This Broken E-Commerce Stock is Poised for a 40% Rebound

Amazon.com (AMZN) makes it look easy. The e-commerce titan has just wrapped up its 15th straight year of at least 20% revenue growth, which is harder than it sounds when you consider its revenue base now stands at $75 billion.

If only all other kinds of e-commerce businesses were so easy to build. Other firms, while clearly benefiting from the long-term growth in the frictionless world of online commerce, are still suffering from growing pains.

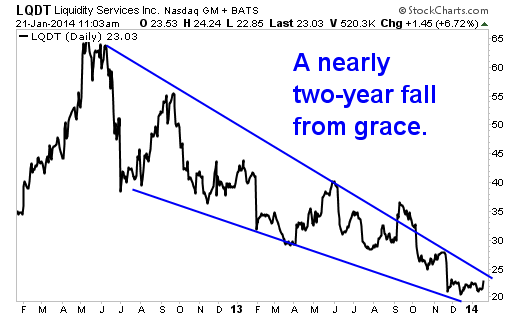

Case in point: Liquidity Services (LQDT), which helps businesses buy and sell surplus equipment through online exchanges. The company had a tremendous growth spurt, boosting sales from $219 million in fiscal 2009 (ended in September) to $475 million by fiscal 2012. Yet sales growth slowed to 6% in fiscal 2013, and analysts don't see much growth in the current fiscal year, sending this stock into a deep funk.

With shares now trading for one-third of the price they fetched in 2012, contrarian investors have started to give this e-commerce play a second look. Though LQDT is unlikely to revisit the $65 mark any time soon, a move back to $30 or even $35 looks quite feasible as the company starts to snag new customers.

Liquidity Services also needs to do a better job of retaining its existing customers. Both Wal-Mart (WMT) and the U.S. Department of Defense (DOD) had become huge customers, accounting for much of that impressive revenue spike a few years ago. But these two behemoths have had less surplus equipment to buy and sell in recent quarters. And fear of an outright loss of the DOD's business was the last straw for many long-suffering investors.

[More from ProfitableTrading.com: Little-Known $2 Weight Loss Stock Could Double Within 6 Months]

However, it increasingly looks like those fears were overblown. On Dec. 4, LQDT announced that a contract to resell the DOD's surplus scrap metal had been extended until June 2015. There's no assurance the company will continue to get that business after that time, but it has been successful in securing rollover contracts in recent years.

LQDT also faced the loss of the rest of its DOD business, all materials and equipment besides scrap metal. An existing contract was put out for bidding in the past few months, raising concerns that Ritchie Bros. Auctioneers (RBA), eBay (EBAY) or others might snatch the exclusive contract away from LQDT. But on Jan. 20, the company announced that it had won the bidding and will keep this contract intact for at least the rest of 2014.

Now investors can more squarely focus on the company's commercial customer base, which has also been struggling lately. Wal-Mart had been a key customer, accounting for 20% of the gross merchandise volume (GMV) of goods sold by LQDT in fiscal 2012, but just 11% in fiscal 2013. As of now, the Wal-Mart business appears to have stabilized at that lower level, and management has been pushing to expand its relationships with other retailers and manufacturers.

Companies turn to LQDT to help unload their excess unsold merchandise, as well as other equipment used in daily operations. The company stores, grades, refurbishes and re-markets thousands of items, from oil-drilling pipes to unsold computers. Thanks to a series of acquisitions, LQDT now has 15 distinct e-commerce platforms, each targeting a different niche. The company's GovDeals.com, for example, sells confiscated vehicles, real estate and items in more than 100 other categories.

The company is also rolling out a range of new services and features that will help it tap into customers that previously have found its offerings to be too limited. "Investments in these areas during fiscal year '14 will enable Liquidity Services to serve and monetize previously untapped markets and unlock new opportunities with new capabilities beginning in early fiscal year '15," said CEO William Angrick in a November 2013 call with investors.

[More from ProfitableTrading.com: This Shunned Stock Could Rally 60% in the New Year]

LQDT's goal is to handle $2 billion in GMV five years from now, up from less than $1 billion in fiscal 2013.

Thanks to the renewal of the DOD contract, shares of LQDT rose more than 6% in Tuesday trading. Investors needed to know that business has at least stabilized. For this stock to continue moving higher, investors now need to see organic growth return. Look for a deep discussion about growth initiatives when the company announces fiscal first-quarter results on Feb. 7. Management may not announce new contract wins at that time, but the stars are aligning for new customer wins in the months to come.

As that starts to happen, look for shares to trade back up in line with its more richly valued e-commerce peers. Shares of eBay, for example, trade for 17 times 2014 EPS forecasts, while Ritchie Bros. trades for around 26 times 2014 EPS forecasts. As new contract wins are announced and growth resumes, look for LQDT to trade back up to a 20X multiple on projected EPS for fiscal 2014 of around $1.60. That equates to a $32 target price, which is about 40% from current levels.

Recommended Trade Setup:

[More from ProfitableTrading.com: This Fallen Star Could Surprise Traders With 50%-Plus Upside]

-- Buy LQDT up to $25

-- Set stop-loss at $18

-- Set initial price target at $32 for a potential 28% gain in six months

Related Articles

Related Articles