Bull of the Day: Skyline Champion Corporation (SKY)

Skyline Champion Corporation SKY is a large North American homebuilder focused on manufactured, modular homes, and more. Skyline Champion is coming off some impressive quarters and its outlook continues to look strong amid rising rates and rising prices across the economy.

SKY stock also appears more enticing as it falls alongside many other homebuilders. Plus, the prefabricated housing and building sector could just be starting to gain steam in the U.S. and beyond.

The Skyline Champion Story

Skyline Champion Corporation is one of the largest factory-built homebuilders in North America. The currently-constructed company was formed by the merger between Skyline Corporation and Champion Enterprises in the summer of 2018.

Skyline Champion builds a range of manufactured and modular homes, as well as ADUs or additional dwelling units, which is a fancy way of saying some type of guest house. The company also operates a park-model RVs segment. SKY’s offerings service modular buildings for both single-family and multi-family housing, alongside the hospitality, senior, and workforce sectors.

Skyline Champion operates roughly 40 manufacturing facilities throughout the U.S. and western Canada and sells its various factory-built housing under various brand names. SKY’s portfolio caters to a somewhat different aspect of the homebuilder and home buying market that might be set to soar.

Image Source: Zacks Investment Research

Manufactured Housing Potential

Skyline Champion’s manufactured and modular houses, apartments, hotels, and more, like all prefabricated housing, are built inside plants and factories and then transported to the site in one or more sections to be completed. Manufactured and modular housing is becoming more indistinguishable from traditional on-site made housing.

Skyline Champion’s manufactured and modular offerings gained steam during the pandemic housing boom because of both speed and affordability. Two of the main reasons manufactured and modular housing might just be starting to surge again are the faster turnaround times and the lower costs, even if buyers are looking for multimillion-dollar prefabs. Investors should know that there is now a growing luxury and high-end side of the prefab housing market.

Soaring demand and ultra-low inventory continues to push up home prices around the country. Home prices rose at a record pace in 2021 and reports suggest the U.S. housing market is still millions of homes short of demand. This trend could grow worse as millennials, who are now the largest generation, are driving the housing market. And millennials are projected to form 6.4 million new households by 2025.

The lower average prices and the speed could see manufactured and modular housing pick up the slack in 2022 and beyond. For example, a new single-family home built on-site sold for an average of about $309K excluding the cost of the underlying land in 2020, according to U.S. government data. That same year, new manufactured homes cost $87K not including land.

Image Source: Zacks Investment Research

Growth and Outlook

Skyline Champion’s 2021 revenue (period ended April 3, 2021) popped 4% to $1.42 billion. This came on top of 1% sales growth in FY20 and 28% expansion in fiscal 2019. Meanwhile, its adjusted earnings climb 33% last year.

Thankfully, Skyline Champion ended FY21 on a much higher note, with fourth quarter sales up 49% and its average selling price per U.S. home sold 12% higher at $67K. And it’s ripped off three strong quarters in its fiscal 2022, including 42% revenue growth in Q3 and a 210% climb in adjusted earnings.

SKY has been forced to raise its prices to combat surging materials and labor costs, with its average selling price per U.S. home sold up 32% YoY to $83K in the third quarter. Skyline Champion’s total backlog skyrocketed from $489 million at the end of 2020 to $1.5 billion on January 1, as order levels outpace production.

Looking ahead, Zacks estimates call for Skyline Champion’s FY22 revenue to surge 50% to $2.13 billion, with FY23 projected to come in another 11% higher. Meanwhile, its adjusted EPS are expected to soar by 150% and 11%, respectively.

Other Fundamentals

Skyline Champion has topped our EPS estimates by an average of 50% in the trailing four quarters. Plus, its FY22 and FY23 consensus earnings estimates are up by 15% and 14%, respectively since its early February financial release. This bottom-line positivity helps Skyline Champion scoop up a Zacks Rank #1 (Strong Buy) right now. SKY also sports “A” grades for Growth and Momentum in our Style Scores system.

Skyline Champion boasts a relativity strong balance sheet, with total a total of $382 million in cash and equivalents and $1.1 billion in total assets vs. $335 million in liabilities. SKY’s Building Products - Mobile Homes and RV Builders industry currently ranks #7 out of over 250 Zacks industries right now. This helps show that many of the companies in the larger homebuilder market remain strong despite rising interest rates and prices.

Mortgage rates reached 3.45% by the early weeks of 2022, up from their lows of around 2.65% last January. The 30-year fixed rate mortgage did surge nearly 1% since then to hover at 4.42%. But this is still below where it was in parts of 2018 and within the range over the last decade. Plus, mortgage rates are historically low when we expand our view to pre-financial crisis levels. And the demographic trends remain in the industry’s favor.

Image Source: Zacks Investment Research

Bottom Line

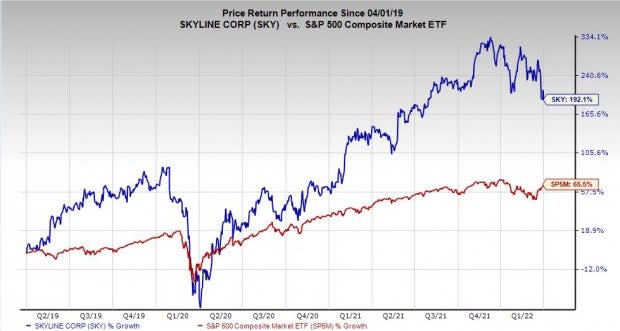

SKY stock has climbed 192% in the last three years to outpace its highly-ranked industry’s 82% run, the Construction Sector’s 60% and the S&P 500’s 65%. Skyline Champion is also up 25% in the past 12 months to outclimb the benchmark’s 17% pop and its industry’s 15% downturn.

SKY shares have tumbled roughly 28% in 2022, including its 6% drop during regular hours Wednesday to put it at $56.44 a share, or around where it was in late July 2021. Skyline Champion stock now trades 44% below its current Zacks consensus price target of $81.50 a share.

The pullback, coupled with its strong earnings outlook, has SKY trading at its lowest levels in three years (outside of the covid lows) at 14.3X forward 12-month earnings. This also marks a 40% discount vs. Skyline Champion's own median during the last three years and over 60% below its highs.

All said, investors with long-term horizons might want to consider buying Skyline Champion stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skyline Corporation (SKY) : Free Stock Analysis Report

To read this article on Zacks.com click here.