BP's CEO Receives $12M Total Pay for 2022 Due to Huge Profit

BP plc’s BP CEO, Bernard Looney, received a total pay of $12 million in 2022, which more than doubled from the previous year as a result of bumper profits amid rising commodity prices.

In 2022, BP reported a record profit of $28 billion since Russia’s aggressive invasion of Ukraine drove oil and gas prices to their highest levels. As a result, the company hiked its dividend and announced plans to buy back an additional $2.75 billion of shareholder stock.

However, BP provoked environmentalists by receding from its plans to cut hydrocarbon production and reduce emissions by 2030. According to BP’s annual report, the company’s emissions in 2022 remained unchanged from the previous year at around 340 million tons of carbon dioxide equivalent.

BP has already achieved its target to reduce well-to-forecourt emissions by 10-15% by 2025 against a 2019 baseline. Despite increasing its hydrocarbon production through 2025, BP intends to cut the well-to-forecourt emissions by 20-30% by 2030 and achieve net zero emissions by 2050. It plans to reduce its hydrocarbon production by 25% by 2030.

Oil giants’ massive profits and big salaries for top executives have urged energy companies to do more to protect consumers from high energy prices, which have fueled higher inflation and increased utility bills. As oil and gas bosses are sweeping millions in bonuses, families are struggling to heat their homes.

Hence, activist groups and some opposition lawmakers in Britain demanded expanded taxes on the windfall profits of energy companies and taxing bonuses.

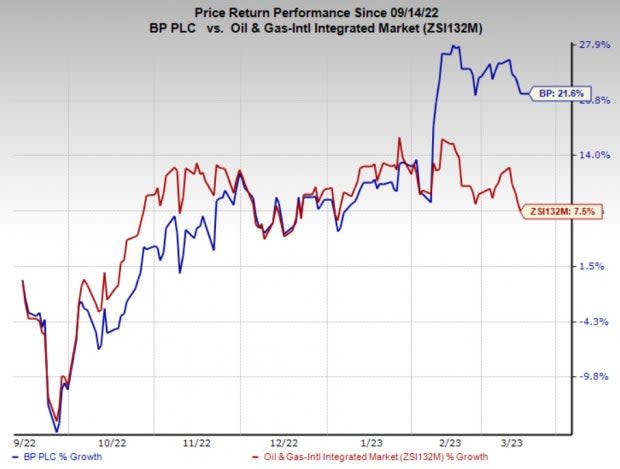

Price Performance

Shares of BP have outperformed the industry in the past six months. The stock has gained 21.6% compared with the industry’s 7.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

BP currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sunoco LP’s SUN fourth-quarter 2022 earnings of 42 cents per unit missed the Zacks Consensus Estimate of 77 cents. Weak quarterly earnings resulted from the higher total cost of sales and operating expenses.

Sunoco has witnessed upward estimate revisions for 2023 earnings in the past 30 days. For 2023, Sunoco expects adjusted EBITDA of $850-$900 million.

RPC Inc.’s RES adjusted earnings of 41 cents per share in the fourth quarter beat the Zacks Consensus Estimate of 30 cents. The strong quarterly results were backed by higher activity levels in all the service lines and rising equipment utilization.

As of Dec 31, RPC had cash and cash equivalents of $126.4 million, up sequentially from $73.2 million. Nonetheless, the company managed to maintain a debt-free balance sheet.

Valero Energy Corporation’s VLO fourth-quarter 2022 adjusted earnings of $8.45 per share beat the Zacks Consensus Estimate of $7.45 per share. The strong quarterly results were driven by increased refinery throughput volumes and a higher refining margin.

Valero can benefit from the Gulf Coast export volumes as fuel demand recovery gets support from Asia economies. The Gulf Coast contributed 59.4% to the total throughput volume in the fourth quarter of 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report