Be Careful About Buying Spok Holdings Inc (NASDAQ:SPOK) For The 3.22% Dividend

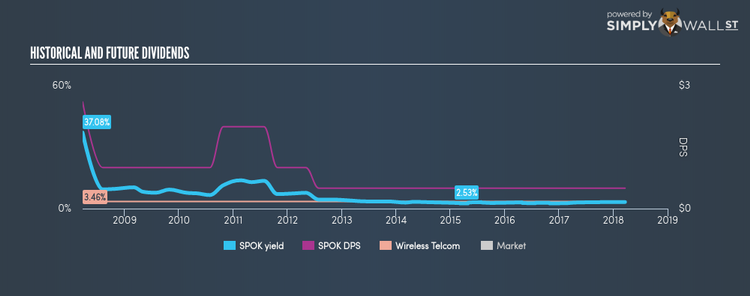

Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. Spok Holdings Inc (NASDAQ:SPOK) has returned to shareholders over the past 10 years, an average dividend yield of 6.00% annually. Should it have a place in your portfolio? Let’s take a look at Spok Holdings in more detail. View our latest analysis for Spok Holdings

How I analyze a dividend stock

If you are a dividend investor, you should always assess these five key metrics:

Is it the top 25% annual dividend yield payer?

Has its dividend been stable over the past (i.e. no missed payments or significant payout cuts)?

Has dividend per share amount increased over the past?

Is is able to pay the current rate of dividends from its earnings?

Will the company be able to keep paying dividend based on the future earnings growth?

How well does Spok Holdings fit our criteria?

Spok Holdings has a negative payout ratio, which means that it is loss-making, and paying its dividend from its retained earnings. If dividend is a key criteria in your investment consideration, then you need to make sure the dividend stock you’re eyeing out is reliable in its payments. Dividend payments from Spok Holdings have been volatile in the past 10 years, with some years experiencing significant drops of over 25%. These characteristics do not bode well for income investors seeking reliable stream of dividends. Compared to its peers, Spok Holdings produces a yield of 3.22%, which is on the low-side for Wireless Telcom stocks.

Next Steps:

After digging a little deeper into Spok Holdings’s yield, it’s easy to see why you should be cautious investing in the company just for the dividend. On the other hand, if you are not strictly just a dividend investor, the stock could still be offering some interesting investment opportunities. Given that this is purely a dividend analysis, I recommend taking sufficient time to understand its core business and determine whether the company and its investment properties suit your overall goals. There are three relevant factors you should further examine:

Historical Performance: What has SPOK’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Spok Holdings’s board and the CEO’s back ground.

Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.