Carl Icahn Further Tones Up Stake in Xerox

- By Sydnee Gatewood

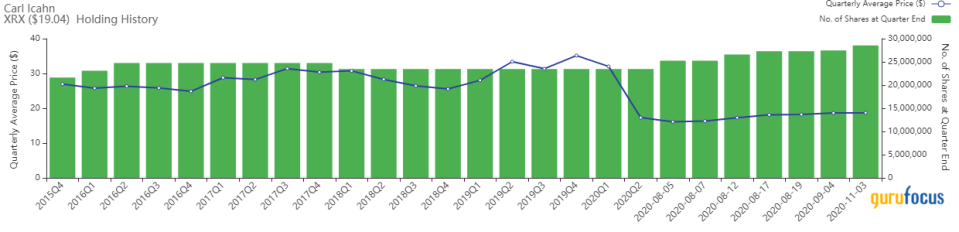

Continuing his streak of increasing the Xerox Holding Corp. (NYSE:XRX) stake over the past several months, Carl Icahn (Trades, Portfolio) disclosed he boosted the position another 3.86% earlier this week.

The guru's New York-based firm, Icahn Capital Management, is known for taking activist positions in undervalued, struggling companies and working with management with the goal of improving profitability as well as unlocking value for shareholders.

According to GuruFocus Real-Time Picks, a Premium feature, Icahn picked up another 1.06 million shares of the Norwalk, Connecticut-based printer manufacturer on Nov. 3, impacting the equity portfolio by 0.10%. The stock traded for an average price of $18.69 per share on the day of the transaction.

He now holds 28.53 million shares, which account for 2.7% of the total assets managed and represent a nearly 14% stake in the company. It was his 10th-largest holding at the end of the second quarter.

GuruFocus estimates the firm has lost 22.42% on the investment since establishing it in the fourth quarter of 2015.

In December 2019, Xerox offered to buy HP Inc. (NYSE:HPQ) for $35 billion. Despite Icahn's encouragement for shareholders to accept the deal, it was ultimately abandoned in March as a result of the coronavirus pandemic.

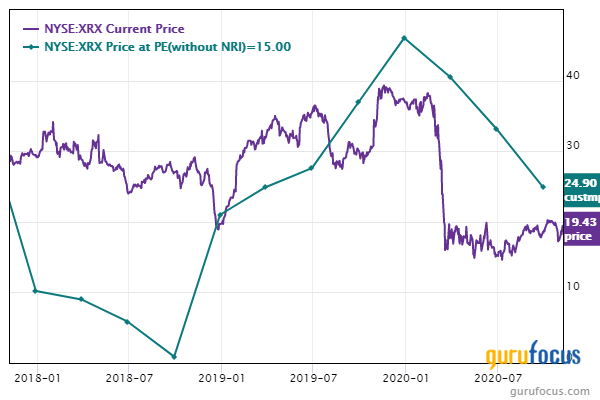

The company, which sells print and digital document products and services, has a $3.85 billion market cap; its shares were trading around $19.40 on Friday with a price-earnings ratio of 4.73, a price-book ratio of 0.76 and a price-sales ratio of 0.59.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued. The GuruFocus valuation rank of 7 out of 10 supports this assessment.

On Oct. 27, Xerox reported its third-quarter results. It posted adjusted earnings of 32 cents per share, which were down from the prior-year quarter but topped Zacks' consensus estimate of 24 cents. Revenue also declined 18.9% from a year ago to $1.77 billion, but surpassed expectations of $1.6 billion.

In a statement, Vice Chairman and CEO John Visentin said the company's "flexibility and financial discipline" enabled it "to increase earnings and cash flow sequentially."

"While we can't reliably predict the ongoing economic impact of the pandemic, we are prepared to respond however events unfold and are committed to delivering positive cash flow and earnings in the fourth quarter," he added. "Investments in digital solutions and services are paying off as companies prepare for a more hybrid work experience that shifts seamlessly between the office and home."

GuruFocus rated Xerox's financial strength 5 out of 10. Although the company has adequate interest coverage, the Altman Z-Score of 1.66 warns it could be in danger of going bankrupt. In addition, the weighted average cost of capital eclipses the return on invested capital, indicating value is being destroyed.

The company's profitability scored a 6 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a moderate Piotroski F-Score of 5, which indicates business conditions are stable. As a result of recording a decline in revenue per share over the past five years, Xerox's predictability rank of one out of five stars is on watch. According to GuruFocus, companies with this rank typically return an average of 1.1% annually over a 10-year period.

Icahn is by far Xerox's largest guru shareholder. Other gurus who own the are Jim Simons (Trades, Portfolio)' Renaissance Technologies, Joel Greenblatt (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio), Caxton Associates (Trades, Portfolio), Lee Ainslie (Trades, Portfolio) and Chuck Royce (Trades, Portfolio).

Portfolio composition

Over half of Icahn's $19.73 billion equity portfolio, which was composed of 16 stocks as of the end of the second quarter, was invested in the industrials sector.

His largest holdings as of the end of the three months ended June 30 were Icahn Enterprises LP (NASDAQ:IEP), Occidental Petroleum Corp. (NYSE:OXY), Herbalife Nutrition Ltd. (NYSE:HLF), CVR Energy Inc. (NYSE:CVI) and Caesars Entertainment Corp. (NASDAQ:CZR), which has since been delisted.

Disclosure: No positions.

Read more here:

Top 5 Trades of the Matthews Asia Small Companies Fund

The Matthews Japan Fund's Top 5 Trades

Vanguard Health Care Fund Adds 3 Positions to Portfolio?

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.