As the Buyback Binge Continues, Give ‘PKW’ a Look

This article was originally published on ETFTrends.com.

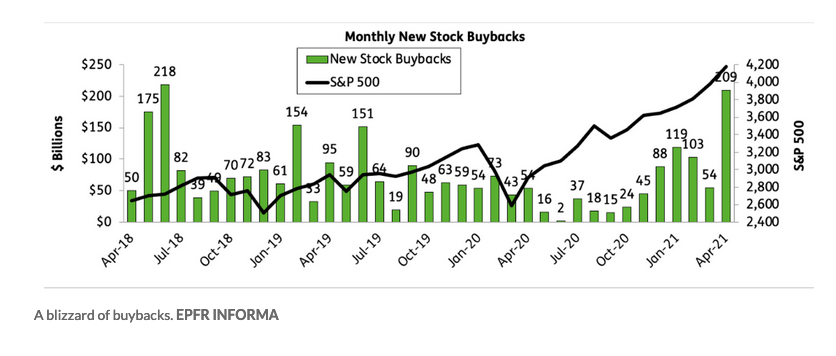

April marked a banner month for stock buybacks, which should put ETFs like the Invesco BuyBack Achievers ETF (PKW) on investors' radars.

"April alone saw $209 billion worth of stock repurchases announced by companies, the second-highest month on record behind the $209 billion from June 2018, following the Trump administration’s tax overhaul," a MarketWatch report said. "Nearly four years ago, then-President Donald Trump said slashing the corporate tax rate to 21% would be like 'rocket fuel for our economy.'"

“It’s going to be a big earnings season for buybacks,” said Winston Chua, an analyst at research firm EPFR, who also noted in the MarketWatch report that buybacks will still remain high in May and beyond before tapering off.

“Historically, share buybacks have a high correlation to the S&P 500 index,” Chua told MarketWatch. “But it’s not a pace that can be sustained.”

PKW seeks to track the investment results of the NASDAQ US BuyBack AchieversTM Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The NASDAQ includes common stocks in the underlying index pursuant to a proprietary selection methodology that identifies a universe of "BuyBack Achievers TM." Due to the recent strength in buybacks, the fund is up close to 25% for the year.

Top Holding Expands Buyback Plan

Under the hood of PKW is a balanced portfolio from a variety of sectors, with financials and information technology leading the way. On the topic of tech, PKW's top holding Oracle expanded its stock repurchase program.

"Oracle also announced a $20 billion expansion of its stock repurchase program and lifted its quarterly dividend rate to 32 cents, from 24 cents. The move gives the stock a yield of about 1.8%," a Barron's report said.

Holdings in Oracle don't exceed 5%, so allocation is not too heavy in one stock. Charter Communication and HP Inc round out the top three holdings.

Big tech has ramped up its stock buybacks as of late. One of the biggest in the buyback game has been iPhone maker Apple, with $77 billion in buybacks the last four quarters.

“We continue to believe there is great value in our stock and maintain our target of reaching a net cash neutral position over time,” said Luca Maestri, chief financial officer at Apple.

For more news and information, visit the Innovative ETFs Channel.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM