth quarter were down 40% from third-quarter levels, and management does not expect to be at positive absorption in 2023.

Takeaway

Boston Properties presents a mixed bag for those that want to invest in the REIT space. On one hand, it has posted strong metrics for 2022. Demand for quality workspace is still strong, but hotels and other establishments will be hard-pressed to keep up with that demand. The market will likely be undersupplied over the long term.

As such, the situation will remain in a state of stress for the office REIT. There is a lot of volatility in the market amid the likelihood of interest rate increases to combat inflation. Boston Properties is still recovering from the pandemic, and the same is true for its tenants. Considering these circumstances, the stock could be a good option now, but may fall further.

This article first appeared on GuruFocus.