I Built A List Of Growing Companies And Columbia Financial (NASDAQ:CLBK) Made The Cut

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Columbia Financial (NASDAQ:CLBK). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Columbia Financial

How Fast Is Columbia Financial Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Over twelve months, Columbia Financial increased its EPS from US$0.49 to US$0.52. That amounts to a small improvement of 6.7%. It also seems the company is in good financial health, since it has boosted EPS by buying back shares.

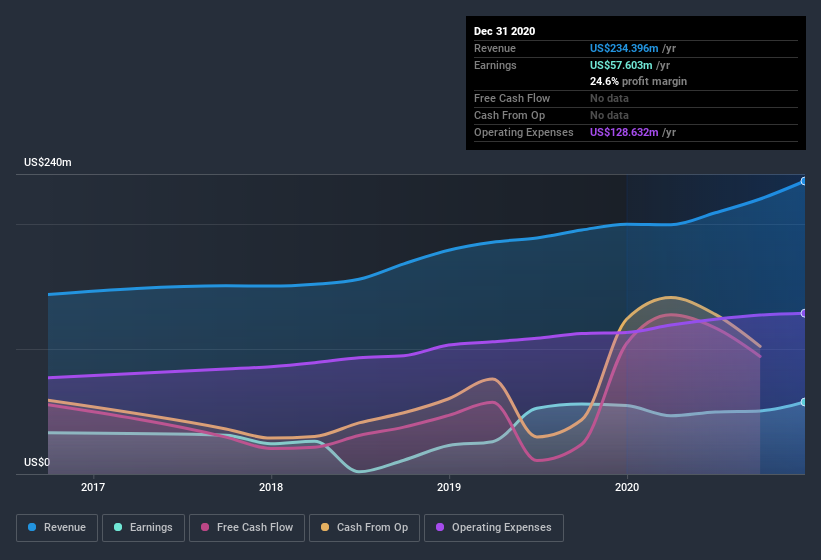

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Columbia Financial's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Columbia Financial's EBIT margins were flat over the last year, revenue grew by a solid 17% to US$234m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Columbia Financial.

Are Columbia Financial Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Columbia Financial insiders walking the walk, by spending US$669k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Independent Director, Robert Van Dyk, who made the biggest single acquisition, paying US$176k for shares at about US$14.70 each.

Along with the insider buying, another encouraging sign for Columbia Financial is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$34m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Columbia Financial Worth Keeping An Eye On?

One positive for Columbia Financial is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Still, you should learn about the 1 warning sign we've spotted with Columbia Financial .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Columbia Financial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.