Carl Icahn Discards HP Stake in the 2nd Quarter

Carl Icahn (Trades, Portfolio), board chairman of Icahn Enterprises LP (NASDAQ:IEP), disclosed last week that his top sells during the second quarter were HP Inc. (HPQ), Hertz Global Holdings Inc. (NYSE:HTZ) and Freeport-McMoRan Inc. (NYSE:FCX).

Through his three investing vehicles, which include Icahn Capital Management, Icahn takes minority stakes in out-of-favor companies, pushes for changes and then sells the stake once the company reaches its fair value.

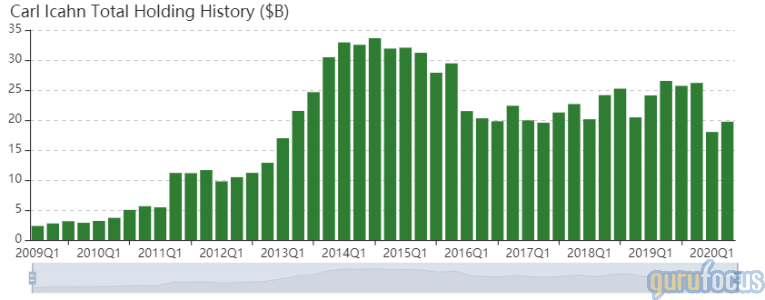

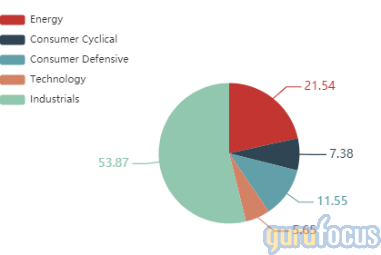

As of quarter-end, Icahn's $19.73 billion equity portfolio contains 16 stocks, with no new positions and a turnover ratio of 2%. The equity portfolio contains a 50.41% weight in Icahn Enterprises, followed by a 21.54% weight in the energy sector and an 11.55% weight in the consumer defensive sector.

HP

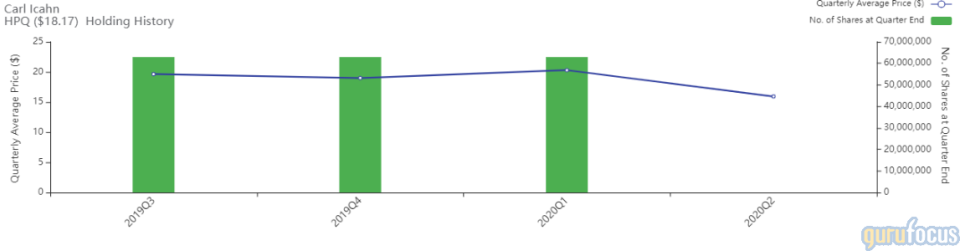

Icahn sold 62,902,970 shares of HP, reducing the equity portfolio 6.07%. Shares averaged $15.93 during the second quarter; based on GuruFocus estimates, Icahn took a loss of approximately 18.89% on the stock since the initial purchase during the third quarter of 2019.

Icahn said in a Dec. 4, 2019 open letter to HP's board of directors that he took the stake to push for the merger between the Palo Alto, California-based computer giant and Norwalk, Connecticut-based multifunction printer company Xerox Holdings Corp. (NYSE:XRX). The investor chastised HP's board of directors' "unreasonable refusal to engage in a customary mutual due diligence process," prolonging the combination that could yield over $2 billion in cost synergies according to Icahn's letter.

Xerox ended merger talks with HP in March, citing macroeconomic and microeconomic turmoil stemming from the coronavirus pandemic.

GuruFocus ranks HP's profitability 7 out of 10 on the back of profit margins outperforming over 66% of global competitors and returns on assets outperforming over 85% of global hardware companies.

Hertz

Icahn sold 55,342,109 shares of Hertz, reducing the equity portfolio 1.90%. Shares of the embattled car dealer averaged $3.26 during the second quarter.

According to GuruFocus Real-Time Picks, a Premium feature, Icahn disclosed the transaction on May 26, with shares trading around just 56 cents per share. GuruFocus ranks the Estero, Florida-based company's financial strength 2 out of 10 on several warning signs, which include a weak Altman Z-score of 0.3 and debt ratios that underperform over 90% of global competitors.

Freeport-McMoRan

Icahn sold 26,770,875 shares of Freeport-McMoRan, reducing the equity portfolio 1%. Shares averaged $9.11 during the second quarter. Based on GuruFocus estimates, Icahn has gained approximately 10.58% on the stock since initially buying shares during the third quarter of 2015.

GuruFocus ranks the Phoenix-based copper producer's financial strength 3 out of 10 on the back of debt ratios underperforming over 77% of global competitors, coupled with a low Piotroski F-score of 3.

See also

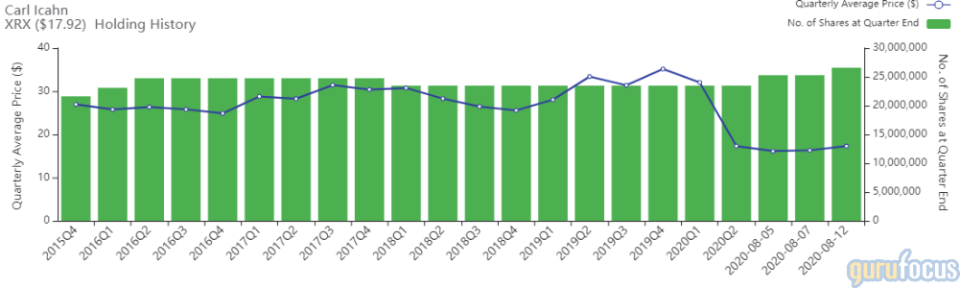

According to GuruFocus Real-Time Picks, a Premium feature, Icahn reported as of Aug. 12 a holding of 26,578,684 shares in Xerox, approximately 12.48% of the company's total shares outstanding.

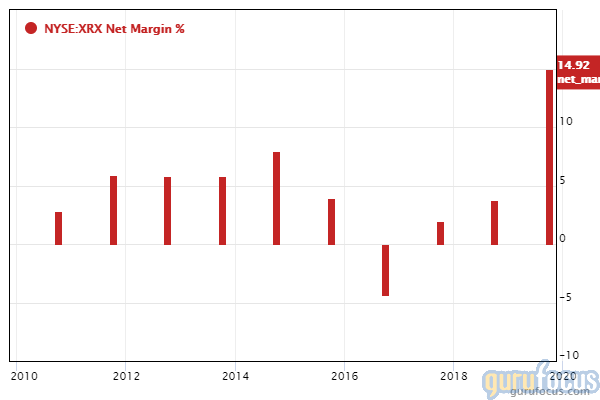

GuruFocus ranks Xerox's profitability 6 out of 10: Even though revenues are declining approximately 2.6% per year on average over the past three years, a rate that underperforms over 75% of global competitors, its net margin and return on equity are outperforming over 83% of global software companies.

Disclosure: No positions.

Read more here:

David Tepper's Top 5 Buys in the 2nd Quarter

Prem Watsa's Top 4 Trades in the 2nd Quarter

Seth Klarman Buys HCA Healthcare, Slims 4 Positions in the 2nd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.