British American Tobacco Is Currently a Solid Potential Pick

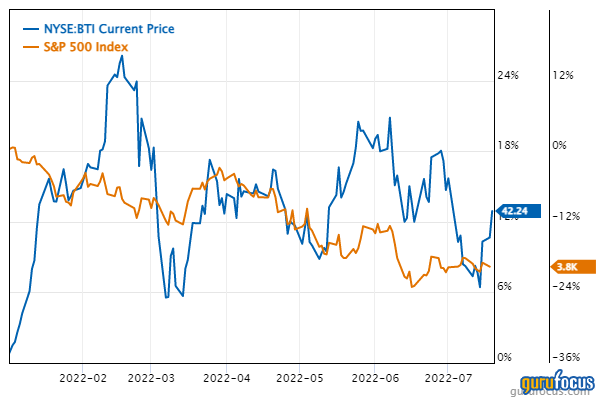

One of Ray Dalio (Trades, Portfolio)'s recent portfolio additions, British American Tobacco PLC (NYSE:BTI), has been one of the few U.S.-listed companies to hold firm during 2022's bear market. The stock has risen by over 10%, providing a radically different trajectory to that of the S&P 500 Index.

However, given the company's recent rise, many investors might be thinking about cashing out their profits or alternatively selling out due to risk aversion.

In my opinion, British American Tobacco remains a solid stock for those seeking solid total returns.

Consumer staples appeal

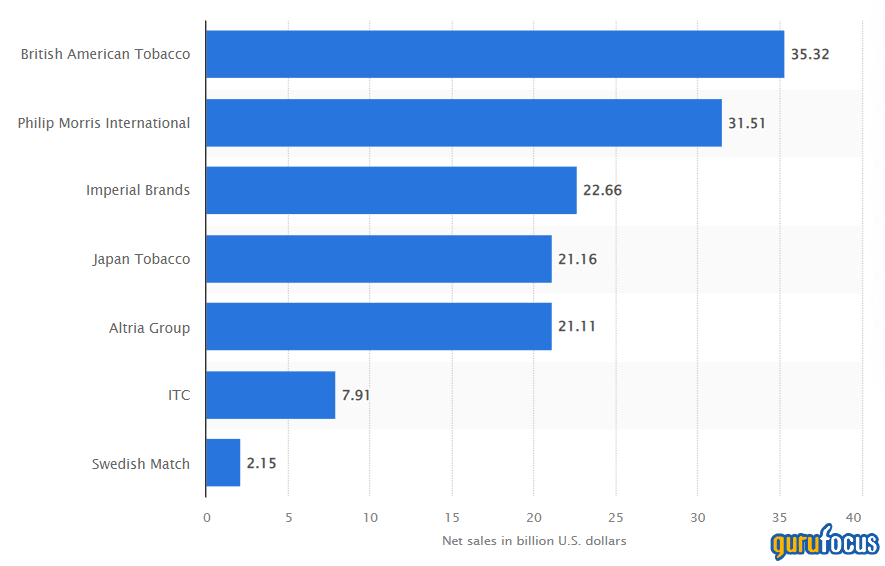

Tobacco products are considered consumer staples, which places them in the non-cyclical bracket. As such, British American Tobacco is able to absorb economic downturns to a greater extent. Furthermore, the company possesses a moat with approximately 35% market share in the tobacco market, allowing it to exercise superior pricing and bargaining power.

Source: Statista

Earnings review and outlook

The company's pre-close report for the first half of the year, which was published in June, suggests it holds firm despite headwinds on the supply side. British American Tobacco beat its revenue target by approximately $48 million amid 50% year-over-year growth in its new product segment, which included non-combustible consumer growth of more than 2.6 million individuals.

Looking ahead, the company expects full-year revenue to compound at 5% annually through 2025 and remains committed to its 65% dividend payout policy.

Furthermore, Wall Street remains bullish on British American Tobacco's prospects. For example, Owen Bennett of Jeffries said:

"During its recent results, BAT pointed to increasing value share in all key RRP segments (with the one exception being U.S. modern oral). BAT also continues to take value share in cigs, while it was also fairly relaxed around signs of any accelerated down-trading, likely a concern for investors, specifically in the U.S. due to the growth of deep discount and BAT's aggressive pricing the last couple of years. It looks like down-trading is continuing to be driven by value into deep discount, while BAT share gains are driven by premium brands Newport and Natural American Spirit."

Valuation and dividends

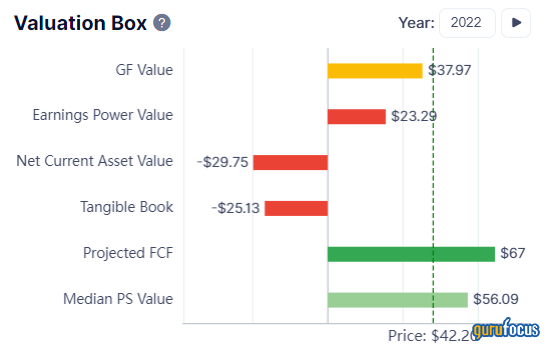

According to GuruFocus' free cash flow tool, British American Tobacco could reach $67 per share, which is significantly higher than its current price, oscillating in the mid-$40 range.

Furthermore, British American Tobacco's relative valuation metrics suggest it is an undervalued asset. According to the price-earnings ratio of 10.42, the stock is trading at a 47.92% discount. Additionally, the company pays a solid dividend with a yield worth 6.94%, placing it in the upper quantile of dividend payers.

Concluding thoughts

Based on key metrics, British American Tobacco is a significantly undervalued stock with attractive dividend-paying attributes. Furthermore, the market seems to be leaning toward consumer staples in the current risk-off market environment, providing the company with systemic tailwinds.

This article first appeared on GuruFocus.