Breaking Down Lyft (LYFT) Stock Before Earnings

Lyft LYFT will be a highlight of earnings next week, with the company set to release its Q3 report on Monday, November 7. Competitor Uber Technologies UBER is up roughly 9% since its report.

Unlike Uber, Lyft is already profitable and investors will be hoping the company can sustain this despite challenging operating environments.

Overview

The ride-sharing service and network provider is only three years removed from its IPO in 2019. Each quarterly report and the company’s guidance are crucial for LYFT’s stock, especially during an economic downturn and higher operating costs.

Image Source: Zacks Investment Research

Amidst rising costs, Lyft recently announced it plans to lay off 13% of its workforce. Both Lyft and Uber’s performance has lagged the benchmark over the last few years but LYFT has fallen mightily behind. Investors will be hoping an earnings beat and a stronger than expected outlook could boost LYFT stock and perhaps lead to a sustained rally.

Image Source: Zacks Investment Research

Q3 Outlook

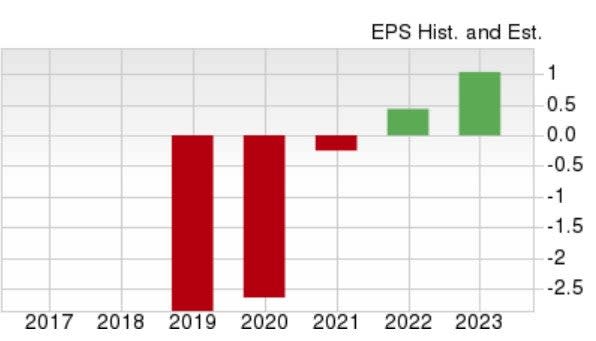

The Zacks Consensus Estimate for LYFT’s Q3 earnings is $0.08 per share, which would represent a 60% increase from Q3 2021. Earnings estimates have also gone up from $0.06 at the beginning of the quarter. Sales for Q3 are expected to climb 22% at $1.05 billion.

LYFT earnings are expected to climb from an adjusted loss of -$0.25 a share in fiscal 2021 to $0.43 per share this year. Top line growth is expected, with sales now projected to be up 27% this year and rise another 23% in FY23 to $5.02 billion.

Performance & Valuation

LYFT is down -67% YTD to largely underperform the S&P 500’s -22%. Since going public in 2019 the stock is also down -67% and underperformed the benchmark. After opening at $87.24 and popping 21% above its initial offering price, the stock has given up all its early gains and trades at around $13 per share.

Image Source: Zacks Investment Research

At current levels, LYFT has a forward P/E of 32.5X which is higher than the industry average of 20X and above the S&P 500’s 17.1X. However, this is more rational when considering some of the high premiums paid for growth stocks.

LYFT’s price to sales has become a lot more favorable for investors as well. LYFT’s P/S of 1.3X is much lower than its 3-year high of 10.4X and the median of 3.9X. Investors initially paid a very high premium for every dollar of sales the company made and it is noteworthy that LYFT’s P/S is now way below the benchmark once again.

Image Source: Zacks Investment Research

Bottom Line

Lyft’s guidance and outlook will lbe more important than its actual Q4 results. LYFT stock could get a nice boost with another profitable quarter and even a slight earnings beat.

LYFT currently lands a Zacks Rank #3 (Hold) and its Internet-Services Industry is in the top 34% of over 250 Zacks Industries. With LYFT trading well below its IPO price, long-term investors have a more attractive entry point. Patient investors who hold the stock may be rewarded as LYFT’s valuation is more reasonable. Plus, the Average Zacks Price Target suggests an inspiring 133% upside from current levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research