Should You Buy Senomyx Inc (SNMX) For This Reason?

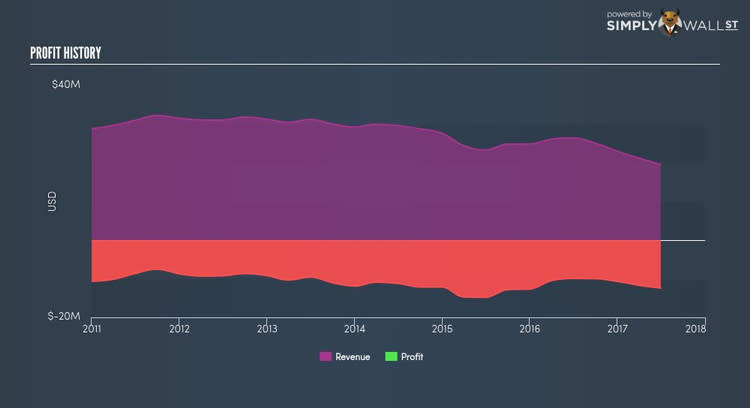

Senomyx Inc (NASDAQ:SNMX) continues its loss-making streak, announcing a -$12.40M earnings for its latest financial year ending. Cash is crucial to run a business, and if a company burns through its reserves fast, it will need to come back to market for additional capital raising. This may not always be on their own terms, which could hurt current shareholders if the new deal lowers the value of their shares. Below, I’ve analysed the most recent financial data to help answer this question. See our latest analysis for SNMX

What is cash burn?

With a negative operating cash flow of -$10.90M, SNMX is chipping away at its $11.23M cash reserves in order to run its business. The biggest threat facing SNMX’s investor is the company going out of business when it runs out of money and cannot raise any more capital. SNMX operates in the specialty chemicals industry, which has an average EPS of $5.18, meaning the majority of SNMX’s peers are profitable. SNMX faces the trade-off between running the risk of depleting its cash reserves too fast, or risk falling behind its profitable competitors by investing too slowly.

When will SNMX need to raise more cash?

Opex (excluding one-offs) grew by 0.62% over the past year, which is relatively reasonable for a small-cap company. But, if SNMX continues to ramp up its opex at this rate, given how much money it currently has in the bank, it will actually need to come to market again within the next year. Moreover, even if SNMX kept its opex level at $12M, it will still have to come to market within the next year. Although this is a relatively simplistic calculation, and SNMX may reduce its costs or open a new line of credit instead of issuing new equity shares, the outcome of this analysis still helps us understand how sustainable the SNMX’s operation is, and when things may have to change.

What this means for you:

Are you a shareholder? Hopefully, the analysis has shed some light on the risks you should bear in mind as a shareholder of SNMX, in particular, its tight cash runway moving forward. Now that we’ve accounted for opex growth, you should also look at expected revenue growth in order to gauge when the company may become breakeven.

Are you a potential investor? Loss-making companies are a risky play, especially those that are still ramping up its opex. Though, this shouldn’t discourage you from considering entering the stock in the future. The cash burn analysis result indicates a cash constraint for SNMX, due to its current opex growth rate and its level of cash reserves. The potential equity raising resulting from this means you could potentially get a better deal on the share price when the company raises capital next.

An experienced management team on the helm increases our confidence in the business – have a peek at SNMX’s CEO experience and the tenure of the board here. If you believe you should cushion your portfolio with something less risky, scroll through my list of highly profitable companies to add to your portfolio..

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.