Campbell Soup And Other Top Dividend Stocks

Campbell Soup is one of companies that can help grow your investment income by paying large dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. Here are other similar dividend stocks that could be valuable additions to your current holdings.

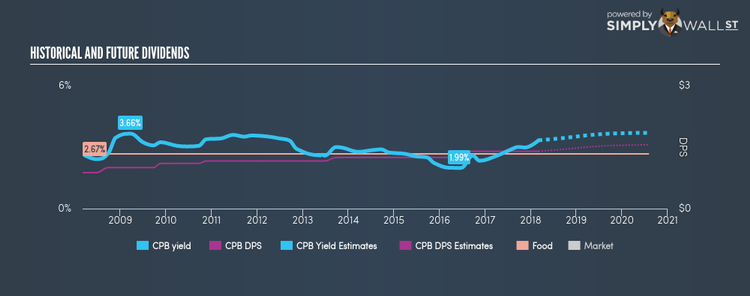

Campbell Soup Company (NYSE:CPB)

Campbell Soup Company, together with its subsidiaries, manufactures and markets food and beverage products. Founded in 1869, and currently headed by CEO Denise Morrison, the company size now stands at 18,000 people and with the company’s market capitalisation at USD $12.63B, we can put it in the large-cap stocks category.

CPB has a wholesome dividend yield of 3.33% and is currently distributing 40.11% of profits to shareholders , with analysts expecting this ratio to be 47.75% in the next three years. CPB’s last dividend payment was US$1.40, up from it’s payment 10 years ago of US$0.88. They have been dependable too, not missing a single payment in this time. Campbell Soup’s performance over the last 12 months beat the us food industry, with the company reporting 111.31% EPS growth compared to its industry’s figure of 9.99%. More detail on Campbell Soup here.

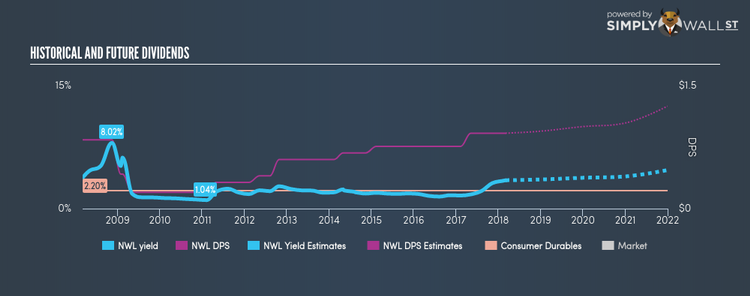

Newell Brands Inc. (NYSE:NWL)

Newell Brands Inc. designs, manufactures, sources, and distributes consumer and commercial products worldwide. Founded in 1903, and currently headed by CEO Michael Polk, the company currently employs 53,400 people and with the stock’s market cap sitting at USD $12.90B, it comes under the large-cap stocks category.

NWL has a good dividend yield of 3.46% and the company has a payout ratio of 15.58% , with analysts expecting the payout in three years to be 34.97%. Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from US$0.84 to US$0.92 over the past 10 years. Newell Brands’s earnings per share growth of 420.11% outpaced the us consumer durables industry’s 10.30% average growth rate over the last year. Dig deeper into Newell Brands here.

Invesco Ltd. (NYSE:IVZ)

Invesco Ltd. is a publicly owned investment manager. Formed in 1935, and currently headed by CEO Martin Flanagan, the company size now stands at 7,030 people and with the company’s market cap sitting at USD $13.11B, it falls under the large-cap category.

IVZ has a nice dividend yield of 3.60% and their payout ratio stands at 42.13% . IVZ’s last dividend payment was US$1.16, up from it’s payment 10 years ago of US$0.38. Much to the delight of shareholders, the company has not missed a payment during this time. More on Invesco here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.