Business - Information Services Outlook: Good Run to Continue

The global business information industry is currently benefiting from rising demand for risk mitigation services. Changes in market dynamics are more or less a constant phenomenon and keep companies exposed to credit fund and operational risks. Accurate market and financial information is required for risk mitigation and that spurs demand for business information services. Technavio expects global business information market to witness CAGR of more than 5% in 2021.

In the United States, steady economic growth, rise in corporate earnings on tax reforms, increased business spending along with the presence of a large number of big companies that provide business information services has kept the industry in good shape.

Industry Offers Solid Shareholder Returns

Looking at shareholder returns over the past year, it appears that the broader economic recovery is enhancing investors’ confidence in the industry.

The Zacks Business - Information Services Industry , which is a group within the broader ZacksBusiness Services Sector, has outpaced the S&P 500 and its own sector in the past year.

While the stocks in this industry have collectively gained 26.5%, the Zacks S&P 500 Composite and Zacks Business Services Sector have rallied 15.6% and 21.8%, respectively (the blue line in the chart below represents the industry).

One-Year Price Performance

Information Services Stocks Look Expensive

The strong run in share prices over the past year have, however, led to a relatively rich valuation.

Comparing the industry to the S&P 500 on the basis of price to forward 12 months earnings, we see that the industry’s 22.6X is ahead of the S&P 500’s 17.1X. It does, however, compare favorably with the sector’s 23.3X.

Comparing the industry to the S&P 500 on the basis of price to forward earnings growth, we see that the industry’s 2.1X is again ahead of the S&P 500’s 1.8X. It is also ahead of the sector’s 2X.

Comparing the industry to the S&P 500 on the basis of price to free cash flow, we see that the industry’s 28.5X is again ahead of the S&P 500’s 23.3X. It is also ahead of the sector’s 18.1X.

So any way you cut it, the industry is overvalued.

Outperformance May Continue Due to Solid Growth Potential

Constantly increasing volume of data from private and government organizations has augmented the demand for improved enterprise-wide financial performance visibility. Augmented demand for news, information, and analytics solutions will drive the growth of the market. An improving economy and Trump’s business friendly moves are benefiting manufacturing as well as non-manufacturing sectors, which, in turn, are aiding business information services.

But what really matters to investors is whether this group has the potential to perform better than the broader market in the quarters ahead. The earlier valuation discussion shows that market participants have been willing to pay up for these stocks already, potentially limiting further upside from the current levels.

One reliable measure that can help investors understand the industry’s prospects for a solid price performance going forward is the industry's earnings outlook. Empirical research shows that earnings outlook for the industry, a reflection of the earnings revisions trend for the constituent companies, has a direct bearing on its stock market performance.

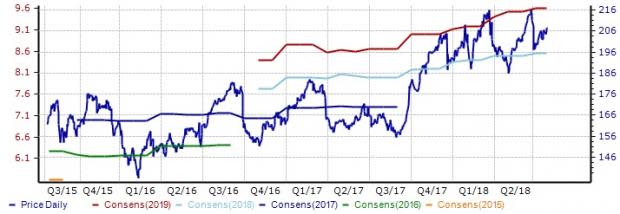

The Price & Consensus chart for the industry shows the market's evolving bottom-up earnings expectations for the industry and the industry's aggregate stock market performance. The red line in the chart represents the Zacks measure of consensus earnings expectations for 2019, while the light blue line represents the same for 2018.

Price and Consensus: Business - Information Services Industry

This becomes even clearer by focusing on the aggregate bottom-up EPS revisions trend. The chart below shows the evolution of aggregate consensus expectations for 2018.

Please note that the $3.62 EPS estimate for the industry for 2018 is not the actual bottom-up EPS estimate for every company in the Zacks Gaming industry, but rather an illustrative aggregate number created by our proprietary analytics model. The key factor to keep in mind is not the earnings of $3.62 per share of the industry for 2018, but how this number has evolved recently.

Current Fiscal Year EPS Estimate Revisions

As you can see here, the $3.62 EPS estimate for 2018 is up from $3.58 at the end of March and $3.32 at the end of July 2017. In other words, the sell-side analysts covering the companies in the Zacks Business - Information Services Industry have been steadily raising their estimates.

Zacks Industry Rank Indicates Bright Prospects

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued outperformance in the near term.

The Zacks Business - Information Services Industry currently carries a Zacks Industry Rank #73, which places it at the top 29% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Information Services Stocks Promise Long-Term Growth

While the near-term prospects look welcoming for investors, the long-term (3-5 years) EPS growth estimate for the Zacks Business - Information Services Industry appears promising. The group’s mean estimate of long-term EPS growth rate is at the current level of 11.4%. This compares to 9.8% for the Zacks S&P 500 composite.

Mean Estimate of Long-Term EPS Growth Rate

In fact, the basis of this long-terms EPS growth could be the recovery in the top line that the Zacks Consulting Services industry has been showing since the beginning of 2016.

Bottom Line

This is a great place to invest in right now, both with respect to the near term and the longer term. While valuations do appear rich, there are indications that the momentum will continue.

Rising demand for information, analytics solution and risk mitigation, and increasing volume of data from private and government organizations should support growth of the industry in the long run. A strong U.S. economy, reduced tax rates, robust manufacturing and non-manufacturing activity and higher government spending should support growth in near to mid-term.

So while the more cautious of us might wait for a better entry point, here are some stock picks for the rest.

FactSet Research Systems Inc. (FDS): The Zacks Rank #2 (Buy) stock has gained 25.3% over the past year. The Zacks Consensus Estimate for current-year EPS has risen 0.7% in the past 60 days.

Price and Consensus: FDS

Verisk Analytics, Inc. (VRSK): The Zacks Rank #2 stock has gained 31.5% over the past year. The Zacks Consensus Estimate for current-year EPS has increased 0.2% in the past 60 days.

Price and Consensus: VRSK

Black Knight, Inc. (BKI): The Zacks Rank #2 stock has gained 26.9% over the past year. The Zacks Consensus Estimate for current-year EPS has remained unchanged in the last 60 days.

Price and Consensus: BKI

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report

FactSet Research Systems Inc. (FDS) : Free Stock Analysis Report

Black Knight Financial Services, Inc. (BKI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research