Should You Buy BlackBerry (BB) Stock Ahead of Earnings?

Shares of BlackBerry BB dipped over 1.5% during morning trading on Tuesday, just one day before the former smartphone power is expected to report its latest quarterly financial results. After a rough few weeks of trading, investors will be on the lookout for strong earnings results, which means Wall Street will be focusing on BlackBerry when it reports Wednesday.

BlackBerry’s days of dominating the smartphone market might be long gone, but the company has slowly and successfully transitioned into a cybersecurity software and services firm. Shares of BlackBerry have skyrocketed 84.6% over the last year as the fight against cyber attacks becomes an everyday battle.

BlackBerry now works with some of the biggest names in tech, including Qualcomm QCOM and Baidu BIDU, and secured two notable contracts within the last week alone. The company will now provide cybersecurity services for luxury carmaker Jaguar Land Rover, as it makes a bigger connected vehicle push. Along with this deal, BlackBerry’s stock popped last week after the company announced it would provide security for Microsoft’s MSFT flagship Office apps.

With all of that said, investors have clearly loved BlackBerry stock over the last year as it moves into a new growth sector. But the firm’s stellar run could be dampened if it fails to impress in its soon-to-be-reported quarter. Let’s take a closer look.

Latest Outlook

Our Zacks Consensus Estimates are calling for BlackBerry to post break-even earnings and revenues of $211.03 million. These results would represent year-over-year declines of 100% and 26.21%, respectively.

Earnings ESP Whispers

Investors will also want to anticipate the likelihood that BlackBerry surprises investors with better-than-anticipated earnings results. For this, we turn to our Earnings ESP figure.

Zacks Earnings ESP (Expected Surprise Prediction) looks to find earnings surprises by focusing on the most recent analyst estimates. This is done because, generally speaking, when an analyst posts an estimate right before an earnings release, it means that they have fresh information which could potentially be more accurate than what analysts thought about a company two or three months ago.

A positive Earnings ESP paired with a Zacks Rank #3 (Hold) or better ranking helps us feel confident about the potential for an earnings beat. In fact, our 10-year backtest has revealed that this methodology has accurately produced a positive surprise 70% of the time.

BB is sporting a Zacks Rank #3 (Hold) and an Earnings ESP of 0.00%. This means we have seen no change in estimates leading up to the report. Based on this information, our model does not conclusively suggest that a surprise is in store.

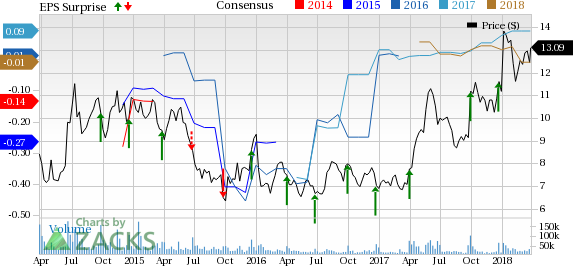

Price Performance and Surprise History

Another important thing to consider ahead of BlackBerry’s report is the company’s history of earnings surprises and the effect that these surprises have had on share prices.

BlackBerry Limited Price, Consensus and EPS Surprise

BlackBerry Limited Price, Consensus and EPS Surprise | BlackBerry Limited Quote

As we can see, BlackBerry has a relatively strong earnings surprise history, but its bottom-line results have not always translated into upward momentum for the stock. Yet, the company has been on a solid run in terms of earnings performance over the last two years and posted massive beats in the trailing two quarters.

We judge the price effect of these earnings beats by comparing the closing price of the stock two days before the report and two days after the report. BlackBerry’s stock surged 8.56% and 21.13%, respectively, over the last two quarters.

As most investors know, past performance is no guarantee of future success, but we can see that investors have rewarded BlackBerry’s earnings beats recently. Along with that, BlackBerry stock has been on a strong run over the last year as the company becomes a force in the cybersecurity industry.

BlackBerry is expected to report its fiscal fourth quarter and full-year 2018 results before the opening bell on Wednesday, March 28.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research