Broker-Dealers ETF Leads Financial Sector

Financial ETFs are among the best-performing sectors so far this year after solid fourth-quarter earnings from major banks and on expectations the economy will continue to improve in 2013. However, a narrowly-focused fund tracking broker-dealer firms is leading the pack.

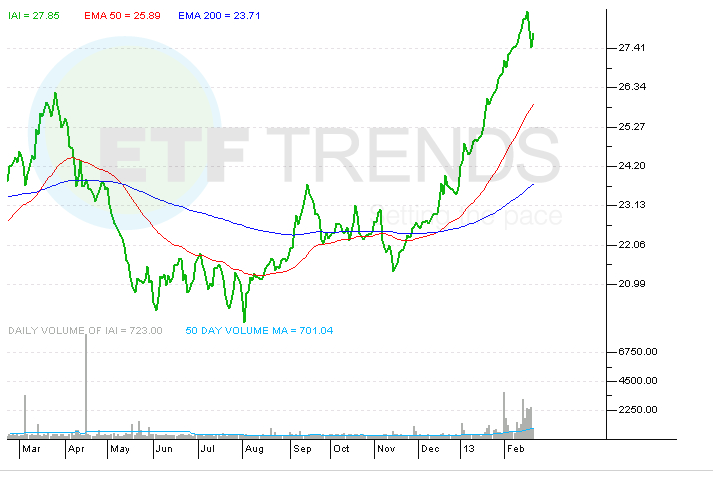

The the iShares Dow Jones U.S. Broker Dealers Index Fund (IAI) is up about 18% year to date.

“This ETF provides an opportunity for investors to participate in the recovery of the capital markets industry without taking on firm-specific risks,” Morningstar says in a profile of IAI. “This ETF’s targeted (and unique) exposure might appeal to those seeking a surgical way to gain access to some of the marquee names in the investment-banking and brokerage business.”

It notes the “broker/dealer” rubric covers a wide variety of firms, including Wall Street banks with large trading businesses, retail and online brokers, exchanges and market specialists.

The fund’s top three holdings are Goldman Sachs (GS), Morgan Stanley (MS) and NYSE Euronext (NYX). [ETF Spotlight: Broker-Dealers]

Bank ETFs have also been solid performers so far in 2013.

“Progress seen in the past one year gives a clear growth indication for the U.S. banking sector. Besides contraction in provisions for credit losses and cost containment, a marked recovery in the equity markets and consequent revenue growth led most of the banks to report higher-than-expected earnings,” Eric Dutram wrote for Zacks.

Although fundamentals such as an improving housing sector, a turning unemployment picture and decent economic data support a run-up in banking stocks, the low-interest rate climate can be a headwind. Strong earnings reported from banking giants JP Morgan Chase (JPM) and Goldman Sachs have bolstered sentiment for the financial sector. Furthermore, profits have been derived from sound, traditional sources rather than bad debt, reports Dutram. [Regional Bank ETFs for Financial Sector Exposure]

Bank-related ETFs include SPDR S&P Bank ETF (KBE) , PowerShares Dynamic Banking (PJB), PowerShares KBW Bank ETF (KBWB).

A recovery in the banking sector has been long awaited, as this is the corner of the market looked to as an indicator of overall economic health. The growth momentum started in the third quarter of 2012, up about 7%, as banks posted healthy earnings not seen in about 6 years. [Regional Bank ETFs: Best and Worst Performing Banks]

iShares Dow Jones U.S. Broker Dealers Index Fund

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.