Buy Procter & Gamble for its Recession-Proof Dividend

- By Nathan Parsh

Well-run companies often trade with a premium multiple. That is the price of partnering with blue-chip companies. If you want to own those names, then you often have to be willing to pay a higher price and accept fairly average returns. That can be especially true if the company is recession-proof.

One company that has earned the blue-chip moniker is the Procter & Gamble Company (NYSE:PG). Procter & Gamble's products control considerable market share in their respective categories. The company also has one of the longest dividend growth streaks in the market, which is one of the reasons the name is so popular with dividend growth investors.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Shares are also trading above both the historical average valuation and the stock's GF Value. However, Procter & Gamble is an industry leader and has successfully navigated many recessions. Let's dig deeper into the company to see why I think Procter & Gamble should be owned by all investors looking for recession-proof dividend stocks, despite the overvaluation.

Company background and historical performance

Procter & Gamble is a leading consumer products company that has operations in more than 180 countries around the world. The company has slimmed its operations over the past few years and now has 65 brands in its portfolio, down from 170 previously. Core brands include Tide, Pampers, Bounty, Gillette, Charmin, Crest and Oral-B, among others. Procter & Gamble has a market capitalization of $341.5 billion and generated $71 billion of revenue in fiscal 2020 (the company's fiscal year ends June 30).

Procter & Gamble has leveraged its product line into a growing revenue stream fairly well over a long period of time:

Procter & Gamble revenue growth has been pretty steady up until the early part of this century, but then saw some alternating years of growth and decline. The company's top line has declined with a compound annual growth rate of 1.5% over the last 10 years.

The recent revenue weakness has to do with the previously discussed shedding of non-core brands. Despite this, since the first quarter of fiscal 2017, Procter & Gamble has averaged 3.1% year-over-year quarterly revenue growth.

Earnings per share growth has had some issues gaining traction over the last decade. From fiscal 2011 through fiscal 2020, EPS grew at an annual rate of 2.7%. The company did retire 286 million shares during this period of time. Adjusting for this, net profit grew just 1.3%. EPS results increased in just six out of the last 10 years while net profit was higher in five out of the last 10.

Where Procter & Gamble really shines is in its ability to extract a higher percentage of profits out of its sales. The company's net profit margin was 14.3% in 2011, but improved by 460 basis points to 18.9% by 2020. Procter & Gamble's focus on core brands, which tend to carry a higher profit margin, was a major driver of gains in this area.

As a result, Procter & Gamble outpaces the competition and its own history in several key profitability measurements:

Procter & Gamble receives a score of 8 out of 10 in profitability from GuruFocus. The company scores highly on its returns on various costs. With a return on capital (ROC) of 82.94%, Procter & Gamble rates higher than 95% of the 1,684 companies in the consumer packaged goods industry. This is an impressive rating given the size of the industry. Perhaps more importantly, the company's ROC is also at the very top of its own range over the last decade.

The company also rates well in several other areas. Procter & Gamble's operating margin of 23% tops 94% of its peers, while net margin and return on equity both beat 93% of the competition. Procter & Gamble's current totals in all three areas are also at the high end of the company's own historical range. Procter & Gamble's three-year revenue and EPS growth are also better than the long-term averages, even if they are more in the middle of the pack for the industry.

Procter & Gamble has had some issues growing its top and bottom lines over the last decade, but some of this is due to the divesting of non-core assets. These actions have trimmed lower-margin businesses and allowed the company to focus on its higher margin brands. This success is reflected in the company's current profitability metrics and the performance compared to peer group. In a massive industry, Procter & Gamble's profitability ranking is almost unmatched.

Dividend analysis

Procter & Gamble has increased its dividend for 64 consecutive years. The Dividend Investing Resource Center, which maintains a database of companies that have at least five consecutive years of dividend growth, notes that the company's growth streak is the fifth-longest of all U.S. based companies. Procter & Gamble has increased its dividend by an average of:

3.4% over the past three years.

3.1% over the past five years.

5.6% over the past 10 years

Procter & Gamble's dividend growth has slowed from the mid-single-digits to the low single-digits over the past few years.

One positive note is that dividend growth of the past few years is trending higher. For example, shareholders received 4% dividend increases in both 2018 and 2019 before seeing a 6% increase at the beginning of this year.

Even with a long history of dividend growth, Procter & Gamble does have a mixed rating in terms of shareholder returns:

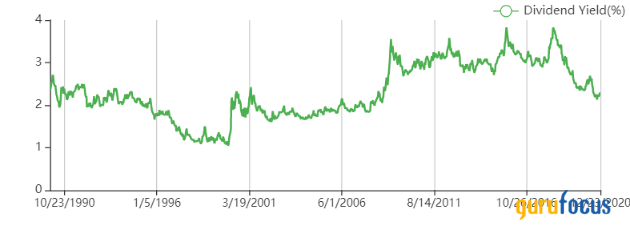

The company's three-year average share buyback ratio is above more than 88% of its peers and rates pretty well compared to the historical average. Dividend growth is almost exactly in the middle of the industry average. It will be interesting to see if dividend increase begin to trend higher or if they settle in and are more consistent with the longer-term averages. We may receive an answer to this when the company announces its next dividend increase sometime in the new year. Lastly, Procter & Gamble's yield of 2.3% is higher than more of its industry mates, but near the low end of the stock's 10-year yield range.

While the current yield is near the bottom of its 10-year range, shares of the company only began to yield above 3% in the later portions of the first decade of this century. Prior to this, the yield was often in the 1% to 2% range. This correlates to the period where the company had mixed business results. The stock has a 10-year average yield of 3.1%, so shares aren't producing as much income as they have in recent times. That is the trade off that comes with a 51% share price increase in just the last two years.

Except for 1993 and 2018, Procter & Gamble's EPS has more than covered the company's dividend over the last three decades. Free cash flow has sufficiently covered dividend payments every year since 1991. A well covered dividend is a major reason why the company has such a long history of dividend growth.

Shareholders of Procter & Gamble received $3.118 of dividends per share over the last four quarters while the company produced EPS of $5.38 for an earnings payout ratio of 58%. This is below the average payout ratio of 60.6% that Procter & Gamble has had over the last decade.

The free cash flow payout ratio is even better. Procter & Gamble has distributed $7.9 billion of dividends over the last year while generating free cash flow of $15.1 billion for a free cash flow payout ratio of 52%. This is an improvement from the previous three years where the company averaged a free cash flow payout ratio of 68%.

Procter & Gamble has seen a 53% surge in free cash flow from 2017 through 2020 while dividends distributed have increased by just 7.6%. This is the likely reason that the company's dividend raise in 2020 was higher than any of the historical averages previously listed. If the company expects that free cash flow will continue to grow, then shareholders might be on the receiving end of higher dividend growth. A higher dividend growth rate to go with an extremely long growth streak would be welcomed by shareholders.

Recession performance

A company that sells laundry detergent, toothpaste, deodorant and razors can be expected to perform well during a recession. Afterall, consumers need personal and everyday items regardless of the status of the economy. Procter & Gamble largely delivered in this area even during the Great Recession.

Listed below are the company's EPS results for the years before, during and after the last recession:

2006 EPS: $2.64

2007 EPS: $3.04 (15.2% increase)

2008 EPS: $3.64 (19.7% increase)

2009 EPS: $3.58 (1.6% decrease)

2010 EPS: $3.53 (1.4% decrease)

2011 EPS: $3.93 (11.3% increase)

Procter & Gamble's EPS grew almost 18% during the last recession even as results fell slightly in 2009. Even accounting for the repurchase of 215 million shares during this time, net profit still grew 10%. The company did see another small decline in 2010, but produced a new EPS high the very next year. These results demonstrated the quality of the business as consumers will still buying more of the company's products during the last economic downturn. Listed below are the company's dividends paid before, during and after the last recession.

2006 dividends: $1.15

2007 dividends: $1.28 (11.3% increase)

2008 dividends: $1.45 (13.3% increase)

2009 dividends: $1.64 (13.1% increase)

2010 dividends: $1.80 (9.8% increase)

2011 dividends: $1.97 (9.4% increase)

Dividend growth remained strong during the last recession and hovered around the 10% mark in the following years.

Companies don't achieve more than six decades of dividend growth without the ability to manage the ups and downs of business. Procter & Gamble's dividend growth over such a long-time horizon is a testament to the company's strong business model and the power of its brands. Procter & Gamble's dividend has increased through the last eight recessions, a feat duplicated by only a handful of other companies. This gives me confidence that the company will perform well during the next recession and will be able to continue raising its dividend for years to come.

Financial strength and debt analysis

Procter & Gamble has a solid score in the area of financial strength according to GuruFocus:

The company scores a 6 out of 10, with its best point showing up in interest coverage. Here, Procter & Gamble tops 71% of its peers, but, more importantly, produces its best result over the last 10 years. The cash-to-debt ratio ranks in the middle of the pack both against peers and the company's own historical result. Procter & Gamble's weakest rating is in the area of the equity-to-asset ratio, which is below more than two-thirds of the industry. On the plus side, the current equity-to-asset ratio is in the middle of the company's 10-year range.

A poor balance sheet could mean that a company might have to consider cutting its dividend to make ends meet if its growth hits a stumbling block. This shouldn't be the case for Procter & Gamble, as its balance sheet is in strong shape.

The company ended the most recent quarter with total assets of $119.9 billion, including $13.4 billion of cash and equivalents and $5 billion in receivables. Current liabilities totaled $30 billion, with $22.3 billion of payables and accrued expenses. Total debt is $31.7 billion, and Procter & Gamble has $7.7 billion of debt due within one year.

Procter & Gamble had $136 million of interest expense in the most recent quarter, which gives the company a weighted average interest rate of just 1.8%.

Reviewing the company's balance sheet, it seems unlikely that Procter & Gamble is at risk for defaulting on its debt obligations. The company does have a sizeable amount of debt due within the next year, but free cash flow over the last year would have been just about enough to meet this obligation while also covering dividend payments. Therefore, it is unlikely that debt will impact Procter & Gamble's ability to continue paying its dividend.

Valuation

According to Yahoo Finance, analysts expect that Procter & Gamble will post EPS of $5.57 in the current fiscal year. With shares currently trading at $137.72, Procter & Gamble has a forward price-earnings ratio of 24.7. This a premium to the stock's five and 10-year average price-earnings ratios of 21.6 and 19.8, respectively. It should be noted that an earnings multiple in the low 20s isn't uncommon for Procter & Gamble.

GuruFocus finds that the current share price is trading above the GF Value Line:

Procter & Gamble has a GF Value of $115.60, which results in a price-to-GF Value ratio of 1.19 and earns the stock a rating of modestly overvalued from GuruFocus. The share price would have to decline 16.1% to reach its GF Value, so Procter & Gamble would experience a meaningful pullback if it were to revert to its intrinsic value.

Final thoughts

Procter & Gamble's dividend has not only survived, but increased through the last eight recessions. This speaks volumes about the company's business, its brand strength and consumers' loyalty even under adverse economic conditions. The current yield is on the low side, but the most recent dividend increase was among the highest in the last 10 years.

The valuation is high and a mid-double-digit decline would occur if the stock were to trade with its GF Value, likely due to the low growth expectations. That said, the company has a solid balance sheet, a low weighted interest rate and produces a robust amount of free cash flow in addition to its impressive dividend growth streak.

For these reasons, I feel investors looking for a recession-proof dividend stock should consider buying Procter & Gamble, even at the current price.

Author disclosure: the author maintains a long position in Procter & Gamble.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.