Is CarGurus, Inc. (CARG) Going To Burn These Hedge Funds ?

Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018 as investors first worried over the possible ramifications of rising interest rates and the escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only about 60% S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of CarGurus, Inc. (NASDAQ:CARG) and see how the stock is affected by the recent hedge fund activity.

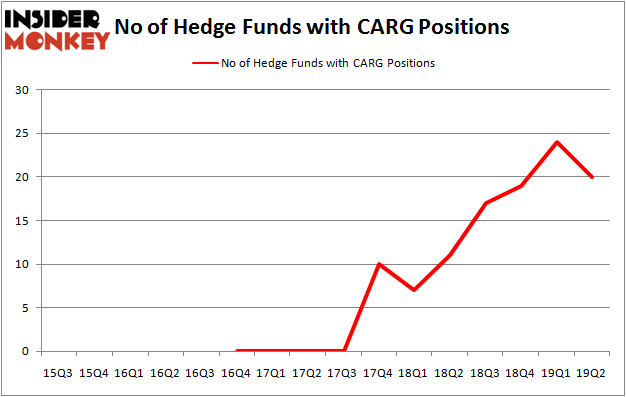

CarGurus, Inc. (NASDAQ:CARG) has seen a decrease in activity from the world's largest hedge funds lately. Our calculations also showed that CARG isn't among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are many metrics market participants have at their disposal to evaluate publicly traded companies. A pair of the less utilized metrics are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the best money managers can beat the broader indices by a very impressive margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let's take a look at the latest hedge fund action encompassing CarGurus, Inc. (NASDAQ:CARG).

How are hedge funds trading CarGurus, Inc. (NASDAQ:CARG)?

Heading into the third quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -17% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in CARG a year ago. With the smart money's sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Hound Partners held the most valuable stake in CarGurus, Inc. (NASDAQ:CARG), which was worth $252 million at the end of the second quarter. On the second spot was Cat Rock Capital which amassed $212 million worth of shares. Moreover, Matrix Capital Management, Renaissance Technologies, and HMI Capital were also bullish on CarGurus, Inc. (NASDAQ:CARG), allocating a large percentage of their portfolios to this stock.

Seeing as CarGurus, Inc. (NASDAQ:CARG) has witnessed declining sentiment from hedge fund managers, we can see that there were a few money managers that slashed their full holdings heading into Q3. Intriguingly, Peter Rathjens, Bruce Clarke and John Campbell's Arrowstreet Capital dumped the largest position of the 750 funds followed by Insider Monkey, worth close to $6.4 million in stock, and Paul Marshall and Ian Wace's Marshall Wace LLP was right behind this move, as the fund said goodbye to about $6.2 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 4 funds heading into Q3.

Let's check out hedge fund activity in other stocks similar to CarGurus, Inc. (NASDAQ:CARG). We will take a look at Plains GP Holdings LP (NYSE:PAGP), MasTec, Inc. (NYSE:MTZ), Brunswick Corporation (NYSE:BC), and Strategic Education, Inc. (NASDAQ:STRA). This group of stocks' market values match CARG's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position PAGP,17,307082,1 MTZ,28,452832,0 BC,30,540469,3 STRA,13,208173,0 Average,22,377139,1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $377 million. That figure was $912 million in CARG's case. Brunswick Corporation (NYSE:BC) is the most popular stock in this table. On the other hand Strategic Education, Inc. (NASDAQ:STRA) is the least popular one with only 13 bullish hedge fund positions. CarGurus, Inc. (NASDAQ:CARG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CARG wasn't nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); CARG investors were disappointed as the stock returned -14.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019