Cardinal Health (CAH) Q4 Earnings Lag Estimates, Revenues Top

Cardinal Health, Inc. CAH reported fourth-quarter fiscal 2022 adjusted earnings of $1.05 per share (EPS), which missed the Zacks Consensus Estimate of $1.17 by 10.3%. The bottom line gained 36.4% year over year.

GAAP earnings per share in the quarter were 50 cents, compared with the year-ago quarter’s earnings of 40 cents per share.

For fiscal 2021 the company reported an adjusted EPS of $5.06, down 5.6% from the previous year. The metric missed the consensus mark by 2.3%.

Revenue Details

Revenues improved 10.6% on a year-over-year basis to $47.1 billion. The top line outpaced the Zacks Consensus Estimate by 5.6%.

For fiscal 2022, revenues were $181.4 billion, up 11.6% from fiscal 2021. The figure beat the consensus mark by 1.4%.

Segmental Analysis

Pharmaceutical Segment

In the fiscal fourth quarter, pharmaceutical revenues amounted to $43.3 billion, up 13.1% on a year-over-year basis. The performance highlights branded pharmaceutical sales growth from existing and net new Pharmaceutical Distribution and Specialty Solutions customers.

Pharmaceutical profit was $451 million, up 26% on a year-over-year basis. The upside was driven by generics program performance along with a higher contribution from the brand sales mix, which was partially offset by rising supply chain costs.

Medical Segment

In the quarter under review, revenues at this segment fell 11% to $3.8 billion due to the divestiture of the Cordis business as well as a decrease in products and distribution volumes.

The company reported a loss of $16 million in the Medical segment, which narrowed 74.6% from the year-ago quarter. The company recorded a loss during the quarter, primarily due to net inflationary impacts and global supply chain restrictions in products and distribution.

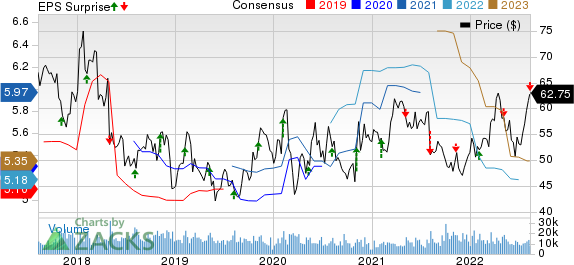

Cardinal Health, Inc. Price, Consensus and EPS Surprise

Cardinal Health, Inc. price-consensus-eps-surprise-chart | Cardinal Health, Inc. Quote

Margin Analysis

Gross profit was up 9% year over year to $1.61 billion.

As a percentage of revenues, the gross margin in the reported quarter was 3.4%, down 6 basis points (bps) on a year-over-year basis.

Distribution, selling, general and administrative expenses totaled $1.12 billion, up 2% year over year.

The company reported an operating income of $36 million in the quarter under review compared with the year-ago quarter’s income of $162 million.

Financial Update

The company exited the quarter with cash and cash equivalents of $4.72 billion, compared with $2.36 billion on a sequential basis.

Cumulative net cash provided by operating activities totaled $3 billion at the end of the fiscal fourth quarter, compared with net cash provided of $3.12 billion in the year-ago quarter.

2023 Guidance

Cardinal Health provided its fiscal 2023 outlook. The company anticipates adjusted earnings per share between $5.05 and $5.40. The Zacks Consensus Estimate is pegged at $5.35 per share.

The company reiterated its long-term outlook for the segment and combined profits. It expects adjusted EPS to grow in the low to mid-single digits for the Pharmaceutical segment and in the mid to high single digits for the Medical segment. The combined adjusted EPS and the dividend yield is expected in double digits. The company is targeting a segment profit of at least $650 million for the Medical segment by fiscal year 2025 on the back of its medical improvement plan.

Conclusion

Cardinal Health exited the fiscal fourth quarter on a mixed note, wherein earnings missed the consensus mark but revenues beat the same. The company witnessed revenue growth in its Pharmaceutical segment in the quarter under review.

The addition of a new medical distribution center in the central Ohio area, partnership with Innara Health and Kinaxis and the acquisition of the Bendcare group purchasing organization entity and ScalaMed are the highlights of the quarter under review. The company also reached an agreement with the state of Oklahoma to resolve opioid-related claims during the fourth quarter.

However, intense competition and customer concentration are other concerns. Weakness in the Medical segment is a woe. Contraction in gross margin remains a headwind.

Zacks Rank and Stocks to Consider

Currently, Cardinal Health has a Zacks Rank #4 (Sell).

Some better-ranked stocks from the pharma/biotech sector include ShockWave Medical SWAV, Patterson Companies PDCO and Alkermes ALKS. While ShockWave Medical sports a Zacks Rank #1 (Strong Buy), Patterson Companies and Alkermes carry a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ShockWave Medical’s earnings per share estimates have improved from $1.84 to $2.57 for 2022 and from $2.82 to $3.42 for 2023 in the past 60 days. SWAV has gained 55.5% so far this year.

ShockWave Medical delivered an earnings surprise of 180.14%, on average, in the last four quarters.

Estimates for Patterson Companies have improved from earnings of $2.25 to $2.30 for 2022 and $2.42 to $2.48 for 2023 in the past 60 days. PDCO stock has risen 4.8% so far this year.

Patterson Companies delivered an earnings surprise of 16.49%, on average, in the last four quarters.

Alkermes’ earnings per share estimates have improved from a loss of 17 cents to earnings of 20 cents for 2022 and from 31 cents to 50 cents for 2023 in the past 60 days. ALKS has gained 10.3% so far this year.

Alkermes delivered an earnings surprise of 325.48%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research