Bristol-Myers (BMY) Down as Merck NSCLC Study Fares Better

Shares of Bristol-Myers Squibb Company BMY fell 7.8% as investors were not much impressed with the company’s initial results from the phase III study, CheckMate -227. The study was evaluating the Opdivo 3 mg/kg plus low-dose Yervoy (1 mg/kg) combination in first-line advanced non-small cell lung cancer (“NSCLC”) patients with high tumor mutational burden (TMB) ≥10 mutations/megabase (mut/Mb).

The combination demonstrated a superior benefit for the co-primary endpoint of progression-free survival (“PFS”) versus chemotherapy. The initial results showed that the one-year PFS rate was more than triple with the combination versus chemotherapy (43% vs. 13%).

The overall response rate with the combination was 45.3% while that of 26.9% the chemotherapy arm. 68% of responders had ongoing responses at one year (25% with chemotherapy). Grade 3-4 treatment-related adverse event rate with the Opdivo plus low-dose Yervoy combination was 31% versus 36% with chemotherapy.

While the results were encouraging, investors were disappointed as Merck’s MRK Keytruda seem to have fared better than Opdivo and Yervoy combination. Merck announced results from a phase III study, KEYNOTE-189, evaluating anti-PD-1 therapy Keytruda, in combination with pemetrexed (Alimta) and cisplatin or carboplatin for the first-line treatment of metastatic nonsquamous NSCLC. The results showed that the Keytruda-pemetrexed-platinum chemotherapy combination significantly improved overall survival (“OS”), reducing the risk of death by half compared with chemotherapy alone.

Consequently, shares of Bristol-Myers declined. The first-line NSCLC market competition is stiffening with quite a few companies trying to capture additional market share.

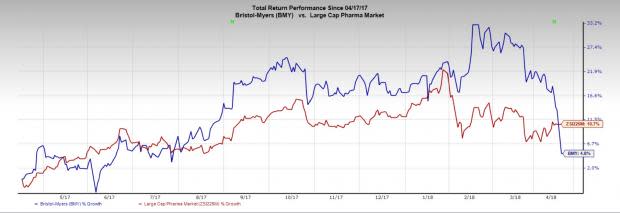

Shares of the company have gained only 4.8% in the past year, underperforming the industry’s growth of 10.7%.

Concurrently, Bristol-Myers announced that it obtained FDA approval for Opdivo plus Yervoy (injections for intravenous use) as the first immuno-oncology combination therapy for previously untreated patients with intermediate- and poor-risk advanced renal cell carcinoma. The phase III trial, CheckMate-214 demonstrated a significant and unprecedented increase in OS for the abovementioned combination in this patient population compared to a current standard of care, Pfizer’s PFE Sutent.

Moreover, Opdivo demonstrated sustained OS advantage over standard of care in patients with recurrent or metastatic squamous cell carcinoma of the Head and Neck in CheckMate-141. Patients treated with Opdivo experienced a 32% reduction in the risk of death after two years minimum follow-up.

We note that Opdivo is currently approved in several countries including the United States, the EU and Japan for several cancer indications. Opdivo continues to be launched globally on approvals and label expansions. The drug has been performing impressively due to demand resulting from the rapid commercial acceptance for several indications including melanoma, renal cell carcinoma, and second-line NSCLC. Label expansion into additional indications would give the product access to a higher patient population and increase the commercial potential of the drug significantly.

Bristol-Myers announced a worldwide collaboration with Johnson & Johnson’s JNJ Janssen Pharmaceuticals, Inc. (Janssen) on a Factor XIa (FXIa) inhibitor program that includes the development and commercialization of the former’s factor XIa (FXIa) inhibitor, BMS-986177.

We note that BMS-986177, an investigational anticoagulant compound is being evaluated for prevention and treatment of major thrombotic conditions. Both companies are expected to advance BMS-986177 into phase II trials in the second half of 2018 for the study of secondary stroke prevention.

Zacks Rank

Bristol-Myers carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley, Goldman Sachs and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol-Myers Squibb Company (BMY) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research