Buy this Medical Sector Pioneer Stock

Gilead Sciences GILD shares have continued to rise after beating on both its top and bottom lines in October. GILD stock is up roughly 20% since its Q3 release, with the stock sporting a Zacks Rank #2 (Buy).

There may be more upside ahead for Gilead. Let’s take a look at what could continue propelling GILD stock.

Medical Pioneer

Gilead Sciences is well known for its ground-breaking treatments in human immunodeficiency virus (HIV), liver diseases, hematology/oncology diseases, and inflammation/respiratory diseases. GILD’s portfolio also includes drugs for Hepatitis C.

The company also illustrated its fast ability to construct prevention efforts during the pandemic with its FDA-approved Covid-19 treatment remdesivir. GILD’s Q3 earnings crushed the Zacks consensus estimate by 32% at $1.90 per share although this was down 28% YoY. Sales of Veklury, the brand name for remdesivir were up 11% from Q3 2021 at $6.05 billion.

The YoY earnings decrease was primarily driven by the acquisition of MiroBio. The $405 million cash deal will provide Gilead with MiroBio’s proprietary discovery platform and its entire portfolio of immune inhibitory receptor agonists. This is expected to complement Gilead’s inflammation research and development strategy which is the next product area the company aspires to advance in.

For now, the company’s profitability continues to lie within its growing HIV sales. HIV product sales for Q3 were up 7% YoY at $4.48 billion. Overall, sales beat top line expectations by 15% at $7.04 billion. This was a 5% decrease from Q3 2021 primarily driven by lower Veklury sales as we move further into a post-pandemic world.

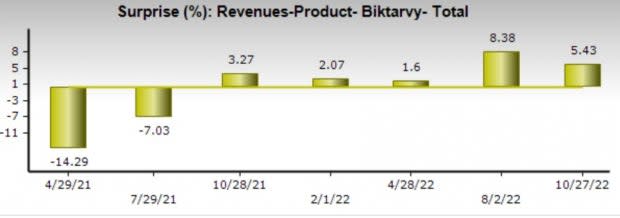

Still, Biktarvy, a medication used for the treatment of HIV/AIDS, saw sales increase 22% YoY to $2.8 billion. Another growth highlight was the 79% increase in oncology sales to $578 million.

Image Source: Zacks Investment Research

This continued growth is impressive and could help GILD stock continue to outperform the broader market despite an economic downturn as consumers will spare no expense when it comes to essential medication.

Outlook

Year over year, GILD earnings are now expected to decline -2% to $7.09 per share. However, earnings estimates have significantly gone up from $6.61 a share 90 days ago. FY23 earnings are expected to drop another -4% to $6.79 per share but earnings estimate revisions for next year have also gone up during the quarter.

Sales are projected to be down -3% this year and another -4% in FY23 to $25.34 billion. Top line estimates have also trended higher since GILD’s Q3 report.

Performance & Valuation

GILD is up +17% YTD to largely outperform the S&P 500’s -18% and its peer group’s -28% with notable companies such as Amgen AMGN and Moderna MRNA. Even better, GILD’s total return is +22% YTD when adding in its strong dividend.

Image Source: Zacks Investment Research

Gilead Sciences has continued to be a pioneer and industry leader. Over the last decade, GILD’s total return is +188% to beat its peer group’s +137%.

Trading around $85 per share, GILD trades at 11.8X forward earnings. This is lower than the industry average P/E of 21.1X. Despite GILD’s impressive rally over the last few weeks, the stock still trades at a discount to its decade-high of 38.4X and is not far from the median of 9.8X.

Image Source: Zacks Investment Research

Bottom Line

On top of GILD’s solid 3.46% annual dividend yield at $2.92 per share, the stock is seeing rising earnings estimate revisions. This makes Gilead Sciences very intriguing for investors, as GILD stock has continued to outperform the broader market and recently reached new highs. This could continue as GILD’s Biomedical and Genetics Industry is currently in the top 21% of over 250 Zacks Industries and the stock has an overall “A” VGM grade.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report