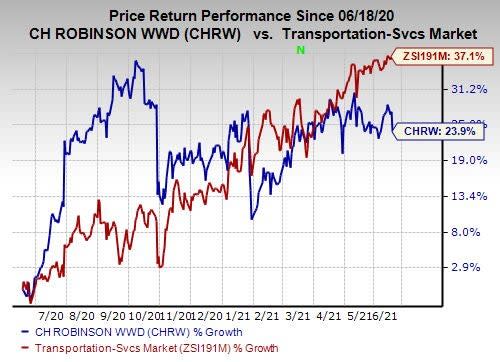

C.H. Robinson (CHRW) Up 23.9% in the Past Year: Here's Why

C.H. Robinson Worldwide, Inc. CHRW shares have surged 23.9% in the past year compared with the industry’s 37.1% increase.

Image Source: Zacks Investment Research

Reasons for Surge

We are impressed by C.H. Robinson's growth-by-acquisition policy. In May, the company acquired freight forwarding company Combinex Holding B.V. to strengthen its European Surface Transportation business. The acquisition not only broadens its customer base but also improves customer services by clubbing Combinex’s expertise. In March 2020, the company acquired Prime Distribution Services, a provider of consolidation services in North America, from Roadrunner Transportation. The company’s NAST business is benefiting from the buyout through expanded capabilities.

Significant cost savings generated by the company are encouraging. In first-quarter 2021, the company generated $90 million of long-term cost savings and expects to achieve the remaining $10 million by the end of the second quarter. In the second half of 2021, the company hopes to continue delivering long-term cost savings through process redesign and automation across the enterprise.

Favorable Estimate Revisions

Driven by the above tailwinds, the Zacks Consensus Estimate for current-year earnings has increased 14.2% to $4.99 per share in the past 60 days.

Zacks Rank & Other Stocks to Consider

C.H. Robinson currently sports a Zacks Rank #1 (Strong Buy).

Investors interested in the broader Zacks Transportation sector can also consider stocks like Landstar System, Inc. LSTR, Triton International Limited TRTN and Herc Holdings Inc. HRI. Herc Holdings sports a Zacks Rank #1, while Triton and Landstar carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term (three to five years) expected earnings per share growth rate for Landstar, Triton and Herc Holdings is projected at 12%, 10% and 42.9%, respectively.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Herc Holdings Inc. (HRI) : Free Stock Analysis Report

Triton International Limited (TRTN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research