Bullish: Analysts Just Made An Incredible Upgrade To Their Ardmore Shipping Corporation (NYSE:ASC) Forecasts

Shareholders in Ardmore Shipping Corporation (NYSE:ASC) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

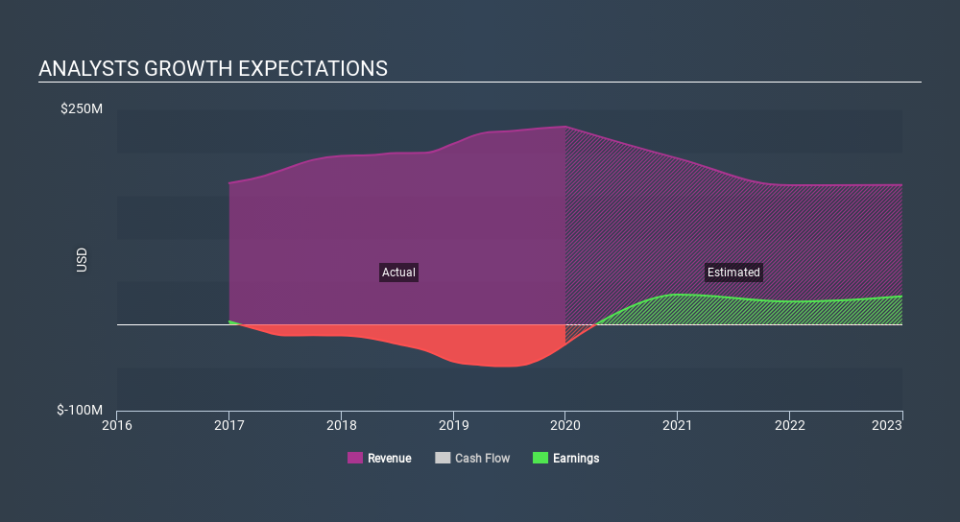

After the upgrade, the consensus from Ardmore Shipping's five analysts is for revenues of US$181m in 2020, which would reflect a sizeable 21% decline in sales compared to the last year of performance. Losses are expected to turn into profits real soon, with the analysts forecasting US$1.14 in per-share earnings US$1.14. Prior to this update, the analysts had been forecasting revenues of US$167m and earnings per share (EPS) of US$0.86 in 2020. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a massive increase in earnings per share in particular.

See our latest analysis for Ardmore Shipping

As a result, it might be a surprise to see that the analysts have cut their price target 5.5% to US$8.58, which could suggest the forecast improvement in performance is not expected to last. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Ardmore Shipping analyst has a price target of US$10.00 per share, while the most pessimistic values it at US$7.30. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Ardmore Shipping shareholders.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with the forecast 21% revenue decline a notable change from historical growth of 15% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.3% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Ardmore Shipping is expected to lag the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. A lower price target is not intuitively what we would expect from a company whose business prospects are improving - at least judging by these forecasts - but if the underlying fundamentals are strong, Ardmore Shipping could be one for the watch list.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Ardmore Shipping going out to 2022, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.