Carl Icahn Expands Southwest Gas Stake

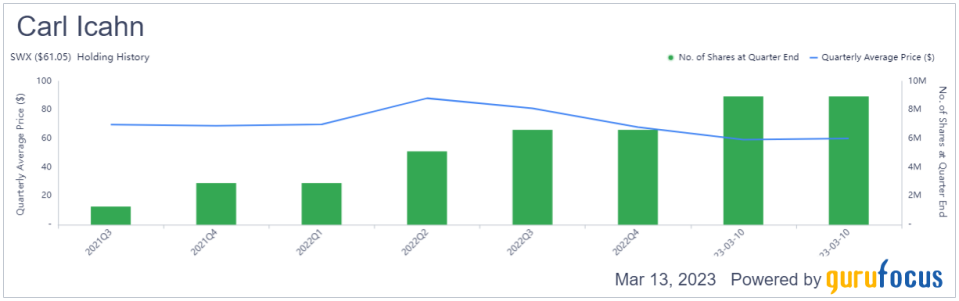

Renowned investor Carl Icahn (Trades, Portfolio) disclosed this week he increased his firms position in Southwest Gas Holdings Inc. (NYSE:SWX) by 35.28% following a public offering of common stock.

The gurus Florida-based firm, Icahn Capital Management, is known for taking activist positions in struggling companies and working with management to improve profitability as well as unlock value for shareholders.

According to GuruFocus Real-Time Picks, a Premium feature based on 13D, 13G and Form 4 filings, Icahn invested in another 2.33 million shares of the Las Vegas-based utility company on March 10. The stock traded for an average price of $59.29 per share on the day of the transaction.

His firm now holds 8.94 million shares total, which account for 2.46% of the equity portfolio. GuruFocus estimates Icahn has lost 16.73% on the investment since establishing it in the third quarter of 2021. The 13F filing for the three months ended Dec. 31 also showed it was his eighth-largest holding.

Investors should be aware that 13F filings do not give a complete picture of a firms holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

About Southwest Gas

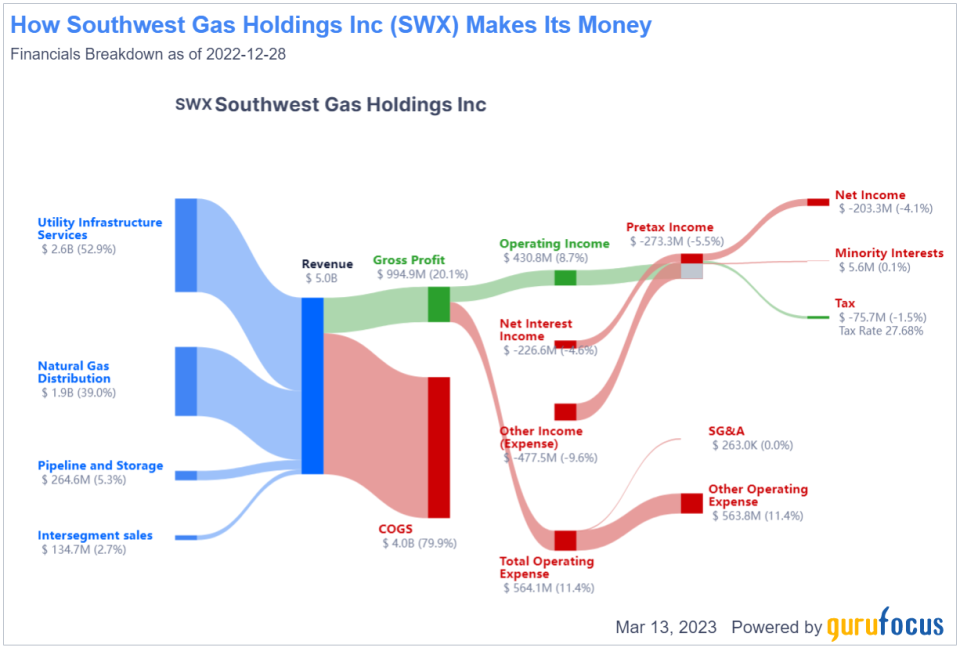

The company, which provides natural gas services to over 2 million customers in Arizona, Nevada and California, is composed of four segments. The Utility Infrastructure Services division accounted for over half of its revenue in 2022 at $2.6 billion.

Overview of Icahns involvement

The corporate raider first took issue with the company when it announced its plans to acquire Questar Pipelines in October of 2021. He sent an open letter to the board of directors in protest of the $2 billion deal, arguing it was paying too much for the company and that it would ultimately hurt shareholders. Icahn also attacked Southwest Gas executive panel for poor governance and egregious errors.

Despite his objections, the Questar deal was completed in December of the same year.

That was not the end of the matter, however. After a months-long battle where Icahn issued a tender offer and called for the ousting of President and CEO John Hester as well as the replacement of 10 directors, Southwest Gas finally reached an agreement with him in May 2022.

In addition to replacing Hester with Karen Haller as chief executive, the company gave the investor three board seats.

Icahn received a fourth board seat in August after Southwest failed to spin off infrastructure services business Centuri Group Inc.

Recent public offering

On March 8, the company announced an underwritten public offering of 3.57 million shares of its common stock, which were priced at $60.12 per share.

While the offering closed on March 10, underwriters were given a 30-day option to purchase up to an additional 536,427 shares.

Southwest noted the net proceeds, which were projected to be $207.7 million, will largely be used to repay outstanding borrowings under its credit facility and the remaining amounts under a credit loan agreement connected with its acquisition of MountanWest Pipelines Holding Co. The remainder will go toward working capital and general corporate purposes.

Valuation

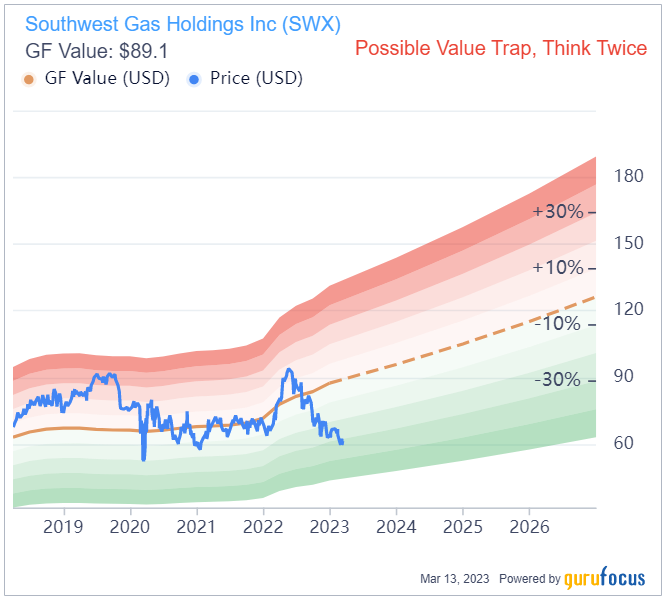

Southwest Gas has a $4.12 billion market cap; its shares were trading around $61.39 on Monday with a price-book ratio of 1.35 and a price-sales ratio of 0.81.

The GF Value Line suggests the stock is, while undervalued, is a possible value trap currently based on its historical ratios, past financial performance and analysts future earnings estimates. As such, potential investors should do thorough research before making a decision on the stock.

At 69 out of 100, the GF Score indicates the company has poor performance potential. While Southwest Gas received high ratings for profitability and GF Value, the growth rank was more moderate and the marks for financial strength and momentum were low.

Earnings

Southwest Gas reported its fourth-quarter and fiscal 2022 financial results on Feb. 28.

For the three months ended Dec. 31, the company posted a net loss of $281 million, or $4.18 per share, on $1.42 billion in revenue. While revenue was up from the prior-year quarter, the net loss widened.

As for the full year, Southwest Gas recorded a consolidated net loss of $203.3 million, or a loss of $3.10 per share, on $4.96 billion in revenue. Although revenue grew from 2021, net income was down substantially.

In a statement, Haller commented on Southwests performance, which delivered strong revenues while managing inflationary cost pressures.

The Company's comprehensive review of strategic alternatives was completed in December with our Board's unanimous decision to transform Southwest Gas into a fully regulated natural gas utility focused on delivering for our customers and communities, she said. We reached a significant milestone in this process with the recent completion of the sale of MountainWest, and used the proceeds to de-lever our balance sheet. Across Southwest Gas Holdings, we are focused on executing our strategic plan to deliver continued earnings growth as we safely address the needs of our customers, invest in the communities we serve and enhance value for our stockholders."

Guru interest

Icahn is by far the companys largest guru shareholder with a 13.32% stake.

Other gurus invested in Southwest Gas as of the end of the fourth quarter included Mario Gabelli (Trades, Portfolio), Hotchkis & Wiley, Paul Tudor Jones (Trades, Portfolio) and Steven Cohen (Trades, Portfolio).

Portfolio composition

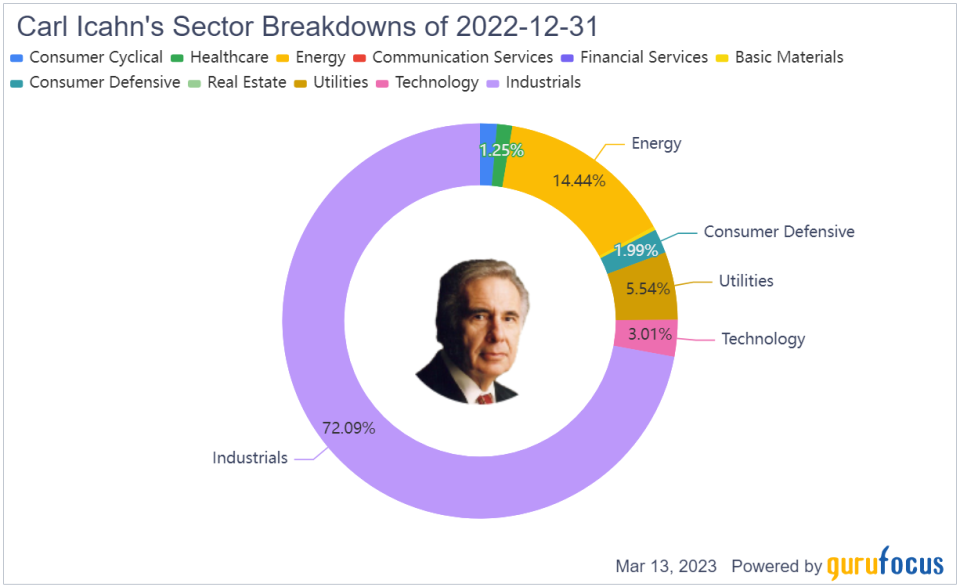

Over 70 % of Icahns $21.75 billion equity portfolio, which 13F filings show was composed of 16 stocks as of Dec. 31, was invested in the industrials sector. Energy had the second-largest representation with a weight of 14.44%, while utilities occupied 5.54%.

Another utilities stock the guru held as of the end of the fourth quarter was FirstEnergy Corp. (NYSE:FE).

This article first appeared on GuruFocus.