Is Buhler Industries Inc’s (TSE:BUI) Balance Sheet Strong Enough To Weather A Storm?

Buhler Industries Inc (TSX:BUI) is a small-cap stock with a market capitalization of CA$102.75M. While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. Why is it important? Given that BUI is not presently profitable, it’s essential to assess the current state of its operations and pathway to profitability. Here are a few basic checks that are good enough to have a broad overview of the company’s financial strength. Though, since I only look at basic financial figures, I recommend you dig deeper yourself into BUI here.

Does BUI generate an acceptable amount of cash through operations?

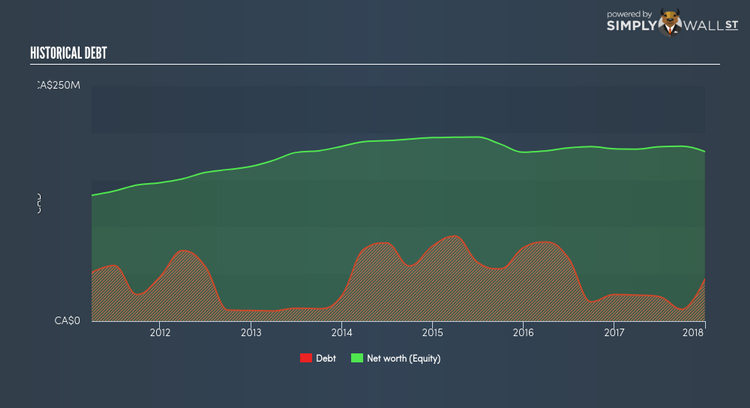

BUI has shrunken its total debt levels in the last twelve months, from CA$20.45M to CA$12.55M . With this debt payback, BUI’s cash and short-term investments stands at CA$0 for investing into the business. Moving onto cash from operations, its operating cash flow is not yet significant enough to calculate a meaningful cash-to-debt ratio, indicating that operational efficiency is something we’d need to take a look at. For this article’s sake, I won’t be looking at this today, but you can take a look at some of BUI’s operating efficiency ratios such as ROA here.

Can BUI pay its short-term liabilities?

Looking at BUI’s most recent CA$133.91M liabilities, it appears that the company has been able to meet these obligations given the level of current assets of CA$254.89M, with a current ratio of 1.9x. For Machinery companies, this ratio is within a sensible range since there’s sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Does BUI face the risk of succumbing to its debt-load?

With a debt-to-equity ratio of 24.71%, BUI’s debt level may be seen as prudent. This range is considered safe as BUI is not taking on too much debt obligation, which can be restrictive and risky for equity-holders. Risk around debt is very low for BUI, and the company also has the ability and headroom to increase debt if needed going forward.

Next Steps:

Although BUI’s debt level is relatively low, its cash flow levels still could not copiously cover its borrowings. This may indicate room for improvement in terms of its operating efficiency. However, the company exhibits an ability to meet its near term obligations should an adverse event occur. Keep in mind I haven’t considered other factors such as how BUI has been performing in the past. I suggest you continue to research Buhler Industries to get a better picture of the stock by looking at:

1. Historical Performance: What has BUI’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

2. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.