Brandes Investments' Top 5 Buys in 4th Quarter

- By James Li

Brandes Investment Partners, founded by Charles Brandes (Trades, Portfolio), disclosed this week the firm's top five buys for fourth-quarter 2018 are NXP Semiconductors NV (NXPI), Cigna Corp. (CI), Copa Holdings SA (CPA), Flex Ltd. (FLEX) and Takeda Pharmaceutical Co. Ltd. (TAK).

Warning! GuruFocus has detected 1 Warning Sign with NXPI. Click here to check it out.

The intrinsic value of NXPI

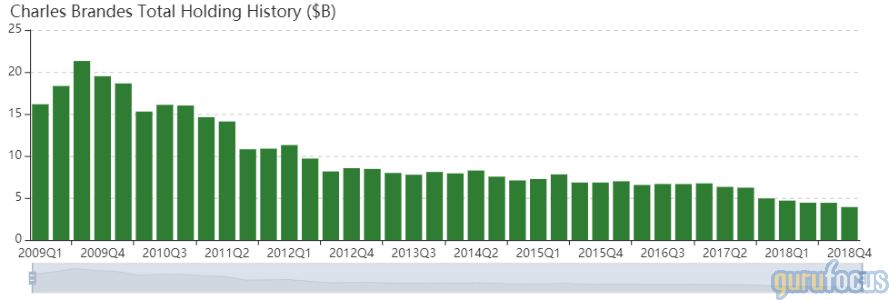

A Ben Graham disciple, Brandes seeks to purchase out-of-favor securities that are trading at discount value and holds them until the market recognizes the securities' true worth.

Brandes said in his shareholder letter that although the Standard & Poor's 500 index increased 19% during 2017, the index declined 4.4% during 2018, including a 9% nosedive in December. Despite this, the fund manager reiterated his investment approach of looking "beyond current market conditions" and taking a long-term approach to investing. Such mindset means "considering valuations and rebalancing to a normal asset-allocation model."

According to current portfolio statistics, Brandes Investments' top three sectors in terms of portfolio weight are financial services, health care and industrials.

NXP Semiconductors NV

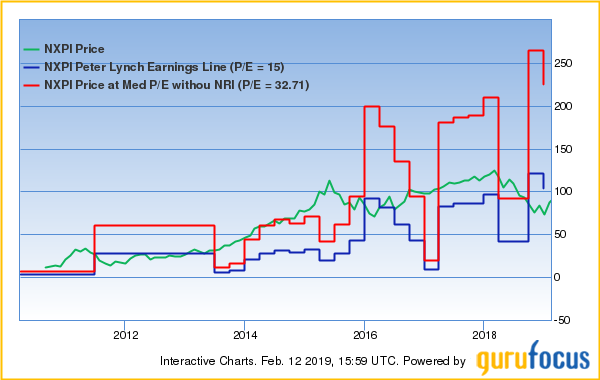

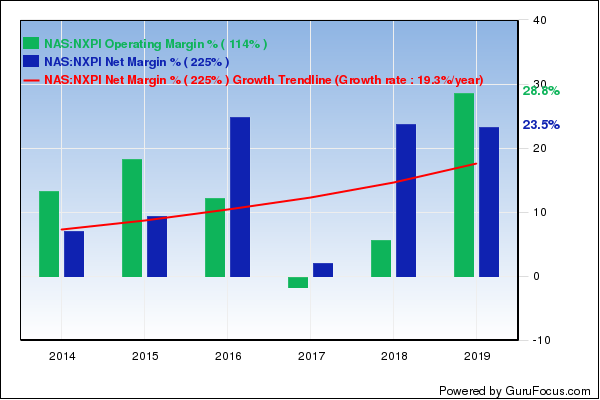

The firm invested in 1,672,584 shares of NXP Semiconductors for an average price of $79.02, giving the position 3.12% portfolio space.

The Dutch semiconductor company primarily provides high-performance mixed signal and standard product solutions for automotive, identification, wireless infrastructure, industrial, mobile, consumer and computing applications. GuruFocus ranks the company's profitability 8 out of 10 on several positive indicators, which include a strong Piotroski F-score of 8 and net profit margins that are near a 10-year high of 28.38% and outperforming 69% of global competitors.

Other gurus with holdings in NXP include T Rowe Price Equity Income Fund (Trades, Portfolio) and Ken Fisher (Trades, Portfolio).

Cigna

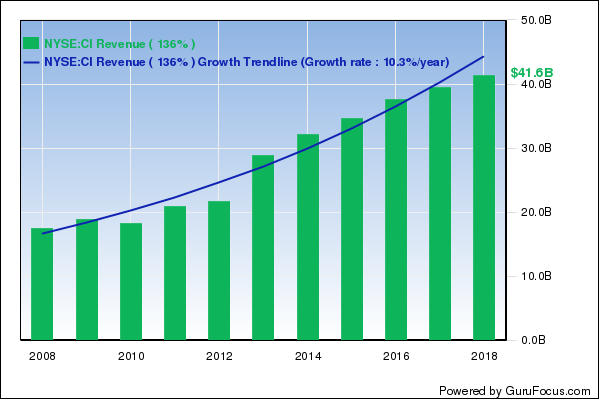

Brandes' firm invested in 235,638 shares of Cigna, Daniel Loeb (Trades, Portfolio)'s newest holding. Shares averaged $208.27 during the quarter; Brandes' firm dedicated 1.14% of its portfolio to the position.

Bloomfield, Connecticut-based Cigna provides a wide range of medical, dental, life and accident insurance products. The company said on Feb. 1 it completed its acquisition of Express Scripts Holding Co. during December 2018 and that adjusted revenues for the year were $48 billion, up 15% from full-year 2017. Strong growth in Cigna's targeted customer segments contributed to the company's revenue growth.

GuruFocus lists three good signs for Cigna: the company's price-earnings ratio is near a three-year low while its price-book ratio and price-sales ratio are both near a two-year low.

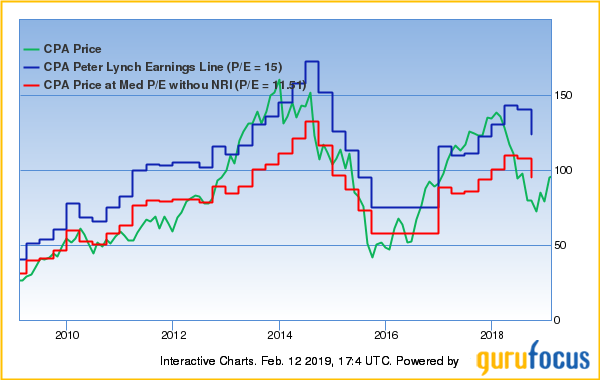

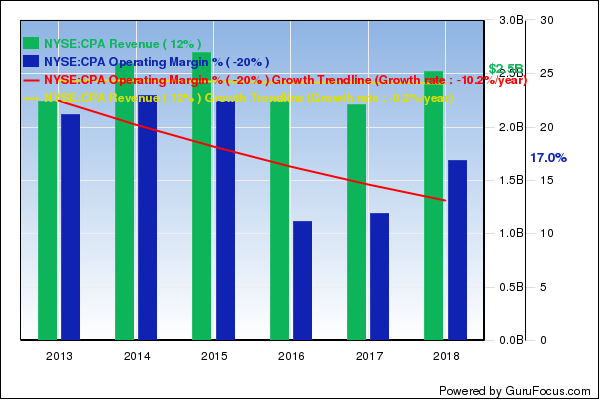

Copa Holdings

The firm invested in 441,530 shares of Copa Holdings for an average price of $78.30, giving the position 0.89% portfolio space.

The Panama City, Panama-based airline provides international air transportation for passengers, cargo and mail services. GuruFocus ranks Copa's profitability 7 out of 10: even though profit margins have declined, Copa's operating margin of 14.40% still outperforms over 90% of global competitors. Despite this, the airline's three-year revenue decline rate of 0.70% ranks lower than 72% of global airlines.

Diamond Hill Capital (Trades, Portfolio) also invested in Copa Airlines during the quarter.

Flex

Brandes' firm invested in 3,808,044 shares of Flex for an average price of $9.15, giving the position 0.74% portfolio weight.

Flex, a major sketch-to-scale service company, provides designing, manufacturing and supply chain services of packaged consumer electronics and industrial products to various industries and end-markets. GuruFocus ranks the company's profitability 7 out of 10: Flex's operating margin has increased 4.80% per year over the past five years despite underperforming 68% of global competitors.

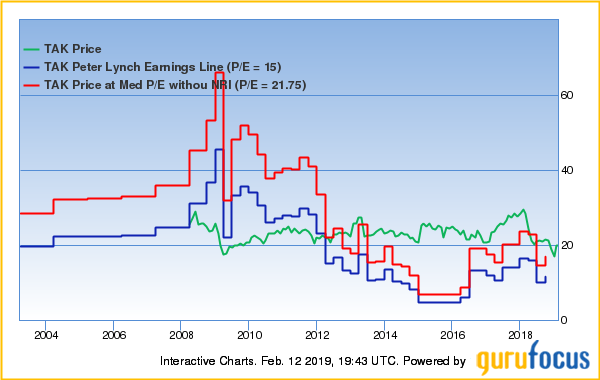

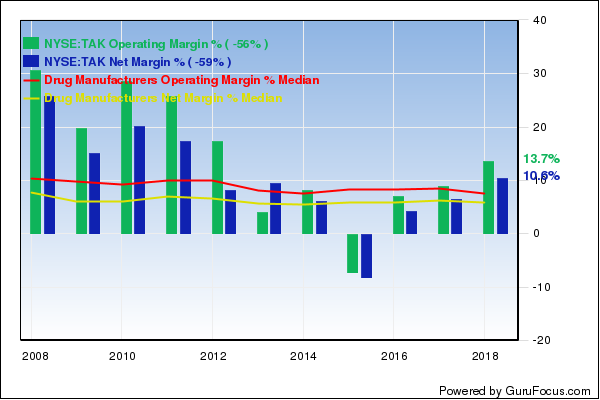

Takeda Pharmaceutical

The firm invested in 1,013,882 shares of Takeda Pharmaceutical for an average price of $18.87, giving the position 0.43% portfolio weight.

The Japanese drug manufacturer primarily focuses on several therapeutic areas, including oncology, gastroenterology, cardiovascular and neurology. GuruFocus ranks the company's profitability 6 out of 10: although the company's profit margins outperform over 67% of global competitors, Takeda's three-year revenue decline rate of 0.20% underperforms 71% of global drug manufacturers.

Disclosure: no positions.

Read more here:

Robert Olstein's Top 5 Buys in 4th Quarter

George Soros Trims Holdings of Allot and VICI Holdings

AzValor Iberia's 3 New Buys for the 4th Quarter

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with NXPI. Click here to check it out.

The intrinsic value of NXPI