CA Surpasses Q4 Earnings Estimates, Revenues Increase Y/Y

CA Inc. CA fourth-quarter 2018 earnings topped the Zacks Consensus Estimate whereas revenues came in line with the same.

The company posted non-GAAP earnings (excluding stock-based compensation and other one-time items) of 62 cents per share, surpassing the Zacks Consensus Estimate of 60 cents. Further, reported earnings witnessed a year-over-year increase of 15%.

Quarter Details

CA’s reported revenues of $1.083 billion increased 7% on a year-over-year basis. On a constant currency basis, revenues were up 4% year over year.

The year-over-year revenue growth was mainly attributable to Mainframe new sales, driven by the company’s ongoing innovations and robust Mainframe hardware cycle. Management was positive about the impressive performance of the company’s Mainframe Operational Intelligence and Dynamic Capacity Intelligence solutions.

With security being one of the key areas in recent times, the company witnessed a surge in demand for its recently launched Trusted Access Manager for Z, a Mainframe solution. Additionally, a similar solution in the Enterprise Solutions segment, named Privileged Access Management or PAM saw new sales growth of around 50%.

Revenues from Subscription and maintenance (77.5% of total revenues) increased 3% and revenues from Professional Services (7.5% of total revenues) were up 5% from the year-ago quarter. Software fees and other revenues (15% of total revenues) surged 32%.

Moreover, on a segment basis, revenues from CA’s Mainframe Solutions increased 3% on a year-over-year basis to $549 million. Revenues from Enterprise Solutions jumped 13% on a year-over-year basis to $453 million, while Services revenues increased 5% to reach $81 million.

North America and International revenues increased 5% and 12%, respectively, on a year-over-year basis. The company witnessed 7% increase in total bookings.

CA reported non-GAAP income before interest and income taxes of $366 million, up 15% year over year. As a percentage of revenues, non-GAAP income before interest and income taxes were up 200 basis points (bps) on a year-over-year basis to 34%.

The company’s non-GAAP net income was approximately $258 million compared with $227 million in the year-ago quarter.

CA exited the quarter with cash and cash equivalents of $3.405 billion compared with $2.971 billion in the previous quarter. The company’s total long-term debt (net of current portion) came in at $2.514 billion. During the quarter, the company generated $548 million of cash flow from operational activities.

During the quarter, the company distributed dividend worth $107 million to its shareholders. As of Mar 31, 2018, the company has approximately $487 million remaining under its current stock repurchase program.

Fiscal 2018 Snapshot

CA reported revenues of $4.235 billion, up 5% from the previous fiscal. The company reported earnings of $2.59 per share that increased 4% from fiscal 2017. Management stated that the company recorded revenue growth for the second consecutive year in fiscal 2018.

During fiscal 2018, the company repurchased around 5 million shares for approximately $163 million.

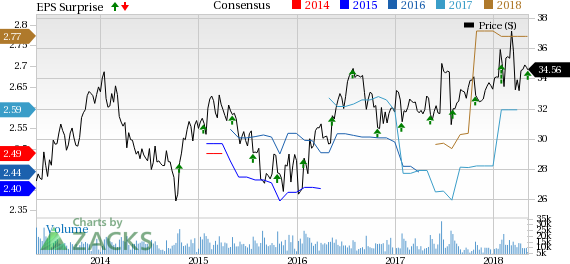

CA Inc. Price, Consensus and EPS Surprise

CA Inc. Price, Consensus and EPS Surprise | CA Inc. Quote

Fiscal 2019 Guidance

Notably, for fiscal 2019, the company will implement ASC 606 revenue standard but will report results under both ASC 605 and ASC 606 revenue standards. However, CA provided guidance for fiscal 2019 per ASC 605 revenue standard for ease of comparison.

The company anticipates total revenues to range between flat to up 1% on a reported basis and down 1% to flat on a constant currency basis. This translates to revenues in the range of $4.25-$4.29 billion at Mar 31, 2018 exchange rates.

The company expects non-GAAP earnings per share to increase in the range of 6% to 8% on a reported and 2% to 4% on a constant currency basis. According to the company, “At March 31, 2018 exchange rates, this translates to reported non-GAAP diluted earnings per share of $2.75 to $2.81.” The Zacks Consensus Estimate for fiscal 2019 is pegged at $2.77 per share.

The company continues to project cash flow from operations to decrease in the range of 1-5% on a reported basis and 3-7% on a constant currency basis. Considering the exchange rates as of Mar 31, 2018, this translates to cash flow in the range of $1.14-$1.18 billion.

The decline in the projected cash flow can primarily be attributed to restructuring charges, U.S. tax reform and adoption of ASC 606 revenue standard.

Bottom Line

CA posted impressive fourth-quarter fiscal 2018 results and management was particularly optimistic about the Mainframe segment. They were also happy about the Application Performance Monitoring (APM) business gaining recognition.

The positive contributions from entities acquired last year, namely Veracode and Automic have also been beneficial for the company’s financials. Veracode’s large transactions and bookings recorded impressive growth. Additionally, the company is also increasing the adoption of the digital go-to-market strategies employed by Veracode across CA.

Management expects to keep up the performance as CA keeps on delivering its offerings across hybrid cloud environments. Additionally, management stated that they would be going for site consolidations and lay-off of around 800 employees in fiscal 2019. They are looking to focus on investments in development of new products and customer success.

However, as the company is shifting toward a higher mix of “Enterprise Solutions as SaaS or subscription-based licenses”, revenues are expected to remain under pressure.

Zacks Rank and Stocks to Consider

CA currently has a Zacks Rank #3 (Hold).

Some of the better-ranked stocks in the broader technology sector are Micron Technology, Inc. MU, Twitter, Inc. TWTR and Lam Research Corporation LRCX, all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term EPS growth rate for Micron, Twitter and Lam Research is projected to be 10%, 23.1% and 17.7%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Twitter, Inc. (TWTR) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research