Bruce Berkowitz's Top 4 Sells in the 1st Quarter

- By James Li

Bruce Berkowitz (Trades, Portfolio), founder and managing member of Fairholme Capital Management, disclosed this week that his firm's top four sells during the first quarter were in The St. Joe Co. (NYSE:JOE), Bank of America Corp. (NYSE:BAC), Canadian Natural Resources Ltd. (NYSE:CNQ) and Cincinnati Financial Corp. (NASDAQ:CINF).

The Miami-based firm focuses investments on companies with solid management teams, good free cash flow and deeply-low valuations. Fairholme concentrates its investments in a small number of companies, believing that the more diversified a portfolio is, the more likely the returns will be average.

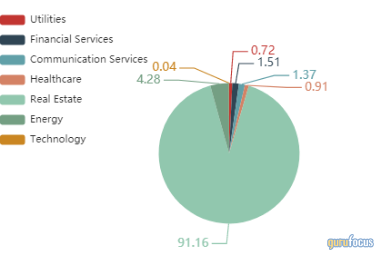

As of March 31, Fairholme's $1.21 billion equity portfolio contains 15 holdings, with four new holdings and a turnover ratio of 3%. The real estate sector occupies 91.16% of the equity portfolio, followed by 4.28% in energy, 1.51% in financial services and 1.37% in communication services.

St. Joe

Fairholme sold 684,800 shares of St. Joe (NYSE:JOE), trimming the position 2.59% and the equity portfolio 2.35%. Shares averaged $47.90 during the first quarter; the stock is significantly overvalued based on Wednesday's price-to-GF Value ratio of 1.33.

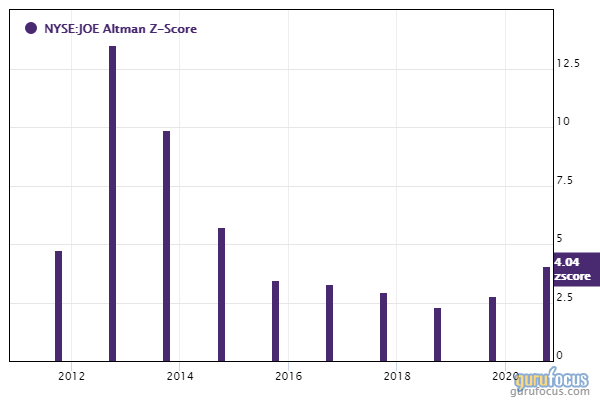

GuruFocus ranks the Watersound, Florida-based real estate company's financial strength 5 out of 10: Although the company has a strong Altman Z-score of 3.98, interest coverage ratios underperform over 55% of global competitors.

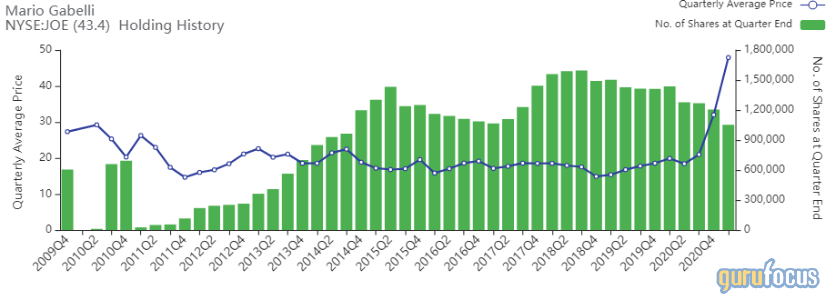

Mario Gabelli (Trades, Portfolio)'s GAMCO Investors Inc. (NYSE:GBL) also has a holding in St. Joe.

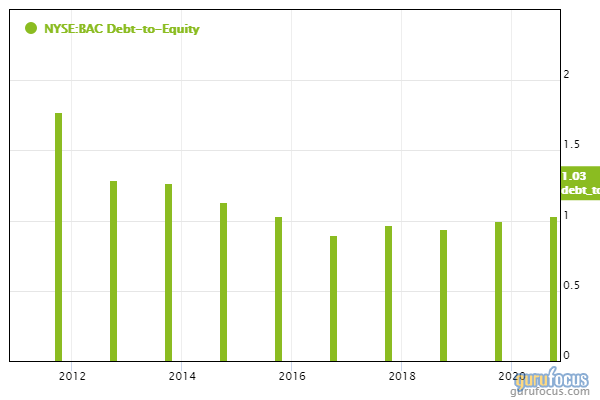

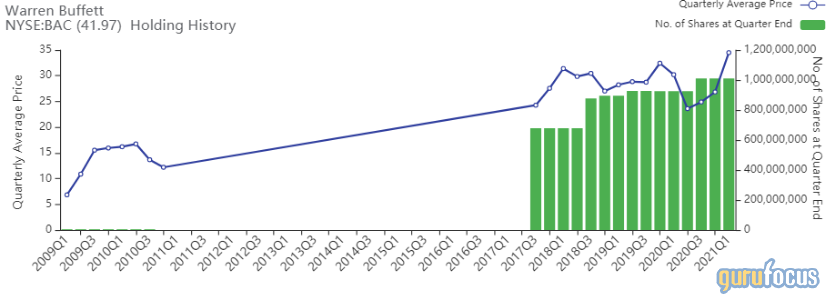

Bank of America

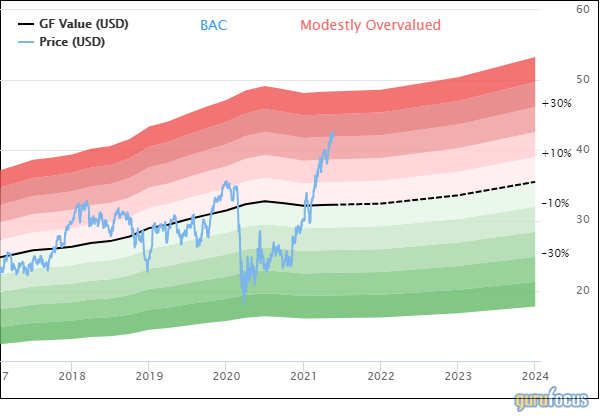

Fairholme sold 483,500 shares of Bank of America (NYSE:BAC), reducing the equity portfolio by 1.19%. Shares averaged $34.49 during the first quarter; the stock is modestly overvalued based on Wednesday's price-to-GF Value ratio of 1.30.

GuruFocus ranks the Charlotte, North Carolina-based bank's financial strength 3 out of 10 on several warning signs, which include a low Piotroski F-score of 3 and debt ratios that underperform over 65% of global competitors.

Gurus with large holdings in Bank of America include Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B), Dodge & Cox and PRIMECAP Management (Trades, Portfolio).

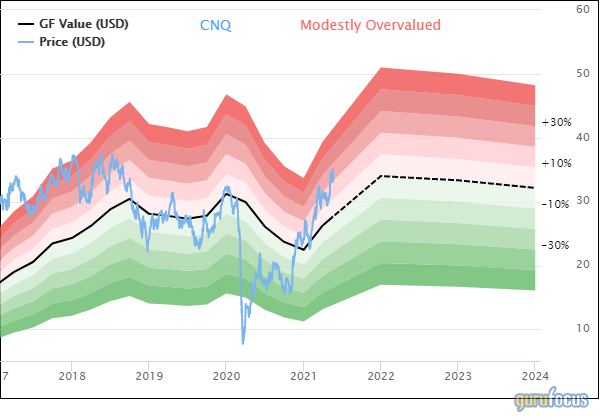

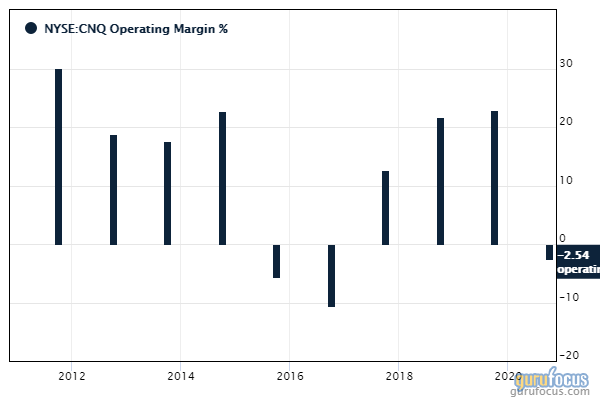

Canadian Natural Resources

The firm sold 475,300 shares of Canadian Natural Resources, dumping 0.93% of the equity portfolio. Shares averaged $27.60 during the first quarter; the stock is modestly overvalued based on Wednesday's price-to-GF Value ratio of 1.20.

GuruFocus ranks the Calgary, Alberta-based energy company's profitability 6 out of 10 on the back of profit margins and returns outperforming over 66% of global competitors.

Cincinnati Financial

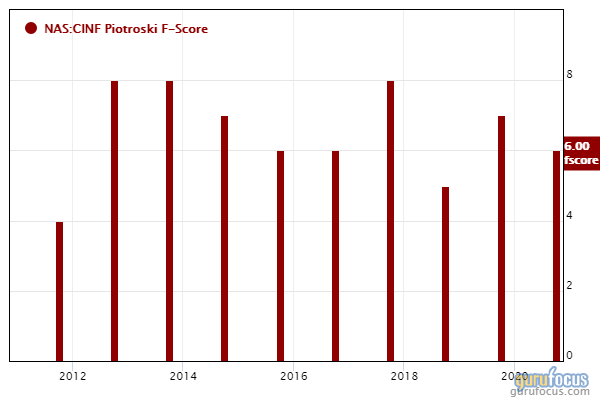

The firm sold 96,700 shares of Cincinnati Financial (NASDAQ:CINF), trimming 0.68% of the equity portfolio. Shares averaged $95.79 during the first quarter; the stock is fairly valued based on Wednesday's price-to-GF Value ratio of 0.92.

GuruFocus ranks the Fairfield, Ohio-based property and casualty insurance company's profitability 7 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank, a high Piotroski F-score of 7 and a net profit margin that outperforms over 92% of global competitors.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.