BP Appears to be a Solid Investment Bet Right Now: Here's Why

BP plc BP has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 60 days. The stock, currently carrying a Zacks Rank #2 (Buy), is likely to see earnings growth of 119.6% this year.

What's Favoring the Stock?

The price of West Texas Intermediate crude is trading over $85-per-barrel mark, highlighting a substantial improvement in the past year. The positive oil price trajectory is a boon for BP’s upstream operations. The favorable oil price scenario and increasing daily oil equivalent production volumes are aiding the energy giant’s bottom line. BP stated that the target of adding a net production of 900 thousand barrels of oil equivalent per day by 2021 from key new projects had been delivered.

BP is expected to gain from the refining business. The integrated energy player has a significant portion of its refining capacities in the United States. In the country, BP operates feedstock-advantaged and sophisticated refineries. The refineries are connected to strong logistics and fuel infrastructure. Thus, with a considerable presence in the United States, the energy major is well placed to capitalize on the solid fuel demand, backed by the reopening of the economy and wider distribution of vaccines.

BP is strongly focused on returning capital to shareholders. The integrated player recently announced that it is planning to repurchase $3.5 billion in shares before declaring results for the September quarter.

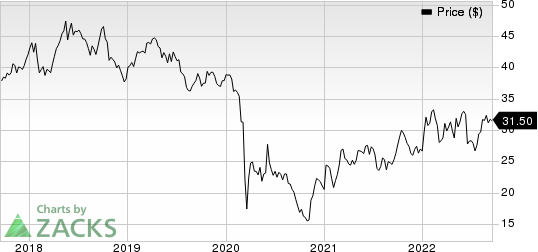

BP p.l.c. Price

BP p.l.c. price | BP p.l.c. Quote

Other Stocks to Consider

Other top-ranked players in the energy space include Chesapeake Energy Corporation CHK, EQT Corporation EQT and Exxon Mobil Corporation XOM. Chesapeake Energy presently sports a Zacks Rank #1 (Strong Buy), while EQT and ExxonMobil currently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Chesapeake Energy is a premium natural gas operator and is well-positioned to gain from the significant improvement in gas prices in the past year. In the prolific gas-rich Marcellus shale play, CHK’s operation is spreading across roughly 650,000 net acres, where an average of four to five rigs will be operating this year.

Chesapeake Energy also has a strong presence in Haynesville and Eagle Ford shale play, making the production outlook bright. Overall, being a leading upstream energy player, CHK has more than 15 years of inventory, signifying more than 2,200 gas locations.

In the core of gas-rich Marcellus and Utica Shales, EQT Corporation has a strong foothold. Being a leading producer of natural gas, EQT is benefiting from high natural gas prices. For 2022, it is likely to witness earnings growth of almost 337%.

The positive trajectory in oil price is a boon for ExxonMobil’s upstream operations. This is because ExxonMobil has a pipeline of key projects in the Permian, the most prolific basin in the United States and offshore Guyana.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

EQT Corporation (EQT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research