You Should Buy Deutsche Telekom AG (FRA:DTE) Because Of These Reasons

As an investor, I look for investments which does not compromise one fundamental factor for another. By this I mean, I look at stocks holistically, from their financial health to their future outlook. In the case of Deutsche Telekom AG (DB:DTE), it is a notable dividend payer with a an impressive history of performance, trading at a great value. Below is a brief commentary on these key aspects. For those interested in digger a bit deeper into my commentary, take a look at the report on Deutsche Telekom here.

Good value with proven track record and pays a dividend

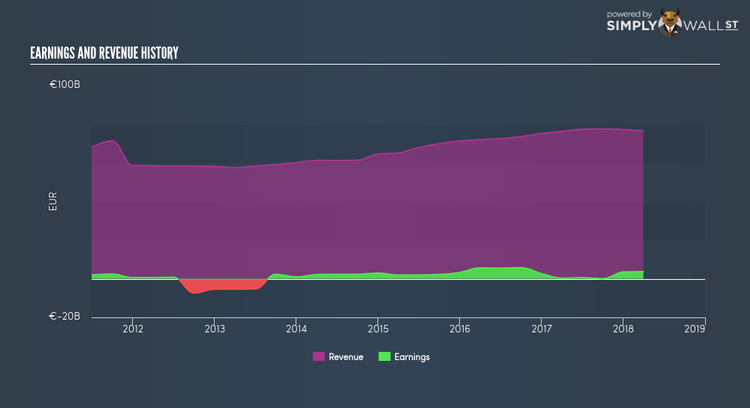

In the past couple of years, DTE has ramped up its bottom line by over 100%, with its latest earnings level surpassing its average level over the last five years. Not only did DTE outperformed its past performance, its growth also exceeded the Telecom industry expansion, which generated a 14.67% earnings growth. This is an optimistic signal for the future. DTE’s shares are now trading at a price below its true value based on its discounted cash flows, indicating a relatively pessimistic market sentiment. Investors have the opportunity to buy into the stock to reap capital gains, if DTE’s projected earnings trajectory does follow analyst consensus growth, which determines my intrinsic value of the company. Compared to the rest of the market, DTE is also trading below other listed companies on the DE stock exchange, relative to earnings generated. This bolsters the proposition that DTE’s price is currently discounted.

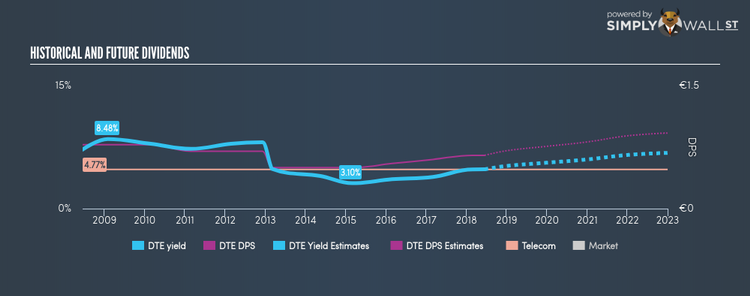

DTE’s high dividend payments make it one of the best dividend stocks on the market, and it has also been able to maintain it at a level in which net income is able to cover dividend payments.

Next Steps:

For Deutsche Telekom, I’ve compiled three pertinent aspects you should further examine:

Future Outlook: What are well-informed industry analysts predicting for DTE’s future growth? Take a look at our free research report of analyst consensus for DTE’s outlook.

Financial Health: Is DTE’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of DTE? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.