Carrier (CARR) Q1 Earnings Beat Estimates, Revenues Down Y/Y

Carrier Global CARR reported first-quarter 2022 adjusted earnings of 54 cents per share, which beat the Zacks Consensus Estimate by 14.9%. Further, the figure increased 13% year over year and 23% sequentially.

Net sales of $4.65 billion declined 1% year over year and 9% sequentially. However, the top line surpassed the Zacks Consensus Estimate by 3%.

The top-line decline was a result of the weak performance of the Refrigeration and Fire & Security segments. Yet, the HVAC segment aided the quarterly performance.

Product sales (90% of net sales) of $4.2 billion increased 8% year over year but declined 2% sequentially. Service sales (10% of net sales) of $484 million were down 42% year over year and 45% from the previous quarter.

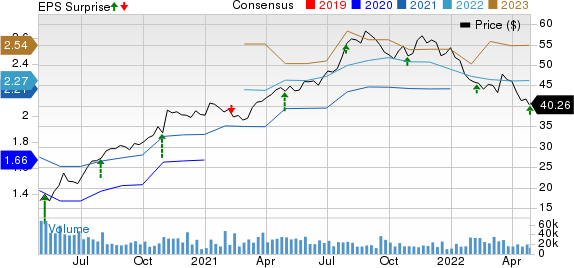

Carrier Global Corporation Price, Consensus and EPS Surprise

Carrier Global Corporation price-consensus-eps-surprise-chart | Carrier Global Corporation Quote

Segment Details

HVAC revenues (63.8% of net sales) increased 19% year over year to $2.97 billion.

Refrigeration revenues (21% of net sales) declined 3% from the year-ago quarter to $976 million.

Fire & Security revenues (17.6% of net sales) of $818 million were down 37% year over year.

Operating Results

Research & development (R&D) expenses grew 3% year over year to $125 million. Selling, general & administrative (SG&A) expenses decreased 19% from the year-ago quarter to $601 million.

As a percentage of revenues, R&D expenses expanded 10 basis points (bps), but SG&A expenses contracted 290 bps year over year.

Adjusted operating profit increased 7% year over year to $650 million. Operating margin expanded 110 bps on a year-over-year basis to 14%.

Adjusted operating margin of the HVAC segment expanded 120 bps year over year to 16%. The Refrigeration segment reported an adjusted operating margin of 11.5%, contracting 130 bps. Adjusted operating margin of Fire & Security was 14.2%, expanding 160 bps year over year.

Balance Sheet

As of Mar 31, 2022, Carrier had cash and cash equivalents of $3.60 billion compared with $2.99 billion on Dec 31, 2021.

Total debt (including current portion) as of Mar 31, 2022 was $8.56 billion compared with $9.70 billion on Dec 31, 2021.

In the reported quarter, the company used $202 million cash in operations. It generated $913 million in cash from operations in the previous quarter.

Capital expenditure was $56 million versus $138 million in the fourth quarter of 2021. Free cash flow was a negative $258 million for the first quarter of 2022.

Guidance

For 2022, Carrier projects sales of $20 billion. The Zacks Consensus Estimate for the same is pegged at $19.86 billion.

The company expects adjusted earnings of $2.20-$2.30 per share. The Zacks Consensus Estimate for the same is pegged at $2.27 per share.

Carrier also expects a free cash flow of $1.65 billion for 2022.

Zacks Rank & Stocks to Consider

Currently, Carrier has a Zacks Rank #3 (Hold).

Investors interested in the broader technology sector can consider stocks like Jabil JBL, Jack Henry & Associates JKHY, and Broadcom AVGO. While Jabil currently sports a Zacks Rank #1 (Strong Buy), Jack Henry & Associates and Broadcom carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Jabil has gained 5.5% over a year. The long-term earnings growth rate for JBL is currently projected at 12%.

Jack Henry & Associates has gained 16.9% over a year. The long-term earnings growth rate for JKHY is currently projected at 17%.

Broadcom has gained 20% over a year. The long-term earnings growth rate for AVGO is currently projected at 14.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Jack Henry & Associates, Inc. (JKHY) : Free Stock Analysis Report

Carrier Global Corporation (CARR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research