Some Canadian Solar (NASDAQ:CSIQ) Shareholders Are Down 44%

Canadian Solar Inc. (NASDAQ:CSIQ) shareholders should be happy to see the share price up 19% in the last month. But if you look at the last five years the returns have not been good. After all, the share price is down 44% in that time, significantly under-performing the market.

Check out our latest analysis for Canadian Solar

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

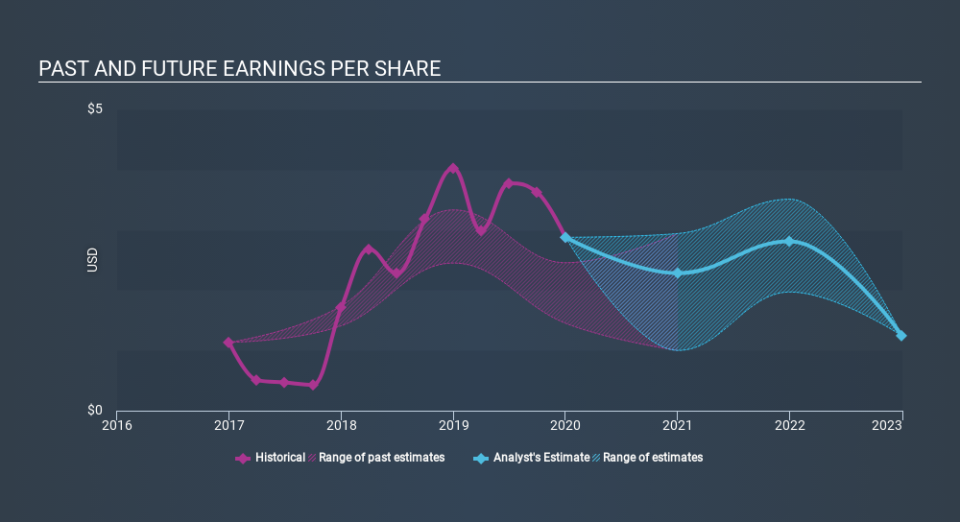

During the five years over which the share price declined, Canadian Solar's earnings per share (EPS) dropped by 8.2% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 11% per year, over the period. This implies that the market is more cautious about the business these days. The low P/E ratio of 6.58 further reflects this reticence.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Canadian Solar has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Canadian Solar stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Canadian Solar shareholders have received a total shareholder return of 8.9% over the last year. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Canadian Solar better, we need to consider many other factors. Take risks, for example - Canadian Solar has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

We will like Canadian Solar better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.