BSX or BAX: Which is a Better Pick for Your Portfolio Now?

The medical device industry has been benefiting from favorable consumer behavior, the growing prevalence of minimally-invasive surgeries, demand for liquid biopsy tests and the use of IT for ensuring quick and improved patient care along with the shift of the payment system to a value-based model.

Further, considering favorable demographics, changing market dynamics toward Artificial Intelligence (AI) & big-data applications, and increased business investments, this sector has been going strong. Broadly speaking, the latest Tax Cuts and Jobs Act, which slashed corporate tax rates to 21% from the earlier 35%, has also buoyed optimism among investors.

Additionally, the Senate’s decision, to defer the implementation of an industry-wide excise tax — known as the Medical Device — for another couple of years, has instilled confidence in investors. The tax will be effective from Jan 1, 2020. The bill also delays the Cadillac tax — 40% tax on employer insurance — until 2022. Per Emergo, the U.S. Medical Device industry is projected to reach a market value of $173 billion by 2019.

Boston Scientific Corporation BSX and Baxter International Inc. BAX are two close contenders in this space.

Notably, both stocks carry a Zacks Rank #2 (Buy), which raises investors’ optimism.

Here, we make a detailed analysis of the companies’ fundamentals to determine which stock is currently positioned better in the Medical Products space.

With a market cap of $44.55 billion, Boston Scientific is one of the leading manufacturers of medical devices and products, used in various interventional medical specialties worldwide.

On the other hand, based in Deerfield, IL, Baxter is a leading global medical technology company. The company has a market cap of $39.79 billion.

Price Performance

In the past year, Boston Scientific’s shares have gained 15.3% compared with the industry’s increase of 11.9%. The stock has also surpassed the S&P 500 index’s increase of 13.7%. Shares of Baxter have risen 24.1% in this period.

Earnings Growth

The Zacks Consensus Estimate for Boston Scientific’s current-year earnings is pegged at $1.39 per share, which reflects year-over-year projected growth of 10.3%.

The same for Baxter is pegged at $2.89, indicating year-over-year rise of 16.5%.

Moreover, per the last nine years data, since 2009, Boston Scientific’s earnings per share have witnessed a CAGR of 93.8% to $1.26 in 2017. Baxter’s earnings are projected at a negative CAGR of 34.5% and totaled $2.49 in 2017.

Hence, Boston Scientific wins this round.

Sales Growth

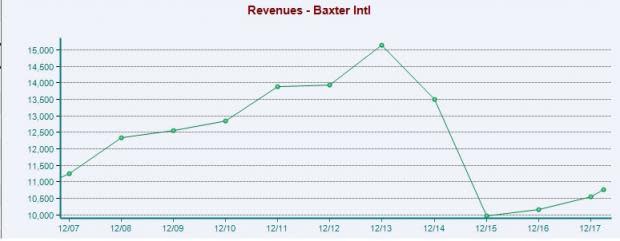

The Zacks Consensus Estimate for Boston Scientific’s current-year revenues is pegged at $9.84 billion, showing year-over-year growth of 8.8%. The same for Baxter is pinned at $11.37 million, reflecting year-over-year growth of 7.7%.

Since 2009, Boston Scientific’s revenues witnessed a CAGR of 10.5% and reached $9.05 billion in 2017. Baxter’s revenues depicted a negative CAGR of 15.9% in 2017.

Here too, Boston Scientific wins over Baxter.

Factors Driving Stocks

Boston Scientific

Over the recently reported quarters, Boston Scientific demonstrated growth across all business lines and geographies. The 2018 view also paints a bright picture. The company achieved clinical milestones for Ranger Drug Coated Balloon and WATCHMAN Left Atrial Appendage Closure device. Also, post the suspension of Lotus valve in Europe, the ACURATE TAVR valve platform continues to build momentum.

Boston Scientific recently announced several acquisitions, including NxThera and nVision in Urology and Pelvic Health, EmCision in Endoscopy, Securus in EP and Millipede in Structural Heart. This inorganic expansion plan bodes well for the stock’s operational growth.

Baxter

Strong demand for Baxter’s CRRT, injectable pharmaceuticals, U.S. IV solutions and peritoneal dialysis therapies is a positive. The buyouts of RECOTHORM and PREVELEAK are noteworthy as well.

Recently, the company got the FDA approval for Spectrum IQ Infusion System. Baxter’s surgical portfolio is highly diversified, with products available in more than 60 countries. It includes exclusive products like FLOSEAL Hemostatic Matrix, TISSEEL Fibrin Sealant, COSEAL Surgical Sealant and VASCU-GUARD Patch among others.

In Conclusion

Our comparative analysis indicates that Boston Scientific is positioned better than Baxter, considering price performance as well as earnings and sales growth.

Other Key Picks

Other top-ranked stocks in the broader medical sector are Illumina, Inc ILMN and IDEXX Laboratories, Inc. IDXX. While Illumina sports a Zacks Rank #1 (Strong Buy), IDEXX carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Illumina expects long-term earnings growth of 19.3%.

IDEXX has an expected long-term earnings growth rate of 20.2%.

Today's Stocks From Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6% and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research