Should You Buy Gladstone Investment Corporation (GAIN)?

Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Gladstone Investment Corporation (NASDAQ:GAIN).

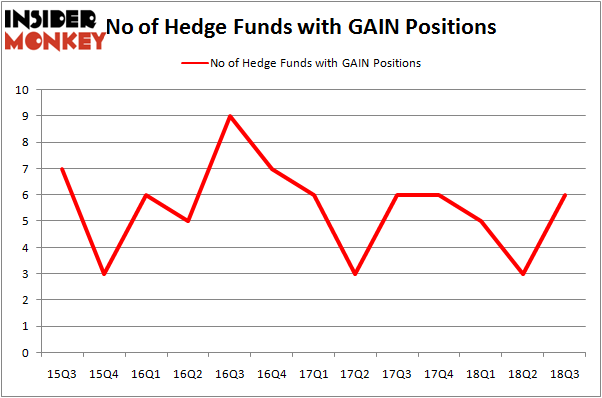

Gladstone Investment Corporation (NASDAQ:GAIN) has experienced an increase in hedge fund interest of late. GAIN was in 6 hedge funds' portfolios at the end of September. There were 3 hedge funds in our database with GAIN holdings at the end of the previous quarter. Our calculations also showed that GAIN isn't among the 30 most popular stocks among hedge funds.

To the average investor there are tons of tools market participants have at their disposal to analyze stocks. Some of the most useful tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite hedge fund managers can trounce the market by a solid amount (see the details here).

Let's take a glance at the latest hedge fund action encompassing Gladstone Investment Corporation (NASDAQ:GAIN).

Hedge fund activity in Gladstone Investment Corporation (NASDAQ:GAIN)

At Q3's end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 100% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in GAIN over the last 13 quarters. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Gladstone Investment Corporation (NASDAQ:GAIN) was held by Millennium Management, which reported holding $1.9 million worth of stock at the end of September. It was followed by Two Sigma Advisors with a $1.9 million position. Other investors bullish on the company included Arrowstreet Capital, Citadel Investment Group, and PEAK6 Capital Management.

As industrywide interest jumped, some big names have jumped into Gladstone Investment Corporation (NASDAQ:GAIN) headfirst. Millennium Management, managed by Israel Englander, initiated the most outsized position in Gladstone Investment Corporation (NASDAQ:GAIN). Millennium Management had $1.9 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital also made a $1.7 million investment in the stock during the quarter. The only other fund with a brand new GAIN position is Gavin Saitowitz and Cisco J. del Valle's Springbok Capital.

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as Gladstone Investment Corporation (NASDAQ:GAIN) but similarly valued. We will take a look at NeoPhotonics Corp (NYSE:NPTN), American Software, Inc. (NASDAQ:AMSWA), Digimarc Corp (NASDAQ:DMRC), and Jernigan Capital Inc (NYSE:JCAP). This group of stocks' market valuations are closest to GAIN's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position NPTN,10,60383,0 AMSWA,6,29991,-2 DMRC,2,25242,-2 JCAP,10,41696,0 Average,7,39328,-1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $6 million in GAIN's case. NeoPhotonics Corp (NYSE:NPTN) is the most popular stock in this table. On the other hand Digimarc Corp (NASDAQ:DMRC) is the least popular one with only 2 bullish hedge fund positions. Gladstone Investment Corporation (NASDAQ:GAIN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. In this regard NPTN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index