Brinker's (EAT) Q3 Earnings & Revenues Surpass Estimates

Brinker International, Inc. EAT reported better-than-expected top- and bottom-line results for the third quarter of fiscal 2018.

Adjusted earnings of $1.08 surpassed the Zacks Consensus Estimate of $1.03 by 4.9%. The bottom line increased 14.9% from the year-ago quarter on higher sales. Also, the company’s savings in tabletop device and Plenti program costs more than offset high labor costs.

Quarterly revenues of $812.5 million beat the consensus estimate of $802.2 million by 1.3%. Revenues, however, increased a meager 0.2% year over year.

Shares did not move in the after-hours trading session following the earnings release. However, over the past six months, the company’s shares have rallied 36.8%, outperforming the industry’s 3.3% gain.

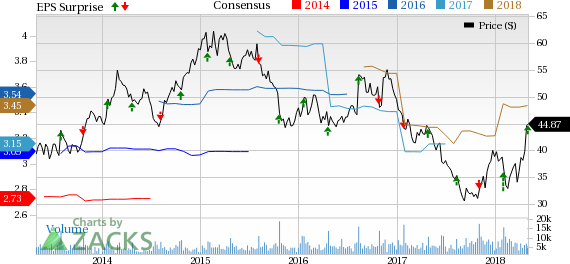

Brinker International, Inc. Price, Consensus and EPS Surprise

Brinker International, Inc. Price, Consensus and EPS Surprise | Brinker International, Inc. Quote

Let’s take a closer look at the third-quarter numbers:

Brand Performances

Brinker primarily engages in the ownership, operation, development and franchising of various restaurant brands under the names, Chili’s Grill & Bar (Chili’s) and Maggiano’s Little Italy (Maggiano’s).

Chili's

Chili’s reported company sales of $688.9 million in the quarter, down 0.1% from the prior-year quarter due to declining comps, partially offset by capacity increase in the United States.

The brand’s company-owned comps fell 0.4% due to a 2.1% decline in traffic, partially offset by a 1.1% and 0.6% improvement in pricing and mix, respectively. However, comps compared favorably with the prior-quarter decline of 1.5% and year-ago drop of 2.3%.

Comps at Chili's franchised restaurants went down 2.1% compared with a 2.5% decline in the year-ago quarter and 1% drop in the last quarter. At international franchised Chili’s restaurants, comps declined 0.2% against the prior-quarter’s increase of 0.1% and compared favorably with the year-ago quarter’s decline of 7.1%. Meanwhile, the same fell in the domestic franchised units by 3.2% against the year-ago quarter’s growth of 0.3% and compared unfavorably with second quarter’s decline of 1.7%.

At Chili's, domestic comps (including company-owned and franchised) declined 1.1%, narrower than the prior-quarter’s drop of 1.6% and the year-earlier quarter’s decline of 1.7%.

Maggiano's

Maggiano's company sales rose 0.6% year over year to $101.6 million, primarily owing to an increase in comps.

Comps grew 0.5% in the quarter, against a fall of 1.6% in the year-ago quarter, on a 1.3% increase in pricing and 0.6% rise in mix, partially offset by a 1.4% decline in traffic. Markedly, comps compared unfavorably with the prior-quarter’s growth of 1.8%.

Operating Results

Total operating costs and expenses increased roughly 0.3% to nearly $739.8 million from $737.8 million in the year-ago quarter. While cost of sales margin expanded 60 basis points (bps), restaurant labor margin increased 40 bps year over year.

Restaurant operating margin, as a percentage of company sales, remained flat year over year. Net income in the quarter increased 10.7% from the year-ago quarter to $46.9 million.

Balance Sheet

As of Mar 28, 2018, cash and cash equivalents were $13.4 million compared with nearly $9 million on Mar 29, 2017.

Long-term debt was $1.36 billion as of Mar 28, 2018, compared with $1.32 billion as of Jun 28, 2017. Total shareholders’ deficit in the quarter was $1.3 billion, compared with $1.4 billion as of Jun 28, 2017. Capital expenditures as of Mar 28, 2018, were $69.5 million. Free cash flow was $168.2 million.

Management approved a quarterly dividend of 38 cents per share of the company’s common stock in the third quarter, which is payable on Jun 28 to shareholders of record as of Jun 8.

2018 Guidance

For the full fiscal year, Brinker expects revenues to be flat to down 0.5% compared with fiscal 2017. Comps are expected to decline within the range of 0.5% to 1%. Restaurant operating margin is also expected to fall 65-75 bps year over year.

Zacks Rank & Peer Releases

Brinker carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Darden DRI reported mixed third-quarter fiscal 2018 results, wherein earnings surpassed the Zacks Consensus Estimate while revenues lagged the same. Adjusted earnings of $1.71 per share increased 29.5% year over year on the back of higher revenues.

Restaurant Brands’ QSR first-quarter 2018 earnings and revenues surpassed the Zacks Consensus Estimate. Earnings under the previous accounting standard came in at 67 cents, growing 86.1% year over year.

Chipotle’s CMG first-quarter 2018 earnings surpassed expectations while revenues were in line with the same. Adjusted earnings of $2.13 grew 33.1% from the year-ago quarter driven by higher revenues and lower food costs.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research