C.H. Robinson (CHRW) Q3 Earnings Miss Mark on Weak Pricing

C.H. Robinson Worldwide’s CHRW third-quarter 2019 earnings of $1.07 per share missed the Zacks Consensus Estimate of $1.16. The bottom line also declined 14.4% year over year. Results were hurt by truckload margin compression in North America.

Total revenues came in at $3,856.1 million, falling short of the Zacks Consensus Estimate of $3,925.1 million. Moreover, the top line fell 10.2% year over year. This downturn can be attributed to unfavorable pricing across most transportation service lines.

Total operating expenses decreased 3.5% year over year to $432.35 million, primarily due to 4.4% decline in Personnel expenses. However, operating ratio (operating expenses as a percentage of net revenues) deteriorated to 68.3% from 64.6% in the year-ago quarter. Notably, lower the value of the metric the better.

The company returned $135.9 million to its shareholders through a combination of cash dividends ($68.9 million) and share repurchases ($67 million). Capital expenditures totaled $19.4 million in the quarter under review.

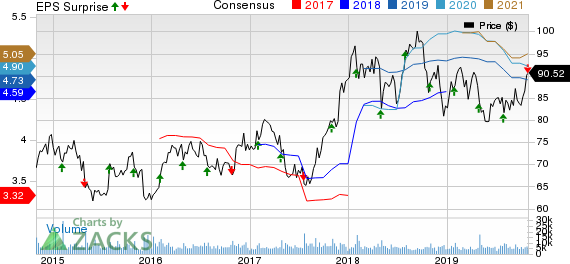

C.H. Robinson Worldwide, Inc. Price, Consensus and EPS Surprise

C.H. Robinson Worldwide, Inc. price-consensus-eps-surprise-chart | C.H. Robinson Worldwide, Inc. Quote

Segmental Results

At North American Surface Transportation (NAST), total revenues were $2.83 billion (down 12.4%) in the third quarter. This downside was due to weak pricing. Net revenues at the segment also dropped 13.2%. NAST results include those of Robinson Fresh transportation, which were previously reported under a separate segment.

Total revenues at Global Forwarding summed $597.69 million, down 6.5%. Low pricing in ocean and air as well as contracted air volumes affected results. However, net revenues at the segment inched up 1.3%. The Space Cargo Group acquisition boosted results by 3.5 percentage points.

A historical presentation of the results on an enterprise basis is given below:

Transportation: The unit (comprising Truckload, Intermodal, Less-than-Truckload, Ocean, Air, Customs and Other logistics services) delivered net revenues of $608.37 million in the quarter under consideration, down 9% from the prior-year figure.

Truckload net revenues declined 16% year over year to $317.99 million with volumes contracting 4%. However, net revenues at Less-than-Truckload inched up 1.6% year over year to $124.52 million. LTL volumes also grew 4% in the quarter.

At the Intermodal segment, net revenues declined 15% year over year to $7.11 million as volumes fell 24%.

Net revenues at the Ocean transportation segment increased 4.1% year over year to $77.88 million. But the same at the Air transportation division dropped 9.6% year over year to $27.12 million. Meanwhile, customs net revenues rose 1.8% to $23.72 million.

Other logistics services’ net revenues dipped 3.7% year over year to $30.03 million.

Sourcing: Net revenues at the segment slipped to $25.06 million.

Liquidity

This Zacks Rank #3 (Hold) company exited the third quarter with cash and cash equivalents of $384.42 million compared with $378.62 million at the end of 2018. Long-term debt was $1.25 billion compared with $1.34 billion at 2018 end. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

2019 Outlook

C.H. Robinson now anticipates capital expenditures between $65 and $75 million for 2019 with the majority to be spent on technology. Previously, capital expenditures were expected to be $80-$90 million for the current year. Additionally, effective tax rate is estimated in the 23-24% band compared with 24-25% expected earlier. Amid the sluggish freight environment, the company expects an oversupply of capacity over the next few quarters in comparison to the available shipments.

Upcoming Releases

Investors interested in the broader Transportation sector are awaiting third-quarter earnings reports from key players like Expeditors International of Washington, Inc EXPD, Air Lease Corporation AL and Hertz Global Holdings, Inc HTZ. While Hertz will release third-quarter results on Nov 4, Expeditors and Air Lease will announce the same on Nov 5 and Nov 7, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Lease Corporation (AL) : Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Hertz Global Holdings, Inc (HTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research