Bullish EUR/NZD on Strong/Weak Relationship & Ichimoku Breakout

DailyFX.com -

Point to Establish Long Exposure: Pullback to Support on Retracement near 1.50

Spot: 1.5254

Target 1:1.5341 - 61.8% Retracement of July-February Price Range

Target 2:1.5837 July 2016 Correct High / Start of Wedge Lower

Invalidation Level:Close 1.4862 (Feb. 9th high)

Fundamental & Technical Focus:

The Euro has been left out of the headlines as a strong currency thanks in large part to the focus on the USD as Janet Yellen has encouraged traders to ask whether or not the Fed could be looking at four rate hikes in either 2017 or 2018.

However, as the question towards ECB tapering is asked in light of rising inflation and economic growth, the EUR continues to find favor against many currencies. A group of currencies that EUR has recently outperformed against is the commodity bloc, such as CAD and NZD.

As the commodity market appears to be a toothless tiger in 2017 with little continuity, New Zealand and other commodity producing economies could continue to see selling orders at the expense of their currency. A recent New Zealand Inflation gauge showed price pressure in New Zealand looked “tame,” which helped push the NZ Dollar to a two-month low. The Canadian Dollar also recently saw 2017 lows against stronger currency pairs.

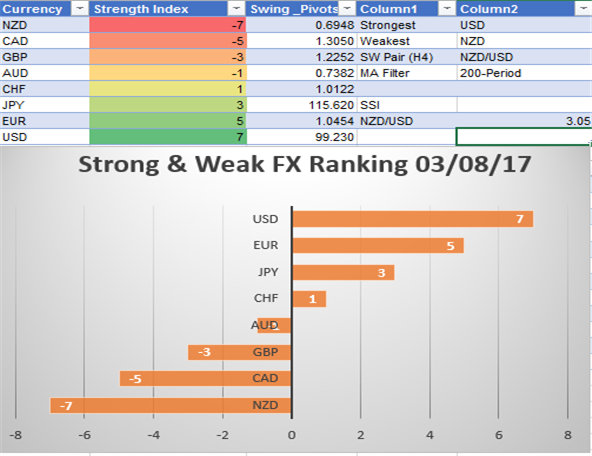

Favorable Strong/Weak Relationship:

Chart:

Created by Tyler Yell, CMT

---

Happy Trading!

Tyler Yell, CMT

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.