British American Tobacco Is at an Inflection Point

British American Tobacco PLC (NYSE:BTI) released its latest trading update on Tuesday, revealing positive results that provided the market with a hint of encouragement as the stock ticked up by nearly 2% in early morning trading.

The multinational cigarette producer has lost more than 25% of its market value in the past year due to various factors, namely an underwhelming full-year earnings report, negative consensus from environmental, social and governance-focused investors and a broad-based market drawdown.

Given the stock's year-over-year capitulation, it would be worth assessing its prospects amid an upbeat trading statement, as many investors might believe an inflection point has occurred. But has it? Let us find out.

British American Tobbaco's June trading update

In his first statement since assuming the chief executive role at British American Tobacco, Tadeu Marroco said he is "pleased with our performance in several key areas."

"We increased the number of consumers of non-combustible products by a further 900,000 in Q1, driving good revenue growth and further reducing losses of New Categories means we are on track to deliver our 5bn revenue ambition in 2025, with profitability in 2024, irrespective of the timing of the transfer of our Russian and Belarusian businesses," he said. "Outside the U.S., combustible brands have been performing well as we address portfolio gaps and optimize pricing. Consistently driving value from our combustibles brands is critical, as they deliver substantial cash returns and generate value to fund New Categories and our transformation. We are also making good progress towards de-leveraging our balance sheet, supporting our ambition to sustainably return excess cash to shareholders."

Let us aggregate the broader context of British American Tobacco's trading statement into numbers.

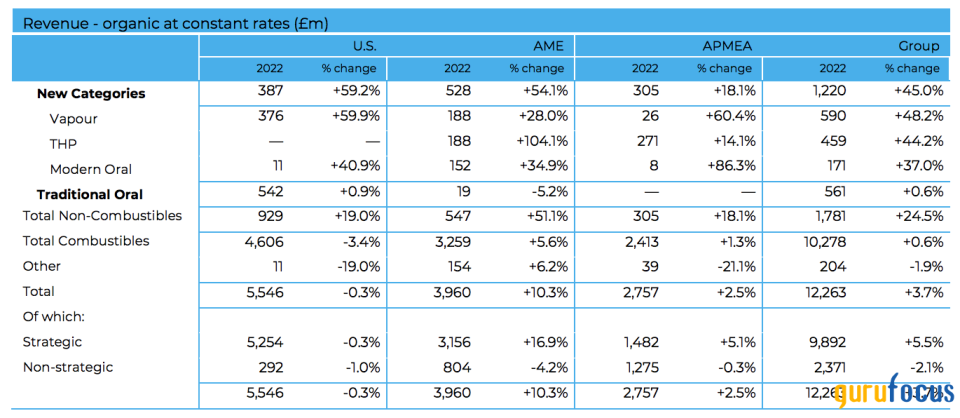

The company's U.S.-based cigarette volume share sales are up by 10 basis points since the turn of the year; however, its value share slipped by 40 basis points amid the implementation of commercial plans within the region. Furthermore, organic group revenue ticked up by 3.7% in the same period, stemming from British American Tobacco's new products of modern oral, THP and Vapour.

Source: British American Tobacco

Although the group's trading update is considered cataclysmic, British American Tobacco's full-year guidance ultimately boosted the stock. Based on the guidance, British American Tobacco will reach constant currency revenue growth between 3% and 5%. Moreover, operating cash flow conversion of above 90% is anticipated, adding allure to the company's potential intrinsic value.

Noteworthy developments

British American Tobacco is in the middle of a substantial restructuring. Not only is the company trying to pivot out of traditional oral cigarettes and into new products, but it is faced with a few emerging market obstacles.

Regarding the latter, British American Tobacco is pulling out of Russia and streamlining its operations in South Africa amid forced exits. The ex-Russia business landscape stems from the war with Ukraine that began in February of 2022, which led to management deciding to exit Russia and Belarus by the end of 2023. In addition, the company has trimmed its exposure to South Africa as the nation's illicit trading is out of control, which has dampened its market stronghold in the region.

British American Tobacco's new products category coalesces benefits from "staying with the times" and alternative emerging market exposure. For example, Velo and Glo have significant emerging market exposure outside of Russia and South Africa while growing at tremendous rates.

In general, the tobacco company's restructuring costs might be costly to investors. Nevertheless, the embedded growth of the new products segment, which now spans approximately 35% of the company's revenue mix, is underappreciated by the market.

Valuation and dividends

A discounted cash flow model of British American Tobacco with a sustainable growth rate of 4% suggests its fair value is approximately $96.65, implying the stock is undervalued by 66.60%. Although the DCF model is merely an indicator, such a large discrepancy certainly provides a sign of an arbitrage opportunity.

In addition to its undervalued status, British American Tobacco possesses a reputation as a constant dividend payer. The forward dividend yield of 8.64% is accompanied by an average share buyback ratio of 0.9, illustrating British American Tobacco's shareholder-driven approach.

In essence, British American Tobacco has lucrative total return prospects in store at a hint of the risk that most other stocks exhibit.

Final word

A mixture of qualitative talking points and quantitative data points show that British American Tobacco's stock is primed for gains in the coming quarters.

Collectively, factors such as a positive half-year trading statement, growth within the company's new products segment and an outstanding discounted cash flow valuation are set to coalesce and might result in upside for British American Tobacco.

This article first appeared on GuruFocus.