Broadridge (BR) Appreciates 7% in Three Months: Here's How

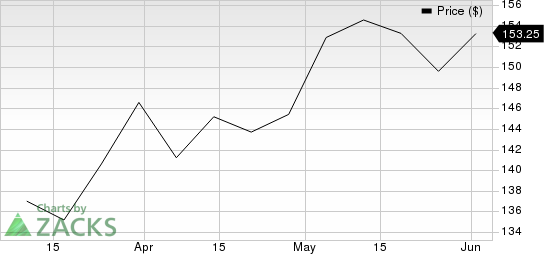

Broadridge Financial Solutions, Inc. BR shares have gained 7.1% in the past three months against the 3.2% decline of the industry it belongs to and the 6.8% rise of the Zacks S&P 500 composite.

Reasons Behind the Rally

Broadridge registered growth in both earnings and revenues in the third quarter of fiscal 2023. Adjusted earnings of $2.05 per share increased 6.2% year over year, whereas total revenues of $1.7 billion were up 7.3% year over year. Recurring revenues of $1.1 billion increased 8% from the year-ago quarter’s level.

Broadridge Financial Solutions, Inc. Price

Broadridge Financial Solutions, Inc. price | Broadridge Financial Solutions, Inc. Quote

The company provided impressive guidance for fiscal 2023. It expects recurring revenue growth to be 6-9%, adjusted earnings per share growth to be 7-11% and adjusted operating income margin to be up by around 50 basis points.

Broadridge’s business is currently benefiting from positive trends such as strong growth in equity and fund records, transformation and digitization of the financial services industry, governance innovation through multiple product launches and an increase in omnichannel customer communication wins.

The company’s Global Technology and Operations business looks well poised to be driven by the Itiviti acquisition. Itiviti is an effective strategic fit for Broadridge’s capital market franchise and contributes significantly to its international revenue growth.

With an increasing demand for technology solutions, the company has ramped up investments in digital and technology platforms. These investments should be beneficial, especially in the post-COVID era, which is expected to see consistent healthy demand for technology solutions.

Zacks Rank and Stocks to Consider

Broadridge currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following better-ranked stocks.

Green Dot GDOT: GDOT currently sports a Zacks Rank #1 (Strong Buy) and has a VGM score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has an impressive earning surprise history, beating the consensus mark in all the four trailing quarters. The company has an average surprise of 37.3%.

Maximus MMS: MMS has a VGM score of A and a Zacks Rank of 2 (Buy).

The company has an impressive earning surprise history, beating the Zacks Consensus Estimate in three of the trailing four quarters and missing once, the average surprise being 9.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report