Breakeven On The Horizon For KemPharm Inc (NASDAQ:KMPH)

KemPharm Inc’s (NASDAQ:KMPH): KemPharm, Inc., a clinical-stage specialty pharmaceutical company, discovers and develops new proprietary prodrugs in the United States. The US$110.66M market-cap posted a loss in its most recent financial year of -US$16.52M and a latest trailing-twelve-month loss of -US$42.76M leading to an even wider gap between loss and breakeven. The most pressing concern for investors is KMPH’s path to profitability – when will it breakeven? In this article, I will touch on the expectations for KMPH’s growth and when analysts expect the company to become profitable.

View our latest analysis for KemPharm

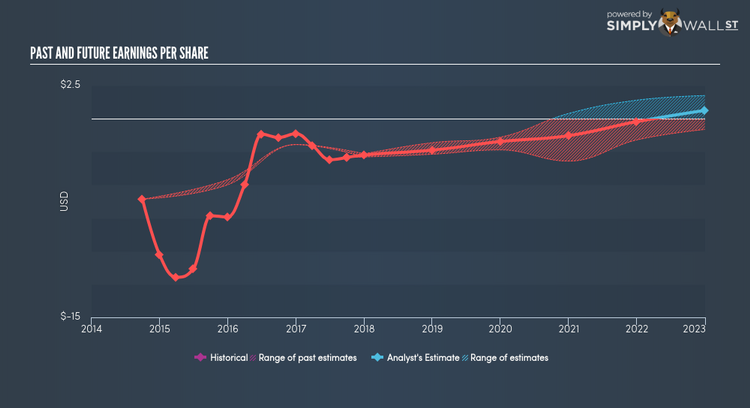

Expectation from analysts is KMPH is on the verge of breakeven. They anticipate the company to incur a final loss in 2021, before generating positive profits of US$25.31M in 2022. KMPH is therefore projected to breakeven around 4 years from now. How fast will KMPH have to grow each year in order to reach the breakeven point by 2022? Working backwards from analyst estimates, it turns out that they expect the company to grow 31.46% year-on-year, on average, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

I’m not going to go through company-specific developments for KMPH given that this is a high-level summary, but, bear in mind that generally pharmaceuticals, depending on the stage of product development, have irregular periods of cash flow. This means that a high growth rate is not unusual, especially if the company is currently in an investment period.

Before I wrap up, there’s one issue worth mentioning. KMPH currently has negative equity on its balance sheet. Accounting methods used to deal with losses accumulated over time can cause this to occur. This is because liabilities are carried forward into the future until it cancels. Oftentimes, losses exist only on paper but other times, it can be a red flag.

Next Steps:

There are key fundamentals of KMPH which are not covered in this article, but I must stress again that this is merely a basic overview. For a more comprehensive look at KMPH, take a look at KMPH’s company page on Simply Wall St. I’ve also compiled a list of key factors you should look at:

Valuation: What is KMPH worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether KMPH is currently mispriced by the market.

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on KemPharm’s board and the CEO’s back ground.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.