Cadence (CDNS) Q4 Earnings & Revenues Top Estimates, Up Y/Y

Cadence Design Systems Inc CDNS posted non-GAAP earnings of 96 cents per share in fourth-quarter 2022, which topped the Zacks Consensus Estimate by 5.5% and increased 17.1% year over year.

Revenues of $900 million surpassed the Zacks Consensus Estimate by 2.2% and increased 16.4% on a year-over-year basis. The top line benefited from continued strength across all segments driven by higher demand for its products. CDNS ended the quarter with a backlog of $5.8 billion.

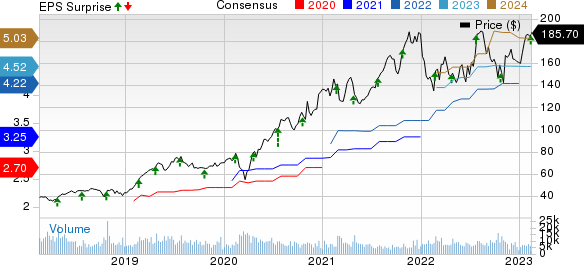

Cadence Design Systems, Inc. Price, Consensus and EPS Surprise

Cadence Design Systems, Inc. price-consensus-eps-surprise-chart | Cadence Design Systems, Inc. Quote

Performance in Details

In the fourth quarter, Product & Maintenance revenues (94% of total revenues) of $846 million were up 17.5% year over year. Services revenues (6%) of $54 million increased 1.5% from the year-ago quarter’s figure.

Geographically, the Americas, China, Other Asia, Europe, Middle East and Africa and Japan contributed 46%, 13%, 18%, 17% and 6%, respectively, to total revenues in the quarter under review.

Product-wise, Custom IC Design & Simulation, Digital IC Design & Signoff, Functional Verification, IP and Systems Design & Analysis contributed 22%, 28%, 25%, 12% and 13% to total revenues, respectively.

The company’s digital IC business delivered 17% year-over-year growth in revenues. Digital Full Flow saw robust traction with 50 new customer wins in 2022. The company is expanding its digital software business by developing front-end Genus and Joules tools and signoff products like Tempus and Quantus.

The company’s Cadence Cerebrus AI-driven solution witnessed accelerating momentum and was deployed by several customers.

Palladium and Protium (especially Z2 and X2) platforms witnessed continued momentum with many deals wins. The company won 30 new clients and 160 repeat orders in 2022. Most deal wins came from clients in the hyperscale, HPC and auto EV segments.

Cadence’s System Design & Analysis Business segment reported 27% year-over-year growth as it expanded its presence beyond EDA.

In the fourth quarter, Cadence announced the launch of its LPDDR5X memory interface IP that is optimized to operate at speeds of up to 8533 megabits per second. LPDDR5X is a solution designed to enable high-speed data transfer between a system-on-chip and LPDDR5X DRAM devices, providing a high-bandwidth, low-power memory solution for a wide range of applications.

Also, the company unveiled the silicon-proven Cadence IP for GDDR6 on TSMC’s N5 process technology. It exceeds the company’s existing 16Gbps designs and helps customers to meet their design requirements.

For the fourth quarter ended, the total non-GAAP costs and expenses increased 16.3% year over year to $579 million.

Non-GAAP gross margin contracted 160 basis points to 91.1%, but the non-GAAP operating margin remained the same on a year-over-year basis to 36% in the quarter under review.

Balance Sheet & Cash Flow

As of Dec 31, 2022, the company had cash and cash equivalents of approximately $0.882 billion compared with $1.026 billion as of Oct 1, 2022.

The company’s long-term debt came in at $648.1 million as of Dec 31, 2022, compared with $647.8 million as of Oct 1, 2022.

The company generated an operating cash flow of $263.6 million in the reported quarter compared with the prior quarter’s figure of $317.1 million. The free cash flow in the quarter under review was $227 million compared with $273 million reported in the previous quarter.

The company repurchased shares worth approximately $300 million in the third quarter.

Q1 and 2023 Guidance

Revenues for 2023 are projected in the range of $4-$4.06 billion. The Zacks Consensus Estimate for 2023 revenues is currently pegged at $3.8 billion, which indicates year-over-year growth of 7.4%.

Non-GAAP earnings for 2023 are expected in the range of $4.9-$5.0 per share. The Zacks Consensus Estimate for 2023 earnings is pegged at $4.52 per share, which suggests year-over-year growth of 7.3%.

For 2023, the non-GAAP operating margin is forecast in the range of 40.5-42%.

For 2023, operating cash flow is projected to be $1.3 to $1.4 billion. Management expects to utilize 50% of the free cash flow to repurchase shares in 2023.

For first-quarter 2023, revenues are projected in the range of $1-$1.02 billion. The Zacks Consensus Estimate for revenues is currently pegged at $913.4 million, suggesting a year-over-year increase of 1.3%.

Non-GAAP earnings are expected to be $1.23-$1.27 per share. The Zacks Consensus Estimate for earnings is pegged at $1.01 per share, suggesting a year-over-year decrease of 13.7%.

Non-GAAP operating margin is projected to be 41-42% for the first quarter. The company expects to repurchase shares for approximately $125 million in the first quarter.

Zacks Rank & Stocks to Consider

Cadence currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Arista Networks ANET, Jabil JBL and Bandwidth BAND, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.38 per share, rising 0.2 in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have increased 10.7% in the past year.

The Zacks Consensus Estimate for Jabil’s 2023 earnings is pegged at $8.37 per share, rising 2.3% in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 8.8%. Shares of JBL have increased 39.1% in the past year.

The Zacks Consensus Estimate for Bandwidth 2022 earnings is pegged at 37 cents per share, unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 25%.

BAND's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 301.8%. Shares of the company have declined 59.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report