'The New Buffettology': Case Studies, Part 1

- By Robert Abbott

So far, the authors of "The New Buffettology" have provided useful information about Warren Buffett (Trades, Portfolio)'s approach to investing. In chapter 19, which is essentially the final chapter, they pull all the bits and pieces into a whole, through case studies. In this article, we review the first two cases, and in a subsequent article the second pair.

Warning! GuruFocus has detected 4 Warning Signs with HRB. Click here to check it out.

The intrinsic value of HRB

H&R Block (HRB) is the subject of the first case study. Like the others, Buffett had made his decisions just a few years before this book was published in 2002. He first became aware of the company through its advertising, then began following it in Value Line and started buying its stock when the share price fell significantly. As noted in an earlier chapter, prices of "old" industries such as insurance dropped off in the mid- and late 1990s as investors rushed into tech stocks.

In the year 2000, Buffett and Berkshire Hathaway (BRK-A)(BRK-B) made a commitment decision, buying roughly 8% of H&R Block's shares for an average price of about $29. At the time, it had begun growing by purchasing four financial services companies. Before buying his first shares, he went through the following process:

Ensuring the company had a brand name product or a durable competitive advantage of some kind.

He could understand how the company worked, and how it provided value to citizens forced to file income tax returns. This indicates a degree of empathy on his part since he had always enjoyed doing his own tax returns.

Buffett was satisfied that the company was conservatively financed. Long-term debt was $872 million and could be paid off in less than five years thanks to its earnings, which were $251 million in 2000.

Earnings growth was strong, with an average annual return of 8.2% from 1989 to 1999. There was one hiccup in that decade, 1995, when earnings stopped growing because a subsidiary was sold.

The company had allocated its capital only in businesses in which it had some expertise. While the development of software for home computers was certainly in that sphere, we do not get enough information about the financial companies to judge their fit.

Buffett likes companies that buy back their own shares (and increase the value of his shares). H&R Block had bought back nine million of its own shares in the previous decade.

Management had invested its retained earnings to increase earnings per share. In 1989 the company earned $1.16 per share, while in 1999 it earned $2.56. That works out to an average annual return of 17.9%.

The company's return on equity was above average. During the decade we've been discussing, H&R Block generated an average annual return of 22%, while the average American corporation had produced an average annual return of 12% over the previous 30 years (the authors do not explain the discrepancy in periods, so we will assume 12% was also the case for the last of the three decades).

Similarly, H&R Block also showed strong growth in return on total capital: about 20%. This means it was effectively using its long-term debt, as well as its shareholders' capital.

It increased its prices as inflation increased in the 1990s, backstopping the conviction that it had a durable competitive advantage.

Buffett also wants companies that do not need to divert large amounts of retained earnings to update their plants and equipment. That was the case for H&R Block, which used only offices and they would require only routine and minor maintenance.

After working through each of these aspects, Buffett felt he understood the company and its durable competitive advantage. Having addressed those aspects to his satisfaction, it was then a matter of waiting until the price came down enough to hit his desired rate of return. That happened when the price came down to $29 in 2000.

By June 2001, the share price had already jumped to $60, and Buffett expected it would grow to between $124 and $144 per share by 2011. The following price chart shows H&R Block's fortunes through to the current day (note that it underwent two-for-one stock splits in 2001 and 2005):

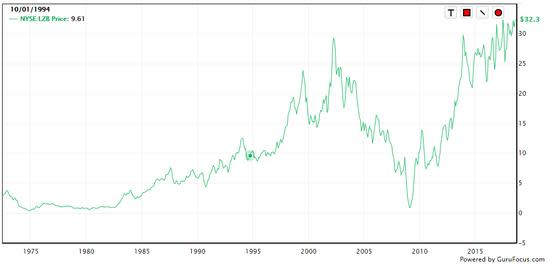

The second case study takes readers through the process that resulted in a purchase of LA-Z-Boy (LZB), the furniture manufacturing and retailing business.

Buffett first discovered the company in Value Line, followed it for several years, became highly interested after the market crash of 2000 and began buying when its price slumped to $14. In the months or years leading up the purchase, he followed his process again:

Lots of companies make furniture, but La-Z-Boy has a brand; consider that consumers apply the name La-Z-Boy to reclining chairs made by a host of companies. Thus, it has a durable competitive advantage.

Its products are certainly easy to understand, as well as the business that makes, distributes and sells them.

Is it conservatively financed? Yes, in 2000 it had total long-term indebtedness of $100 million, while its annual earnings were $92 million. In other words, the whole debt could be erased with just over a year's earnings.

The earnings were strong and growing. Between 1990 and 2000, they grew at an annual compounding rate of 14.1%. A quick look at its annual earnings show steady growth, year after year.

La-Z-Boy allocated its capital to businesses it understood. It sent capital in two directions: to improving its own operations and to acquire other furniture manufacturers.

It had been buying back its own shares, 1.4 million of them over the decade before 2000, and that decreased its overall share count by 2%.

Management's use of retained earnings has increased earnings per share and shareholder value. Over the decade being highlighted, earnings per share increased from 43 cents to $1.61. Shareholders received a dividend and enjoyed a healthy capital gain.

Its return on equity was above average. As noted, the average annual return for American companies was 12.1%. La-Z-Boy earned an average of 12.8% over the decade, but Buffett would have been influenced by the returns of 17% and 16.5% in 1999 and 2000.

It also provided consistently high returns on total capital. It had averaged 12.3%, which is slightly above the average, but again, 1999 and 2000 offered even better results, with 14.5% for each of those years.

Inflation and prices. The company had been able to increase its prices during the decade, allowing it to keep up with inflation.

No large capital allocations are necessary to update its plant and equipment. It had been making essentially the same chair for the previous 40 years, avoiding the need to retool the plant. There is no mention of additional capital for plant size expansion, but presumably that would not be significant.

As the authors put it, "Warren can argue that Berkshire bought a La-Z-Boy equity/bond with a yield of approximately 11.5% with a coupon projected to grow at approximately 14.1% a year. He could also figure that if he held the stock for ten years, his projected pretax annual compounding return would be between 12.34% and 20%."

The [Toledo] Blade reported on May 16, 2002 that Buffett had sold all his 54,100 shares of La-Z-Boy, presumably in the days or weeks before it reported that news. Whether he got out before the company's price began plunging in April of that year is not reported.

Here is a graph of the company's performance since it was first listed:

About

Mary Buffett and David Clark are the authors of "The New Buffettology: The Proven Techniques for Investing Successfully in Changing Markets That Have Made Warren Buffett the World's Most Famous Investor." Buffett is a former daughter-in-law of the "Oracle of Omaha."

(This article is one in a series of chapter-by-chapter reviews. To read more, and reviews of other important investing books, go to this page.)

Disclosure: I do not own shares in any company listed, and do not expect to buy any in the next 72 hours.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with HRB. Click here to check it out.

The intrinsic value of HRB