Capital One (COF) Down on Q3 Earnings Miss as Provisions Rise

Shares of Capital One COF lost 4.7% in after-hours trading in response to lower-than-expected third-quarter 2022 results. Earnings of $4.20 per share lagged the Zacks Consensus Estimate of $5.03. The bottom line also plunged 38% from the year-ago quarter. Our estimate for earnings was $5.12.

Results were adversely impacted by higher provisions for credit losses on the worsening macroeconomic environment and recessionary fears. Also, an increase in operating expenses acted as a headwind.

Yet, a robust improvement in loan balances and higher interest rates aided net interest income (NII). Further decent consumer sentiments supported the credit card business and non-interest income.

Net income available to common shareholders was $1.62 billion, plunging 46% from the prior-year quarter.

Revenues & Expenses Rise

Total net revenues were $8.81 billion, up 12% from the prior-year quarter. The top line also beat the Zacks Consensus Estimate of $8.60 billion. We had projected revenues to be $8.52 billion.

NII improved 14% from the prior-year quarter to $7 billion. Net interest margin (NIM) surged 45 basis points (bps) to 6.80%. This was largely driven by lower average cash and securities balances and higher yields on average interest-earning assets. Our estimates for NII and NIM were $6.67 billion and 6.69%, respectively.

Non-interest income of $1.8 billion rose 8%. This was primarily attributable to growth in net interchange fees (up 17%) and service charges and other customer-related fees (up 2%). On the other hand, other non-interest income declined 22%. Our estimate for the metric was pegged at $1.85 billion.

Non-interest expenses were $4.95 billion, rising 18%. The increase was mainly due to a 32% surge in professional services and a 30% rise in marketing costs. We had expected this metric to be $4.94 billion.

Efficiency ratio was 56.21%, up from 53.46% in the year-ago quarter. A rise in efficiency ratio indicates a deterioration in profitability.

As of Sep 30, 2022, loans held for investment were $303.9 billion, up 3% from the prior quarter. Total deposits, as of the same date, also grew 3% to $317.2 billion.

Credit Quality Worsens

Provision for credit losses was $1.67 billion in the reported quarter against a provision benefit of $342 million in the prior-year quarter. We had anticipated the metric to be $1.07 billion.

The 30-plus day performing delinquency rate rose 61 bps to 2.58%. Also, the net charge-off rate jumped 57 bps year over year to 1.24%.

However, allowance, as a percentage of reported loans held for investment, was 4.02%, down 41 bps.

Capital & Profitability Ratios Deteriorates

As of Sep 30, 2022, Tier 1 risk-based capital ratio was 13.6%, down from 15.7% a year ago. Common equity Tier 1 capital ratio was 12.2% as of Sep 30, 2022, down from 13.8%.

At the end of the third quarter, return on average assets was 1.52%, down from the year-ago period’s 2.92%. Return on average common equity was 13.01%, down from 20.52%.

Share Repurchase Update

During the quarter, Capital One repurchased 2.9 million shares for $313 million.

Our View

Capital One’s strategic acquisitions, rise in demand for consumer loans, higher rates and steady improvement in the card business position it well for long-term growth. However, mounting expenses and a deteriorating macroeconomic backdrop are major near-term concerns.

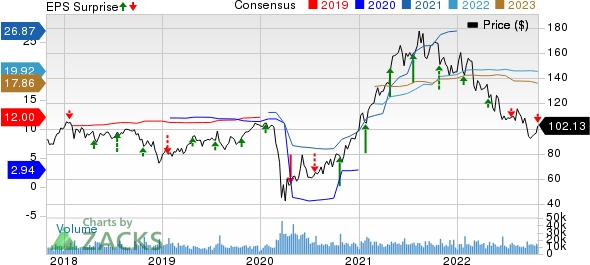

Capital One Financial Corporation Price, Consensus and EPS Surprise

Capital One Financial Corporation price-consensus-eps-surprise-chart | Capital One Financial Corporation Quote

Currently, Capital One carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance Other Consumer Loan Providers

Ally Financial’s ALLY third-quarter 2022 adjusted earnings of $1.12 per share lagged the Zacks Consensus Estimate of $1.73. The bottom line reflects a decline of 48.1% from the year-ago quarter. Our estimate for earnings was $1.75.

Results were primarily hurt by a rise in expenses, a decline in other revenues and higher provisions. However, an improvement in net financing revenues was an offsetting factor. ALLY witnessed a rise in loan balances in the reported quarter.

Navient Corporation’s NAVI third-quarter 2022 adjusted core earnings per share of 75 cents missed the Zacks Consensus Estimate of 77 cents. Also, the bottom line was lower than the prior-year quarter’s 92 cents.

The results of Navient were affected by the fall in non-interest income and NII. An increase in the provision for loan losses also dragged the results. Nonetheless, lower expenses aided the company.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research